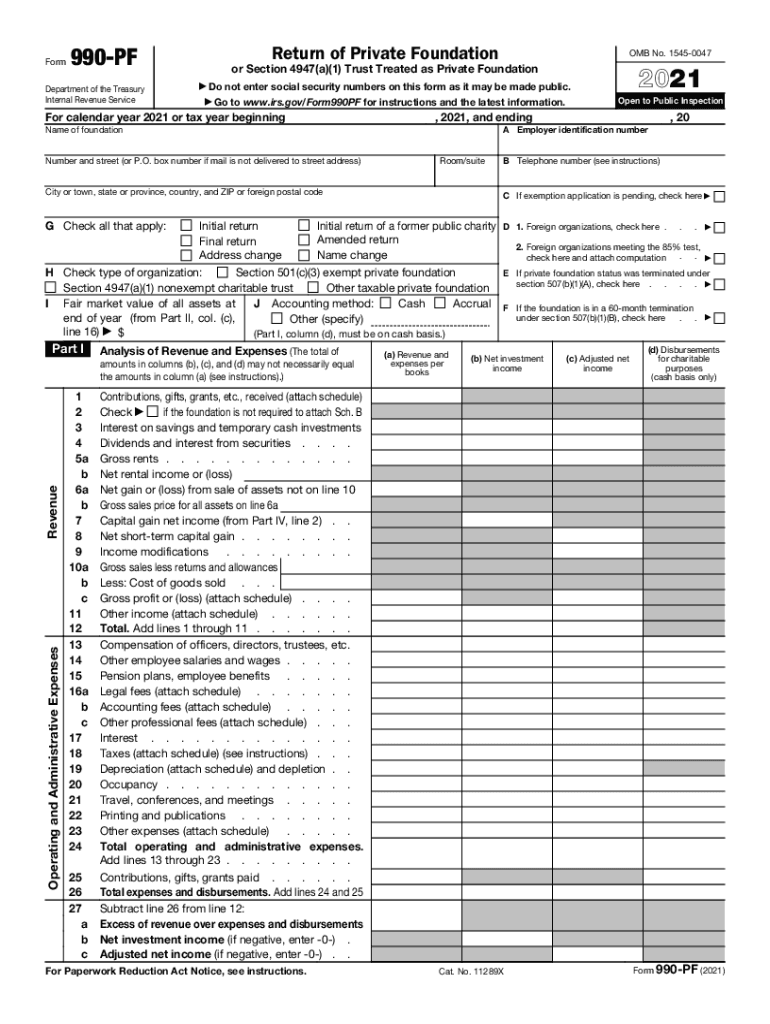

Form 990 PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation 2021

What is the Form 990 PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation

The Form 990 PF is a tax return specifically designed for private foundations and certain trusts treated as private foundations under section 4947(a)(1) of the Internal Revenue Code. This form provides the IRS with essential information about the foundation's financial activities, including income, expenses, and distributions. It is crucial for maintaining compliance with federal tax regulations and ensuring transparency in charitable activities. The form must be filed annually by private foundations to report their financial status and operations.

Steps to Complete the Form 990 PF

Completing the Form 990 PF involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of charitable distributions. Next, fill out the form by providing detailed information about the foundation's activities, including revenues, expenditures, and any investment income. It is essential to accurately report the foundation's assets and liabilities. Finally, review the completed form for accuracy and ensure all required schedules are attached before submission.

Filing Deadlines / Important Dates

The Form 990 PF must be filed annually, typically on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For foundations operating on a calendar year, the deadline is May fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important to keep track of these deadlines to avoid penalties for late filing.

Legal Use of the Form 990 PF

The Form 990 PF serves a legal purpose by ensuring compliance with federal tax laws governing private foundations. It provides the IRS with a comprehensive overview of the foundation's financial activities and charitable distributions. Filing this form is not only a legal requirement but also a means to maintain public trust and transparency in philanthropic efforts. Failure to file the form correctly can lead to penalties and jeopardize the foundation's tax-exempt status.

Required Documents for Form 990 PF

To successfully complete and file the Form 990 PF, several documents are required. These include financial statements, records of charitable contributions, and information regarding the foundation's governance. Additionally, any supporting schedules that detail specific financial activities or compliance with distribution requirements must be included. Having these documents organized and readily available will facilitate a smoother filing process.

Penalties for Non-Compliance

Non-compliance with Form 990 PF filing requirements can result in significant penalties. If a foundation fails to file the form by the due date, it may incur a penalty of $20 per day, up to a maximum of $10,000. In cases of willful neglect or failure to file for three consecutive years, the foundation may lose its tax-exempt status. It is essential for private foundations to adhere to filing requirements to avoid these consequences.

How to Obtain the Form 990 PF

The Form 990 PF can be obtained directly from the IRS website or through tax preparation software that supports nonprofit tax filings. Additionally, many accounting firms and tax professionals can provide the form and assist with its completion. It is important to ensure that the most current version of the form is used, as tax regulations may change over time.

Quick guide on how to complete 2021 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Complete Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly without delay. Manage Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation seamlessly

- Find Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

The way to make an e-signature for your PDF file in the online mode

The way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is a 990 in the context of e-signatures?

A 990 refers to the IRS Form 990, which nonprofit organizations must file annually. Understanding what a 990 is can help organizations streamline their compliance processes, including document signing and management using airSlate SignNow.

-

How can airSlate SignNow help with filing a 990?

airSlate SignNow simplifies the process of gathering signatures and approvals for Form 990 by allowing nonprofits to eSign documents easily. By using this platform, organizations can ensure timely submission and compliance with IRS requirements regarding what is a 990.

-

What features make airSlate SignNow suitable for nonprofits needing to submit a 990?

Key features of airSlate SignNow include document templates, customizable workflows, and secure eSigning capabilities. These tools help nonprofits efficiently manage their Form 990 submissions while focusing on compliance with regulations related to what is a 990.

-

Is there a pricing plan for nonprofit organizations using airSlate SignNow for 990 submissions?

Yes, airSlate SignNow offers competitive pricing plans that cater specifically to nonprofit organizations. These plans help organizations manage costs effectively while ensuring they have the tools necessary to handle what is a 990 submissions seamlessly.

-

What are the benefits of using airSlate SignNow for eSigning a 990?

The benefits of using airSlate SignNow for eSigning a 990 include increased efficiency, enhanced security, and reduced paper waste. By leveraging this platform, organizations can better meet their filing deadlines and ensure compliance with what is a 990 requirements.

-

Can airSlate SignNow integrate with accounting software for 990 preparation?

Absolutely! airSlate SignNow provides integrations with various accounting and document management systems. This allows nonprofits to streamline the preparation and eSignature process for what is a 990 by connecting their existing tools.

-

What type of support does airSlate SignNow offer for users filing a 990?

airSlate SignNow offers dedicated customer support to assist users with the eSigning process for their 990 forms. Whether it's through chat, email, or phone, the support team is equipped to help users understand what is a 990 and navigate the signing process.

Get more for Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- Essential legal life documents for military personnel colorado form

- Agents affidavit that power of attorney not revoked colorado form

- Essential legal life documents for new parents colorado form

- Delegation parent form

- Small business accounting package colorado form

- Colorado procedures form

- Power attorney care children form

- Newly divorced individuals package colorado form

Find out other Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT