990 Pf Form 2013

What is the 990 Pf Form

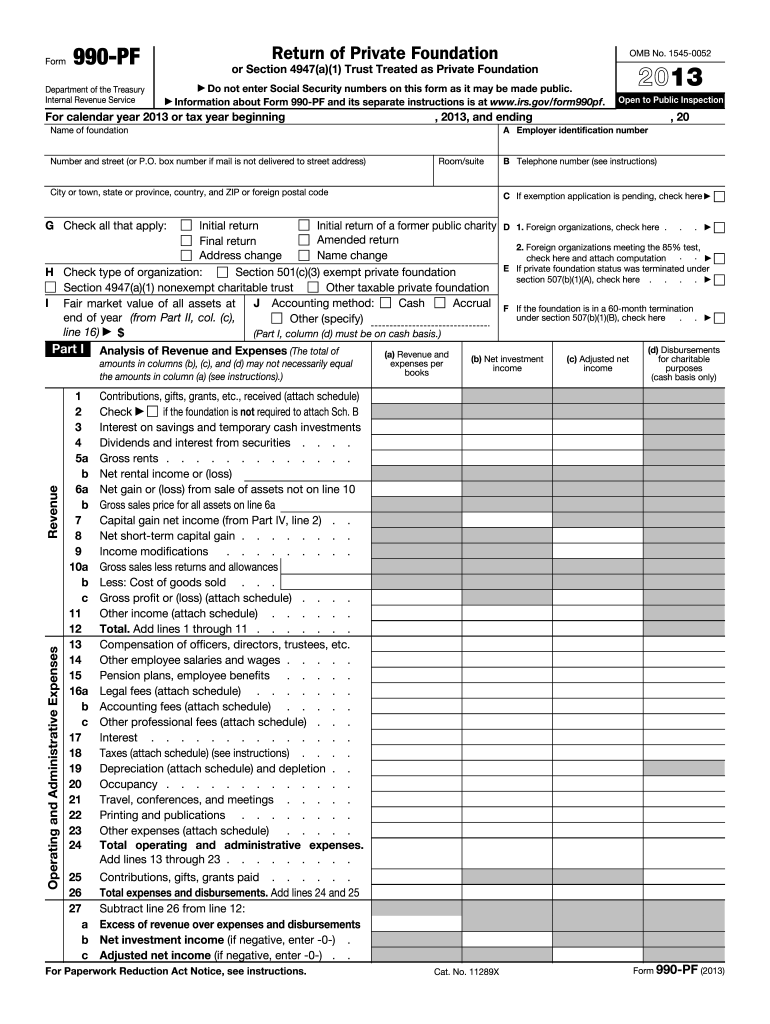

The 990 Pf Form is a tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. This form provides a detailed overview of a foundation's financial activities, including income, expenses, and distributions. It is essential for maintaining transparency and compliance with federal tax regulations. The 990 Pf Form is part of the larger series of Form 990, which is used by various nonprofit organizations to report their financial information.

How to use the 990 Pf Form

Using the 990 Pf Form involves several key steps. First, gather all necessary financial records, including income statements, balance sheets, and documentation of grants made during the year. Next, complete each section of the form accurately, ensuring that all figures are supported by your records. It's important to report any changes in your foundation's activities or structure. After completing the form, review it for accuracy and completeness before submission. This ensures compliance with IRS regulations and helps avoid potential penalties.

Steps to complete the 990 Pf Form

Completing the 990 Pf Form requires careful attention to detail. Follow these steps:

- Gather financial documents, including bank statements and receipts.

- Fill out the basic information section, including the foundation's name and Employer Identification Number (EIN).

- Report income and expenses in the designated sections, ensuring all figures are accurate.

- Detail any grants or distributions made during the year.

- Complete the signature section, ensuring it is signed by an authorized individual.

- Review the entire form for accuracy before submission.

Legal use of the 990 Pf Form

The 990 Pf Form serves as a legal document that provides transparency regarding a private foundation's financial activities. It is important for compliance with federal tax laws. Submitting this form accurately helps maintain the foundation's tax-exempt status and avoids penalties for non-compliance. The IRS uses the information to ensure foundations are operating within the guidelines set forth for charitable organizations.

Filing Deadlines / Important Dates

Filing the 990 Pf Form is subject to specific deadlines. Generally, the form is due on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if the fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. If additional time is needed, organizations can file for an extension, but they must ensure that the form is submitted by the extended deadline to avoid penalties.

Required Documents

To complete the 990 Pf Form, several documents are required:

- Financial statements, including income and balance sheets.

- Records of grants and contributions made during the year.

- Documentation of any changes in organizational structure or activities.

- Previous years' 990 Pf Forms, if applicable, for reference.

Quick guide on how to complete 2013 990 pf form

Complete 990 Pf Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing access to the necessary form and secure online storage. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 990 Pf Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign 990 Pf Form with minimal effort

- Find 990 Pf Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign 990 Pf Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 990 pf form

Create this form in 5 minutes!

How to create an eSignature for the 2013 990 pf form

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 990 Pf Form and how can airSlate SignNow help?

The 990 Pf Form is a tax document used by private foundations in the United States to report their financial activities to the IRS. airSlate SignNow provides a secure and efficient way to send and eSign the 990 Pf Form, ensuring that your submissions are timely and compliant with IRS regulations.

-

Is airSlate SignNow suitable for filing the 990 Pf Form electronically?

Yes, airSlate SignNow is designed to facilitate the electronic submission of the 990 Pf Form. Our platform allows users to upload, sign, and send documents electronically, streamlining the filing process and reducing the risk of errors.

-

What features does airSlate SignNow offer for managing the 990 Pf Form?

airSlate SignNow offers a variety of features that make managing the 990 Pf Form easy. You can create templates, set reminders for deadlines, and securely store documents, all within a user-friendly interface that simplifies the entire process.

-

How much does it cost to use airSlate SignNow for the 990 Pf Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. You can choose a plan that fits your budget while enjoying unlimited access to features for efficiently handling the 990 Pf Form.

-

Can I integrate airSlate SignNow with other accounting software for the 990 Pf Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, making it easier to manage your financial data and prepare the 990 Pf Form. This integration helps eliminate data entry errors and ensures your documents are always up-to-date.

-

What are the benefits of using airSlate SignNow for the 990 Pf Form?

Using airSlate SignNow for the 990 Pf Form brings numerous benefits, including enhanced security, compliance with IRS regulations, and the ability to streamline the signing process. You'll save time and reduce administrative burdens, allowing you to focus on your foundation's mission.

-

Is airSlate SignNow compliant with IRS regulations for the 990 Pf Form?

Yes, airSlate SignNow is compliant with IRS regulations for electronic signatures on the 990 Pf Form. Our platform adheres to the necessary security protocols, ensuring your documents are handled with the utmost care and in accordance with federal guidelines.

Get more for 990 Pf Form

- Contractors final payment affidavit pdf form

- Pa cover lancaster form

- Full text of ampquotthe practice in civil actions and form

- Pa cover sheet form

- Sc guardian form

- City of providence probate court city of providence form

- Fillable online for more information on packages or

- Instructions for completing the self represented litigant form

Find out other 990 Pf Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy