Form 990 PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation 2024

Understanding the Form 990 PF Return of Private Foundation

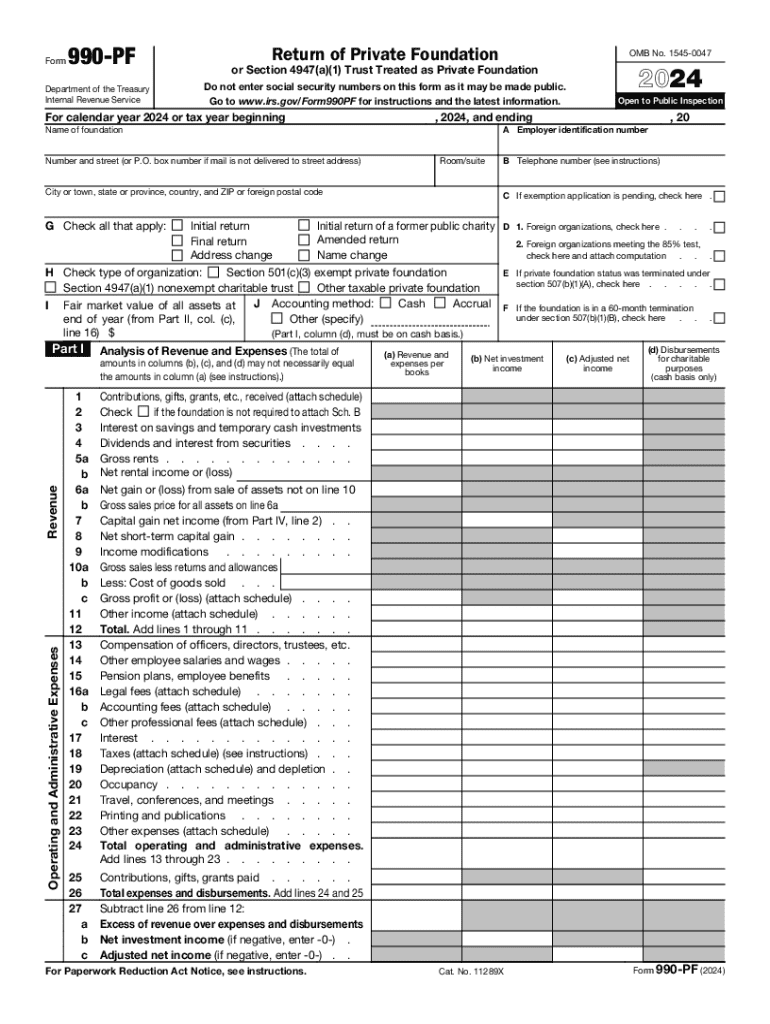

The Form 990 PF is a crucial document for private foundations and certain trusts treated as private foundations under Section 4947(a)(1) of the Internal Revenue Code. This form provides the IRS with essential information about the foundation's financial activities, including income, expenses, and distributions. It is designed to ensure transparency and compliance with federal regulations governing charitable organizations. The form requires detailed reporting on the foundation's investments, grants, and operational costs, making it an integral part of maintaining tax-exempt status.

Steps to Complete the Form 990 PF

Completing the Form 990 PF involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, balance sheets, and documentation of grants made during the reporting period. Next, fill out the form by providing detailed information about the foundation's activities, including revenue sources, expenses, and investment income. Pay close attention to the sections on public support and charitable distributions, as these are critical for demonstrating compliance with IRS requirements. Finally, review the form for errors before submitting it to ensure all information is complete and accurate.

Filing Deadlines for Form 990 PF

Timely filing of the Form 990 PF is essential to avoid penalties. The deadline for submitting the form is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation operates on a calendar year, the form is due on May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Foundations may also request a six-month extension, but this must be filed before the original deadline to be valid.

Legal Use of the Form 990 PF

The legal use of the Form 990 PF is primarily for compliance with federal tax regulations. Foundations must file this form annually to maintain their tax-exempt status and report their financial activities to the IRS. Failure to file can result in penalties, including the loss of tax-exempt status. Additionally, the information provided on the form is made publicly available, promoting transparency and accountability in the charitable sector. Understanding the legal implications of this form is crucial for foundation administrators and board members.

Key Elements of the Form 990 PF

The Form 990 PF includes several key elements that foundations must accurately report. These elements encompass financial data such as total revenue, expenses, and net assets. Additionally, the form requires detailed information about grants made to other organizations, including the amounts and purposes of these grants. Foundations must also disclose their investment activities and any changes in their operational structure. Understanding these elements is vital for ensuring compliance and providing a clear picture of the foundation's financial health.

Obtaining the Form 990 PF

The Form 990 PF can be obtained directly from the IRS website, where it is available as a downloadable PDF. Additionally, many tax preparation software programs offer the form as part of their services, allowing users to complete it electronically. It is important to ensure that the most current version of the form is used, as updates may occur periodically. Foundations should also consult the IRS guidelines for any specific instructions or changes related to the form.

Create this form in 5 minutes or less

Find and fill out the correct form 990 pf return of private foundation or section 4947a1 trust treated as private foundation 770308758

Create this form in 5 minutes!

How to create an eSignature for the form 990 pf return of private foundation or section 4947a1 trust treated as private foundation 770308758

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 pf pdf edit feature in airSlate SignNow?

The 990 pf pdf edit feature in airSlate SignNow allows users to easily modify and fill out 990 PF forms directly in PDF format. This functionality ensures that you can make necessary changes without needing to print or scan documents, streamlining your workflow.

-

How much does it cost to use the 990 pf pdf edit feature?

airSlate SignNow offers competitive pricing plans that include access to the 990 pf pdf edit feature. You can choose from various subscription options based on your business needs, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other applications for 990 pf pdf edit?

Yes, airSlate SignNow supports integrations with various applications, allowing you to enhance your 990 pf pdf edit experience. This means you can connect with tools like Google Drive, Dropbox, and more to streamline your document management process.

-

Is the 990 pf pdf edit feature user-friendly?

Absolutely! The 990 pf pdf edit feature in airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for anyone to edit PDF documents, regardless of their technical expertise.

-

What are the benefits of using airSlate SignNow for 990 pf pdf edit?

Using airSlate SignNow for 990 pf pdf edit provides numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. You can quickly edit, sign, and share documents, making it an efficient solution for your business.

-

Can I access the 990 pf pdf edit feature on mobile devices?

Yes, airSlate SignNow offers a mobile-friendly platform that allows you to access the 990 pf pdf edit feature on your smartphone or tablet. This flexibility ensures you can manage your documents on the go, enhancing productivity.

-

What types of documents can I edit with the 990 pf pdf edit feature?

With the 990 pf pdf edit feature, you can edit various types of documents, including tax forms, contracts, and agreements. This versatility makes airSlate SignNow a valuable tool for businesses needing to manage multiple document types.

Get more for Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

Find out other Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe