Form 990 Pf 2009

What is the Form 990-PF

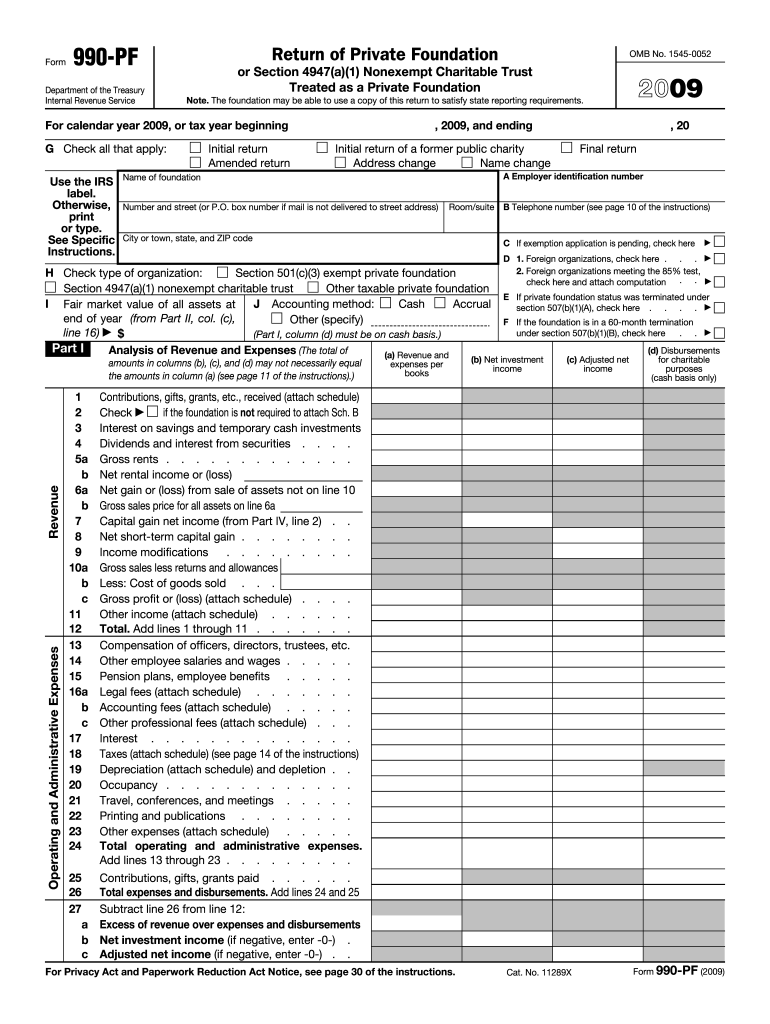

The Form 990-PF is a tax document specifically designed for private foundations in the United States. It provides the Internal Revenue Service (IRS) with essential information about a foundation's financial activities, including its income, expenses, and distributions. This form is critical for ensuring compliance with federal tax regulations and maintaining the foundation's tax-exempt status. Unlike other tax forms, the 990-PF focuses on the unique aspects of private foundations, such as their investment income and the mandatory distribution requirements they must meet annually.

How to use the Form 990-PF

Using the Form 990-PF involves several key steps. First, gather all necessary financial information, including income statements, balance sheets, and details of grants made during the year. Next, complete each section of the form accurately, ensuring that all required schedules are included. It's important to pay special attention to the distribution requirements, as private foundations must disburse a certain percentage of their assets each year. Once completed, the form must be submitted to the IRS by the appropriate deadline, typically the fifteenth day of the fifth month after the end of the foundation's fiscal year.

Steps to complete the Form 990-PF

Completing the Form 990-PF involves a structured approach:

- Gather all relevant financial documentation, including previous tax returns and current financial statements.

- Fill out the basic information section, including the foundation's name, address, and Employer Identification Number (EIN).

- Report income, including contributions, investment income, and any other revenue sources.

- Detail expenses, including administrative costs, grants made, and other financial outflows.

- Ensure compliance with distribution requirements by calculating the minimum amount that must be distributed to charitable purposes.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 990-PF

The Form 990-PF serves as a legal document that must be filed with the IRS to maintain a private foundation's tax-exempt status. It is essential to ensure that the information provided is accurate and truthful, as discrepancies can lead to penalties or loss of tax-exempt status. The form must be filed annually, and failure to do so can result in significant fines. Additionally, the information disclosed in the form is made available to the public, promoting transparency and accountability within the foundation sector.

Filing Deadlines / Important Dates

For private foundations, the Form 990-PF is typically due on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For foundations operating on a calendar year, this means the form is due by May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is advisable to file the form on time to avoid penalties and ensure compliance with IRS regulations.

Required Documents

To accurately complete the Form 990-PF, several documents are necessary:

- Previous year's Form 990-PF, if applicable.

- Financial statements, including balance sheets and income statements.

- Records of grants made during the year.

- Documentation of any contributions received.

- Details of any investments and their performance.

Quick guide on how to complete 2009 form 990 pf

Complete Form 990 Pf effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers a suitable eco-conscious substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without interruptions. Manage Form 990 Pf on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to alter and electronically sign Form 990 Pf effortlessly

- Find Form 990 Pf and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information using tools that airSlate SignNow provides expressly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Change and eSign Form 990 Pf while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 990 pf

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 990 pf

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 990 Pf and why is it important?

Form 990 Pf is an IRS form used by private foundations to report their financial activities, grants, and compliance with regulations. It's essential for transparency and accountability, allowing stakeholders to understand how organizations are utilizing their funds. Utilizing airSlate SignNow can help streamline the submission process for Form 990 Pf.

-

How can airSlate SignNow assist with completing Form 990 Pf?

airSlate SignNow provides an intuitive platform for creating, editing, and electronically signing documents, including Form 990 Pf. With our user-friendly interface, you can ensure accuracy and compliance in your filings, saving you time and reducing errors in your submissions.

-

What features does airSlate SignNow offer for managing Form 990 Pf?

Our platform includes features such as customizable templates, secure eSignatures, and collaboration tools specifically designed for Form 990 Pf and similar documents. These features streamline the preparation and submission process, making it easier to manage your filings efficiently.

-

Is airSlate SignNow cost-effective for managing Form 990 Pf?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses needing to manage Form 990 Pf efficiently. We provide flexible subscription options that accommodate small organizations as well as larger entities, ensuring you can access our powerful document management tools without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 990 Pf management?

Absolutely, airSlate SignNow seamlessly integrates with popular accounting and document management software, making it easier to import and manage data for Form 990 Pf. Our integration capabilities enhance workflow efficiency, allowing you to keep everything organized in one place.

-

What are the benefits of using airSlate SignNow for Form 990 Pf?

Using airSlate SignNow for Form 990 Pf simplifies the document management process, allowing for quick edits, secure eSignatures, and easy tracking of document status. These benefits contribute to improved organization, reduced turnaround times, and enhanced compliance with IRS requirements.

-

Is airSlate SignNow user-friendly for preparing Form 990 Pf?

Yes, airSlate SignNow is designed with user experience in mind, making it highly accessible for users preparing Form 990 Pf. With a straightforward interface, users can easily navigate through the document preparation steps, ensuring a smooth and efficient process.

Get more for Form 990 Pf

- Odm 06723 form

- Medicare consent to release medical records form

- Infusion order oregon medical group form

- Or medical exception prior authorization form oregon pharmacy prior authorizationprecertification request form

- Pennhip form

- Medication pa forms 2020google

- Mar checklist form

- Pa form transfer care

Find out other Form 990 Pf

- Fill eSignature Word Mac

- How To Fill eSignature Form

- Create eSignature PDF Online

- Create eSignature PDF Mobile

- Create eSignature Word Online

- Create eSignature PDF Free

- Create eSignature PDF Secure

- Create eSignature Word Mobile

- Create eSignature Word Free

- How To Create eSignature Word

- How Do I Create eSignature Word

- How To Create eSignature PDF

- Help Me With Create eSignature Word

- Create eSignature Word Simple

- Create eSignature Word Easy

- Create eSignature Document Online

- Create eSignature Document Computer

- Create eSignature Document Mobile

- Create eSignature Document Free

- Create eSignature Document Simple