Taxes Attach Schedule See Instructions 2012

What is the Taxes attach Schedule see Instructions

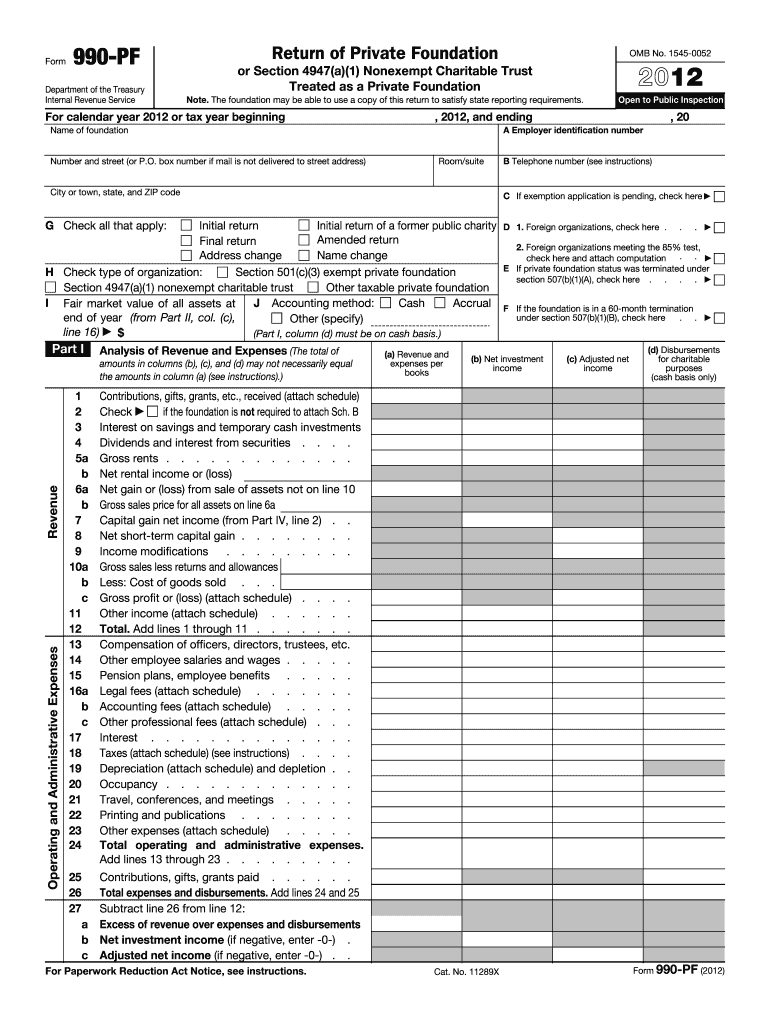

The Taxes attach Schedule see Instructions is a specific form used for tax reporting purposes in the United States. It provides essential guidelines and requirements for taxpayers to accurately report their financial information to the Internal Revenue Service (IRS). This form is particularly important for individuals and businesses that need to attach additional documentation or schedules to their primary tax return. Understanding this form is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Taxes attach Schedule see Instructions

Using the Taxes attach Schedule see Instructions involves several key steps. First, review the instructions carefully to understand what additional information is required based on your specific tax situation. Next, gather all necessary documents, such as income statements, deductions, and credits that need to be reported. Once you have compiled the required information, fill out the form accurately, ensuring that all entries are complete and correct. Finally, attach the completed schedule to your main tax return before submission, whether electronically or via mail.

Steps to complete the Taxes attach Schedule see Instructions

Completing the Taxes attach Schedule see Instructions can be broken down into manageable steps:

- Read the instructions thoroughly to understand the requirements.

- Collect all relevant financial documents and information.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Attach the form to your primary tax return.

- Submit your tax return by the deadline, either electronically or by mail.

Legal use of the Taxes attach Schedule see Instructions

The legal use of the Taxes attach Schedule see Instructions is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted in accordance with IRS guidelines. This includes adhering to deadlines and ensuring that all required attachments are included. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Taxes attach Schedule see Instructions typically align with the annual tax return deadlines set by the IRS. For most individual taxpayers, the deadline is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates and to plan accordingly to avoid late filing penalties.

Required Documents

When completing the Taxes attach Schedule see Instructions, several documents are typically required. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Statements for interest, dividends, or other income.

- Any previous tax returns that may provide relevant information.

Form Submission Methods (Online / Mail / In-Person)

The Taxes attach Schedule see Instructions can be submitted through various methods. Taxpayers have the option to file their forms electronically using approved e-filing software, which is often the fastest and most efficient method. Alternatively, forms can be mailed directly to the IRS or submitted in person at designated IRS offices. Each method has its own set of guidelines and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete taxes attach schedule see instructions

Prepare Taxes attach Schedule see Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Taxes attach Schedule see Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Taxes attach Schedule see Instructions with ease

- Obtain Taxes attach Schedule see Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize necessary sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Taxes attach Schedule see Instructions and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxes attach schedule see instructions

Create this form in 5 minutes!

How to create an eSignature for the taxes attach schedule see instructions

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Taxes attach Schedule see Instructions?

airSlate SignNow is a user-friendly eSignature solution that helps businesses digitally send and sign documents. When dealing with tax-related documents, it's important to ensure that you correctly follow the 'Taxes attach Schedule see Instructions' to stay compliant and avoid penalties.

-

How can airSlate SignNow simplify the process of handling tax documents?

With airSlate SignNow, you can easily send and receive signatures on important tax documents, including those that require you to 'attach Schedule see Instructions.' This streamlines your workflow, reduces paperwork, and ensures timely submissions.

-

Is airSlate SignNow cost-effective for small businesses focusing on tax preparation?

Yes, airSlate SignNow offers affordable pricing plans that cater to small businesses, making it a cost-effective choice for managing tax documents. By using our platform, businesses can efficiently handle documents related to 'Taxes attach Schedule see Instructions' without breaking the bank.

-

What features does airSlate SignNow offer for tax-related document management?

airSlate SignNow includes features like customizable templates, document tracking, and secure cloud storage, which are ideal for managing tax documents. These features ensure that you can effectively handle 'Taxes attach Schedule see Instructions' with ease and security.

-

Can airSlate SignNow integrate with other accounting software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration helps you manage documents related to 'Taxes attach Schedule see Instructions' directly from your preferred platforms, enhancing your productivity.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with regulations. When handling sensitive information such as 'Taxes attach Schedule see Instructions,' you can trust that your data is secure and protected.

-

What benefits can I expect from using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers several benefits, including faster turnaround times for signatures and a reduction in manual errors. This means you can more efficiently manage 'Taxes attach Schedule see Instructions' and ensure compliance with tax regulations.

Get more for Taxes attach Schedule see Instructions

- Ambrosia healthcare inc adult tpn prescription order form

- Adult psychosocial history burrell center form

- Access2care login form

- One time bcontribution formb unc medical center

- Face to face encounter referral form 050212doc

- Exercise intake form

- Micro needling consent form print out

- Personal auto coverage selections page massagentcom form

Find out other Taxes attach Schedule see Instructions

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document