990 Pf Form 2014

What is the 990 Pf Form

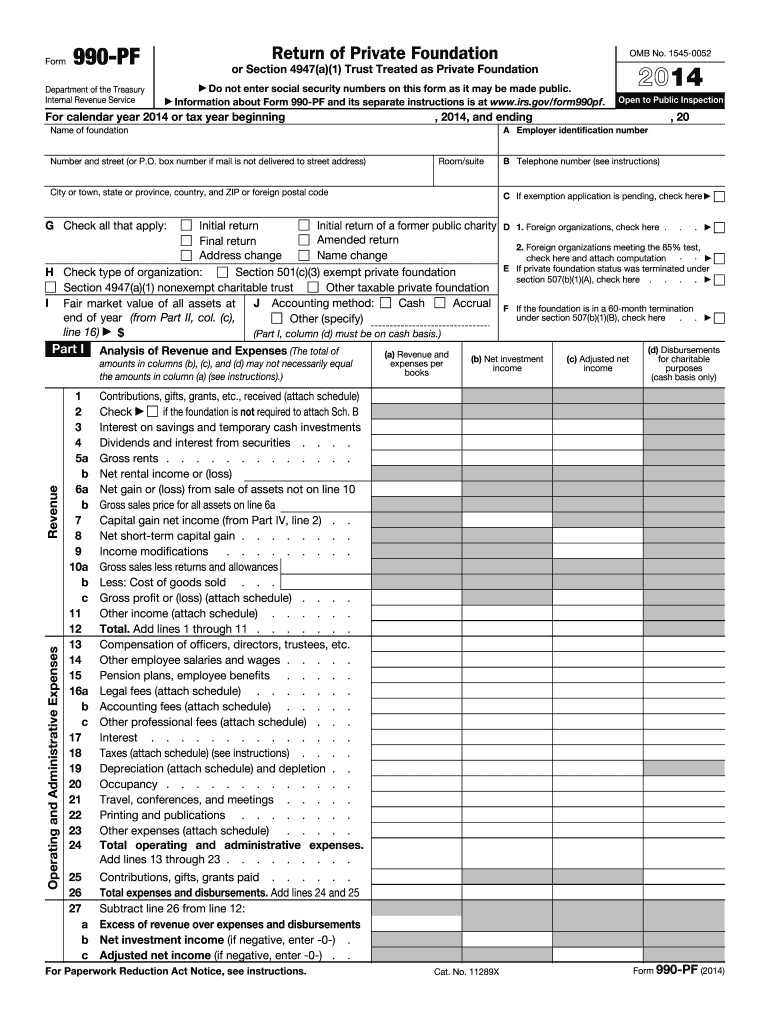

The 990 Pf Form, officially known as the IRS Form 990-PF, is a crucial document used by private foundations in the United States to report their financial activities. This form provides detailed information about a foundation's income, expenses, and distributions to charitable organizations. It is essential for maintaining transparency and compliance with federal regulations governing private foundations. The form must be filed annually, and it includes sections that require the foundation to disclose its assets, liabilities, and the grants it has made during the year.

How to use the 990 Pf Form

Using the 990 Pf Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, balance sheets, and documentation of grants made. Next, fill out the form by providing detailed information in each section, such as revenue sources and expenses incurred. It is important to follow the specific instructions provided by the IRS for each line item to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the foundation's preference and compliance requirements.

Steps to complete the 990 Pf Form

Completing the 990 Pf Form requires careful attention to detail. Here are the essential steps:

- Collect all relevant financial documents, including previous year’s forms, if applicable.

- Fill out the basic information section, including the foundation's name, address, and Employer Identification Number (EIN).

- Report income sources, detailing contributions, investment income, and any other revenue.

- Document expenses, including administrative costs and grants made to other organizations.

- Complete the section on assets and liabilities to provide a clear financial picture.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form by the designated deadline, ensuring that all required attachments are included.

Legal use of the 990 Pf Form

The legal use of the 990 Pf Form is governed by IRS regulations that require private foundations to file this document annually. Failure to submit the form on time can result in penalties, including fines and potential loss of tax-exempt status. The information provided in the form must be truthful and complete, as inaccuracies can lead to legal consequences. Additionally, the form must be made available to the public, ensuring transparency in the foundation's financial activities.

Filing Deadlines / Important Dates

The filing deadline for the 990 Pf Form is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation's fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. Extensions may be requested, allowing an additional six months to file. It is crucial for foundations to be aware of these deadlines to avoid penalties and maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The 990 Pf Form can be submitted through various methods, depending on the foundation's preference. Electronic filing is encouraged, as it allows for quicker processing and confirmation of receipt by the IRS. Foundations can use approved e-filing software to submit the form online. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. In-person submissions are generally not accepted, making electronic or mail options the most viable choices for compliance.

Quick guide on how to complete 2014 990 pf form

Effortlessly Prepare 990 Pf Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle 990 Pf Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign 990 Pf Form With Ease

- Find 990 Pf Form and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to confirm your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 990 Pf Form while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 990 pf form

Create this form in 5 minutes!

How to create an eSignature for the 2014 990 pf form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a 990 Pf Form and why is it important?

The 990 Pf Form is a tax form used by private foundations to report their financial activities to the IRS. It provides detailed information about a foundation's income, expenditures, and charitable activities. Understanding the 990 Pf Form is crucial for compliance and transparency in nonprofit operations.

-

How does airSlate SignNow help with signing and managing 990 Pf Forms?

airSlate SignNow streamlines the process of signing and managing 990 Pf Forms by allowing users to eSign documents securely and efficiently. With its intuitive interface, you can easily send, track, and store your 990 Pf Forms, ensuring that you meet all filing deadlines without hassle.

-

What are the pricing options for using airSlate SignNow for 990 Pf Forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial for new users. Subscription plans include features specifically designed for managing documents like the 990 Pf Form, ensuring that you only pay for what you need as you streamline your foundation's processes.

-

Can I integrate airSlate SignNow with other software for processing 990 Pf Forms?

Yes, airSlate SignNow integrates seamlessly with various software platforms, allowing for smooth workflows when processing 990 Pf Forms. Whether you are using accounting software or cloud storage solutions, these integrations help you manage your documents more effectively and maintain compliance.

-

What features does airSlate SignNow offer for 990 Pf Form management?

airSlate SignNow provides a range of features for managing 990 Pf Forms, including customizable templates, secure eSigning, and document tracking. These features not only simplify the signing process but also help ensure that all necessary data is captured and stored securely.

-

Is it safe to use airSlate SignNow for 990 Pf Forms?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your sensitive information when handling 990 Pf Forms. With features like audit trails and secure storage, you can trust that your documents are safe and compliant with regulatory standards.

-

How can airSlate SignNow improve my workflow for 990 Pf Forms?

By using airSlate SignNow, you can automate and streamline your workflow for 990 Pf Forms, reducing the time spent on manual processes. The platform allows for easy collaboration, document sharing, and real-time updates, ultimately enhancing productivity and ensuring timely submissions.

Get more for 990 Pf Form

- District school board of pasco county mis form 162 new

- Frs form

- Healthcare claim reimbursement form

- Florida nuclear plant emergency notification form

- How to file a formal complaint against hernando county school

- Port st lucie shed requirements form

- Environmental protection and growth management department form

- Parental legal guardian information form must be submitted

Find out other 990 Pf Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors