990 Pf Form 2011

What is the 990 Pf Form

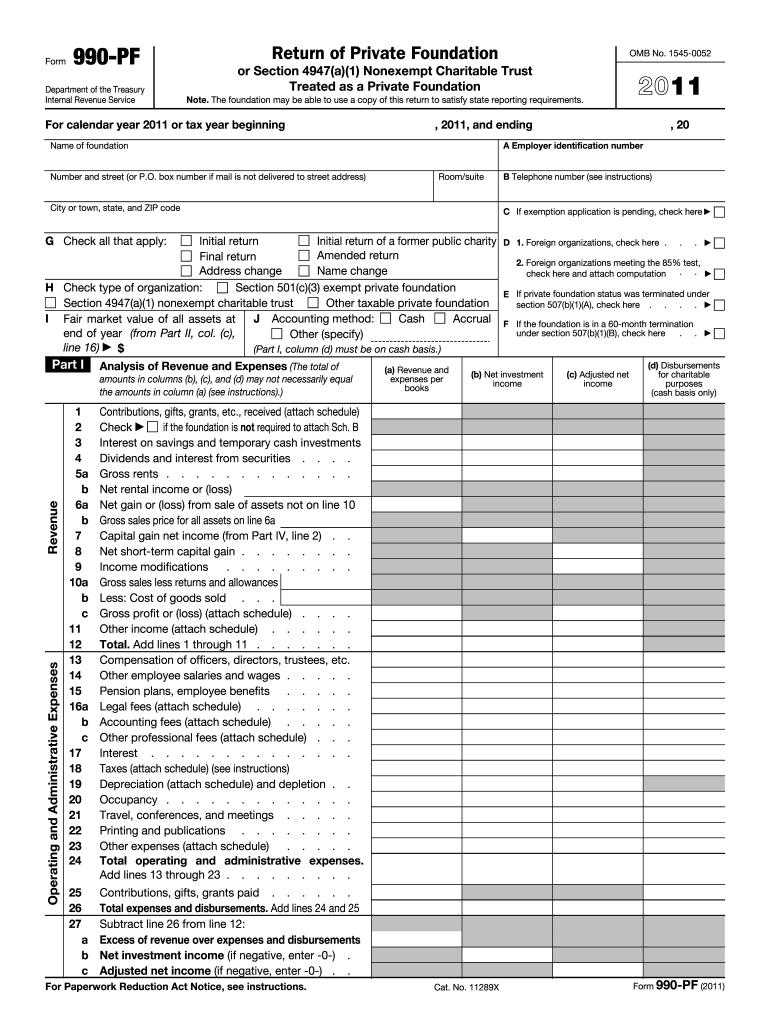

The 990 Pf Form, officially known as the Form 990-PF, is a tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. This form provides a comprehensive overview of a foundation's financial activities, including income, expenses, and the distribution of funds. It is essential for maintaining transparency and ensuring compliance with federal regulations. The 990 Pf Form is typically filed annually and serves as a public record, allowing donors, beneficiaries, and the general public to assess the foundation's operations and financial health.

How to obtain the 990 Pf Form

Obtaining the 990 Pf Form is straightforward. The form can be accessed directly from the IRS website, where it is available for download in PDF format. Additionally, many tax preparation software programs include the 990 Pf Form as part of their offerings, allowing users to complete and file it electronically. It is important to ensure that you are using the most current version of the form, as updates may occur annually to reflect changes in tax laws or reporting requirements.

Steps to complete the 990 Pf Form

Completing the 990 Pf Form involves several key steps:

- Gather financial records: Collect all necessary financial documents, including income statements, balance sheets, and records of grants made.

- Fill out the form: Begin entering information on the form, ensuring accuracy in reporting income, expenses, and distributions.

- Review compliance requirements: Ensure that all sections of the form comply with IRS regulations, including any required disclosures.

- Sign and date: The form must be signed by an authorized individual within the foundation, confirming the accuracy of the information provided.

- Submit the form: File the completed form electronically or via mail by the designated deadline.

Legal use of the 990 Pf Form

The legal use of the 990 Pf Form is crucial for maintaining compliance with IRS regulations. Filing this form is not only a requirement for private foundations but also serves to uphold transparency and accountability. Failure to file the form accurately and on time can result in penalties, including fines and potential loss of tax-exempt status. It is essential for foundations to understand their obligations and ensure that the information reported on the form is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Pf Form are typically set for the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation operates on a calendar year, the form is due by May fifteenth of the following year. Extensions may be available, but it is important to file for an extension before the original deadline. Keeping track of these important dates is essential to avoid penalties and ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The 990 Pf Form can be submitted through various methods, providing flexibility for foundations. The most efficient way is to file electronically using IRS-approved e-filing software, which can streamline the process and reduce the likelihood of errors. Alternatively, foundations can mail a paper version of the form to the appropriate IRS address. In-person submissions are generally not accepted, making electronic filing or mailing the primary options for compliance.

Quick guide on how to complete 2011 990 pf form

Effortlessly Prepare 990 Pf Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage 990 Pf Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign 990 Pf Form Without Stress

- Locate 990 Pf Form and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all your details and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign 990 Pf Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 990 pf form

Create this form in 5 minutes!

How to create an eSignature for the 2011 990 pf form

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 990 Pf Form and why is it important?

The 990 Pf Form is a tax document required for certain organizations to report their financial activities to the IRS. Understanding the 990 Pf Form is crucial for compliance and transparency in nonprofit operations. Using tools like airSlate SignNow can simplify the process of signing and submitting this form.

-

How can airSlate SignNow help with the 990 Pf Form?

airSlate SignNow streamlines the process of preparing and signing the 990 Pf Form by providing an easy-to-use digital platform. With features like eSignature and document management, you can efficiently handle all your tax documents, ensuring accuracy and timely submissions.

-

Is there a cost associated with using airSlate SignNow for the 990 Pf Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, making it a cost-effective solution for managing the 990 Pf Form. You can choose a plan that suits your volume of documents and required features, ensuring value for your investment.

-

What features does airSlate SignNow offer for managing the 990 Pf Form?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and cloud storage that are essential for managing the 990 Pf Form. These features help streamline your workflow, making it easier to gather necessary signatures and keep all your documents organized.

-

Can I integrate airSlate SignNow with other tools for the 990 Pf Form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to enhance your experience when managing the 990 Pf Form. Whether you’re using accounting software or a project management tool, these integrations can facilitate smoother data transfer and document handling.

-

How secure is the 990 Pf Form when using airSlate SignNow?

Security is a top priority for airSlate SignNow, particularly when handling sensitive documents like the 990 Pf Form. The platform employs industry-standard encryption and secure data storage to ensure that your documents remain confidential and protected.

-

What are the benefits of using airSlate SignNow for the 990 Pf Form?

Using airSlate SignNow for the 990 Pf Form brings numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The digital platform allows for quick document preparation and signature collection, saving you time and reducing the likelihood of errors.

Get more for 990 Pf Form

- Annexure 1 quarterly hank yarn packing return form pdf

- Mtr form no 6

- Partner agreement international effective 1 jul 13 version tagalogdocx form

- Equivalence certificate online form

- Bonafide certificate meaning form

- Inz 1017 form

- Credit union membership application form

- Voc3 form medical council of new zealand mcnz

Find out other 990 Pf Form

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple