990 Pf Form 2016

What is the 990 Pf Form

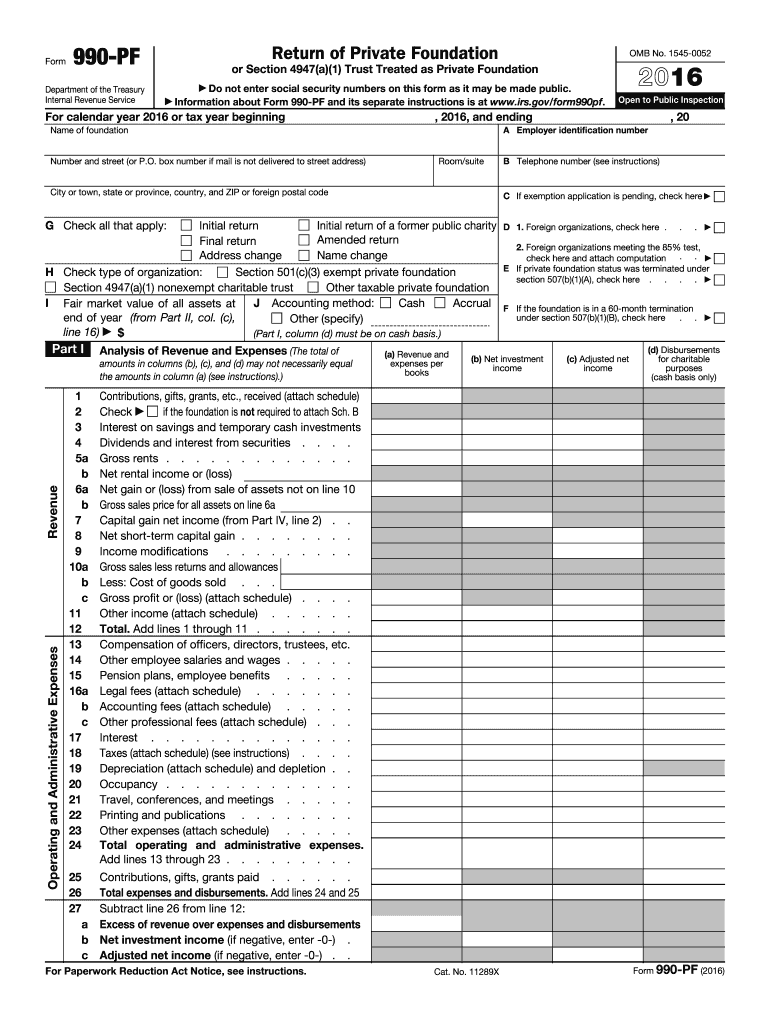

The 990 Pf Form is a tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. It is used to report financial information, including income, expenses, and distributions, to ensure compliance with federal tax regulations. This form provides transparency about the foundation's activities and financial status, helping to uphold public trust in charitable organizations. The 990 Pf Form must be filed annually, and it is essential for maintaining the foundation's tax-exempt status.

How to use the 990 Pf Form

Using the 990 Pf Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, balance sheets, and details of grants made during the year. Next, carefully complete each section of the form, ensuring that all figures are accurate and reflect the foundation's financial activities. It is important to review the instructions provided by the IRS to understand specific requirements for each line item. Once completed, the form must be submitted to the IRS by the designated deadline, typically the fifteenth day of the fifth month after the end of the foundation's fiscal year.

Steps to complete the 990 Pf Form

Completing the 990 Pf Form requires a systematic approach. Follow these steps:

- Gather relevant financial documents, including bank statements and records of donations.

- Fill out the basic information section, including the foundation's name, address, and Employer Identification Number (EIN).

- Report income sources, detailing contributions, investment income, and any other revenue.

- Document expenses, including administrative costs and grants made to other organizations.

- Complete the sections on governance, including information about the board of directors and any related party transactions.

- Review the completed form for accuracy and completeness before submission.

Legal use of the 990 Pf Form

The 990 Pf Form serves a legal purpose by ensuring that private foundations comply with federal tax laws. Accurate completion and timely submission of this form are crucial for maintaining tax-exempt status. The IRS uses the information provided in the form to assess whether foundations are fulfilling their charitable purposes and complying with distribution requirements. Failure to file or inaccuracies in the form can lead to penalties, including loss of tax-exempt status.

Filing Deadlines / Important Dates

Timely filing of the 990 Pf Form is essential for compliance. The deadline for submitting the form is the fifteenth day of the fifth month following the end of the foundation's fiscal year. For example, if a foundation's fiscal year ends on December thirty-first, the form must be filed by May fifteenth of the following year. It is advisable to file well in advance of the deadline to allow time for any necessary corrections or additional documentation.

Required Documents

When preparing to complete the 990 Pf Form, several documents are necessary to ensure accurate reporting. These include:

- Financial statements for the fiscal year, including income and balance sheets.

- Records of grants made to other organizations or individuals.

- Documentation of any fundraising activities and associated expenses.

- Information about the foundation's board of directors and key personnel.

- Prior year’s 990 Pf Form, if applicable, for reference and consistency.

Quick guide on how to complete 990 pf 2016 form

Prepare 990 Pf Form effortlessly on any gadget

The management of online documents has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 990 Pf Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 990 Pf Form effortlessly

- Locate 990 Pf Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 990 Pf Form to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 pf 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 990 pf 2016 form

How to make an electronic signature for your 990 Pf 2016 Form online

How to create an eSignature for your 990 Pf 2016 Form in Google Chrome

How to make an eSignature for putting it on the 990 Pf 2016 Form in Gmail

How to generate an eSignature for the 990 Pf 2016 Form from your mobile device

How to make an eSignature for the 990 Pf 2016 Form on iOS

How to make an electronic signature for the 990 Pf 2016 Form on Android devices

People also ask

-

What is the 990 Pf Form and how does it relate to airSlate SignNow?

The 990 Pf Form is a tax document that nonprofit organizations in the United States must file to report their financial activities. With airSlate SignNow, you can easily eSign and send the 990 Pf Form securely, streamlining your filing process and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help me prepare and send the 990 Pf Form?

airSlate SignNow offers a user-friendly platform that allows you to prepare the 990 Pf Form digitally. You can fill out the form, add necessary signatures, and send it directly to your stakeholders, making the entire process efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for the 990 Pf Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By choosing a plan that fits your needs, you can access features that simplify the management of documents like the 990 Pf Form without breaking the bank.

-

Are there any specific features in airSlate SignNow for managing the 990 Pf Form?

Yes, airSlate SignNow includes features such as templates, customizable fields, and secure storage, specifically designed to facilitate the management of the 990 Pf Form. These tools help ensure that your forms are completed accurately and stored safely.

-

Can I integrate airSlate SignNow with other software for handling the 990 Pf Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 990 Pf Form alongside your other financial tools. This integration enhances your workflow and ensures all your documents are in sync.

-

Is airSlate SignNow secure for submitting sensitive documents like the 990 Pf Form?

Yes, security is a top priority for airSlate SignNow. The platform uses advanced encryption and compliance measures to protect sensitive documents, including the 990 Pf Form, ensuring that your information remains confidential and secure.

-

What benefits does airSlate SignNow provide for organizations filing the 990 Pf Form?

Using airSlate SignNow for the 990 Pf Form offers several benefits, including increased efficiency, reduced errors, and faster turnaround times. By digitizing your document workflow, your organization can focus more on its mission rather than paperwork.

Get more for 990 Pf Form

Find out other 990 Pf Form

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement