Form 990 PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation 2020

What is the Form 990 PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation

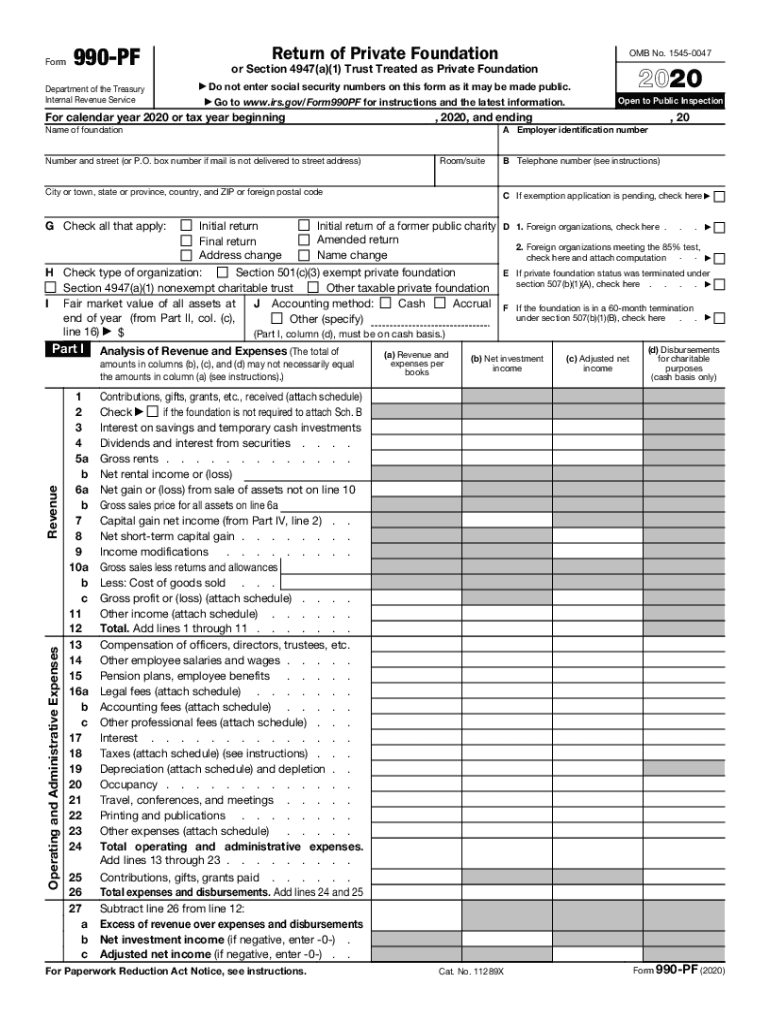

The Form 990 PF is a tax return specifically designed for private foundations and certain trusts that are treated as private foundations under Section 4947(a)(1) of the Internal Revenue Code. This form provides the IRS with detailed information about the foundation's financial activities, including income, expenses, and distributions made to charitable organizations. It is essential for ensuring compliance with federal tax regulations and maintaining the foundation's tax-exempt status.

Private foundations must file this form annually, detailing their financial information and activities for the previous year. The form includes sections for reporting assets, liabilities, revenue, and expenses, as well as required disclosures about the foundation's governance and operations.

Steps to Complete the Form 990 PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation

Completing the Form 990 PF involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including bank statements, investment reports, and documentation of grants made during the reporting period. Next, follow these steps:

- Fill out the basic information section, including the foundation's name, address, and Employer Identification Number (EIN).

- Report the foundation's financial activities, including total revenue, expenses, and net assets.

- Detail any grants or distributions made to charitable organizations, ensuring that all amounts are accurately reported.

- Complete the governance section, providing information about the board members and key staff.

- Review the form for completeness and accuracy before submission.

Once completed, the form can be filed electronically or submitted by mail, depending on the foundation's preference and IRS guidelines.

Legal Use of the Form 990 PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation

The legal use of the Form 990 PF is crucial for maintaining compliance with IRS regulations governing private foundations. Filing this form is not only a legal requirement but also serves to demonstrate transparency and accountability in the foundation's operations. Failure to file the form can result in penalties, including the loss of tax-exempt status.

Foundations must ensure that the information provided on the form is accurate and reflects their financial activities. This includes adhering to specific guidelines regarding the reporting of grants, investments, and operational expenses. Legal compliance is essential for fostering trust with donors, beneficiaries, and regulatory bodies.

Filing Deadlines / Important Dates

Private foundations must adhere to specific filing deadlines for the Form 990 PF to avoid penalties. The standard due date for the form is the fifteenth day of the fifth month following the end of the foundation's fiscal year. For example, if a foundation operates on a calendar year, the form is due on May 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Foundations can apply for an automatic six-month extension by filing Form 8868, which allows additional time to prepare the return. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Key Elements of the Form 990 PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation

The Form 990 PF consists of several key elements that must be accurately completed to ensure compliance. These elements include:

- Financial Statements: Detailed reporting of revenue, expenses, and net assets.

- Grants and Contributions: Information on distributions made to charitable organizations.

- Governance Information: Details about the foundation's board members and key personnel.

- Compliance Statements: Affirmations regarding adherence to IRS regulations and guidelines.

Each section of the form plays a critical role in providing a comprehensive overview of the foundation's financial health and operational integrity.

Form Submission Methods (Online / Mail / In-Person)

Private foundations have several options for submitting the Form 990 PF. The IRS encourages electronic filing, which can be done through approved e-file providers. Electronic submission offers several advantages, including faster processing times and immediate confirmation of receipt.

For those who prefer traditional methods, the form can also be submitted by mail. When mailing the form, it is important to send it to the correct IRS address based on the foundation's location and whether a payment is included. In-person submission is generally not an option for this form, as the IRS does not accept in-person filings for Form 990 PF.

Quick guide on how to complete 2020 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Complete Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation with ease on any device

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an excellent sustainable substitute for traditional paper documents, as you can easily locate the required form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without hold-ups. Handle Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to update and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation with minimal effort

- Obtain Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation to guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the IRS 990 PF form and why is it important?

The IRS 990 PF form is a tax return that private foundations must file annually with the IRS. It's crucial for maintaining transparency, as it provides insight into a foundation’s financial activities and charitable distributions. Understanding how to complete the IRS 990 PF accurately can help organizations avoid penalties and ensure compliance.

-

How can airSlate SignNow assist with completing the IRS 990 PF form?

airSlate SignNow streamlines the process of collecting signatures and required documents for the IRS 990 PF form. Our platform allows you to send, eSign, and manage documents easily, ensuring that your forms are submitted accurately and on time. This can signNowly reduce the administrative burden associated with filing.

-

What features does airSlate SignNow offer for IRS 990 PF management?

With airSlate SignNow, you can utilize features like customizable templates, advanced document tracking, and secure cloud storage, all tailored to support IRS 990 PF submissions. Additionally, our user-friendly interface simplifies the eSigning process for all stakeholders involved, improving efficiency and compliance.

-

Is airSlate SignNow cost-effective for organizations needing to file the IRS 990 PF?

Yes, airSlate SignNow offers affordable pricing plans that cater to different organizational needs, making it a cost-effective choice for those filing the IRS 990 PF. By using our service, organizations can save time and reduce costs associated with paper processes and manual errors in document management.

-

How does airSlate SignNow ensure compliance for IRS 990 PF submissions?

airSlate SignNow follows industry-standard security protocols and provides tools that help ensure compliance with IRS regulations when submitting the IRS 990 PF. Our platform offers audit trails, secure storage, and electronic signatures, all of which help maintain the integrity and legality of your filings.

-

Can airSlate SignNow integrate with other accounting or filing software for IRS 990 PF?

Yes, airSlate SignNow seamlessly integrates with popular accounting and document management software, making it easier for organizations to prepare and submit the IRS 990 PF. These integrations help streamline workflows, ensuring all necessary documents and electronic signatures are collected efficiently.

-

What are the benefits of using airSlate SignNow for non-profits filing IRS 990 PF?

Using airSlate SignNow benefits non-profits by simplifying the document signing process, enhancing communication between stakeholders, and ensuring timely IRS 990 PF submissions. Our platform reduces the risk of errors and compliance issues, allowing non-profits to focus on their missions rather than paperwork.

Get more for Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

Find out other Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile