Form 990 PF IRS Tax Forms 2022

What is the Form 990 PF?

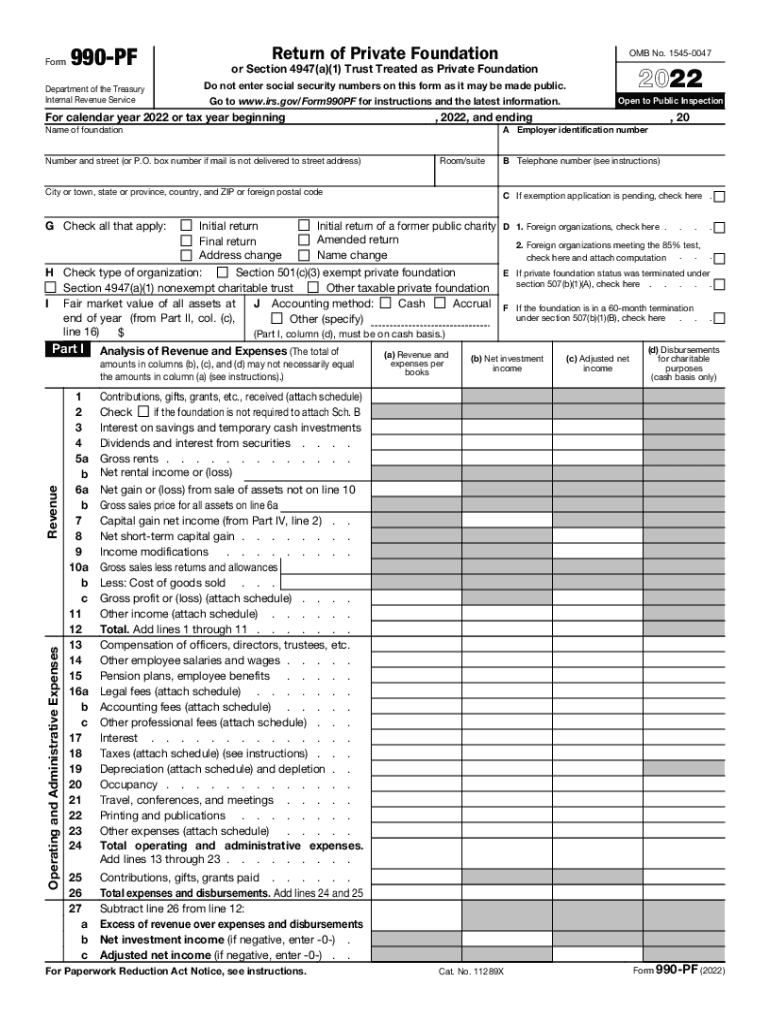

The Form 990 PF is a crucial tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. This form provides transparency regarding the financial activities of these foundations, including their revenues, expenses, and distributions. The information disclosed helps ensure compliance with federal tax regulations and informs the public about the foundation's operations and charitable efforts. Understanding the purpose and requirements of the Form 990 PF is essential for private foundations to maintain their tax-exempt status.

Steps to Complete the Form 990 PF

Completing the Form 990 PF involves several key steps that ensure accurate reporting of a private foundation's financial activities. Begin by gathering all necessary financial records, including income statements, balance sheets, and documentation of charitable distributions. Next, follow these steps:

- Fill out basic information about the foundation, including its name, address, and Employer Identification Number (EIN).

- Report revenue sources, including contributions, investment income, and other income streams.

- Detail expenses, including administrative costs, grants made, and other operational expenses.

- Complete the sections on charitable distributions to demonstrate compliance with the required payout percentage.

- Review the form for accuracy and ensure all required signatures are included.

Once completed, the form can be filed electronically or submitted via mail, depending on the foundation's preference and IRS guidelines.

Legal Use of the Form 990 PF

The legal use of the Form 990 PF is essential for maintaining compliance with IRS regulations governing private foundations. This form must be filed annually to report financial activities and ensure that the foundation meets its charitable distribution requirements. Failure to file the Form 990 PF can result in penalties, including the loss of tax-exempt status. It is important for foundations to understand the legal implications of this form and to file it accurately and on time to avoid any legal issues.

Filing Deadlines / Important Dates

Private foundations must adhere to specific filing deadlines for the Form 990 PF to remain compliant with IRS regulations. Generally, the form is due on the fifteenth day of the fifth month after the end of the foundation's tax year. For example, if a foundation operates on a calendar year, the Form 990 PF would be due by May 15 of the following year. Extensions may be available, but it is crucial to file for an extension before the original due date to avoid penalties.

Required Documents

When preparing to file the Form 990 PF, several documents are necessary to ensure accurate reporting. These include:

- Financial statements, such as income statements and balance sheets.

- Documentation of grants and charitable distributions made during the tax year.

- Records of any investments or income-generating activities.

- Supporting documentation for any deductions claimed.

Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Form Submission Methods

The Form 990 PF can be submitted to the IRS through various methods, providing flexibility for private foundations. The primary submission methods include:

- Online Filing: Foundations can file the form electronically through approved e-filing services, which may expedite processing.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address, ensuring that it is sent well before the deadline.

- In-Person Filing: While less common, some foundations may choose to deliver their forms in person to an IRS office.

Each method has its advantages, and foundations should choose the one that best fits their operational needs.

Quick guide on how to complete 2022 form 990 pf irs tax forms

Complete Form 990 PF IRS Tax Forms effortlessly on any gadget

Web-based document management has gained traction with businesses and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without holdups. Handle Form 990 PF IRS Tax Forms on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form 990 PF IRS Tax Forms with ease

- Find Form 990 PF IRS Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced records, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 990 PF IRS Tax Forms and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 990 pf irs tax forms

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 'pf'?

airSlate SignNow is a comprehensive eSigning solution that empowers businesses to send and eSign documents efficiently. The platform simplifies the signing process, ensuring that key features associated with 'pf' are easily accessible for users. By reducing manual tasks, businesses can streamline their operations and improve workflow efficiency.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans designed to meet diverse business needs while incorporating essential features related to 'pf.' These plans range from basic to advanced options, allowing users to choose what fits their budget. For precise pricing, you can check our website for the latest updates and promotions.

-

What features does airSlate SignNow provide for document management?

The airSlate SignNow platform provides a variety of document management features crucial for 'pf,' including templates, customizable workflows, and secure storage. Users can easily create, send, and track documents all in one place, enhancing productivity and reducing errors. The intuitive interface reduces the learning curve for new users.

-

How does airSlate SignNow ensure the security of signed documents?

Security is paramount at airSlate SignNow, which implements robust measures to protect documents during the 'pf' signing process. Our platform complies with industry standards and regulations, employing encryption and secure access protocols. This ensures that sensitive information remains confidential throughout the entire eSigning lifecycle.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow supports integrations with various applications to enhance productivity and streamline processes related to 'pf.' Our solution easily connects with popular CRMs, cloud storage services, and productivity tools, allowing businesses to leverage existing software. This integration capability fosters seamless data flow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers several benefits, particularly pertaining to 'pf.' It accelerates the signing process, reduces paperwork, and minimizes delays in document handling. Additionally, businesses can track the status of documents in real-time, improving communication and ensuring timely responses.

-

Is there a free trial available for airSlate SignNow?

airSlate SignNow provides a free trial for users to explore its features related to 'pf' before committing to a subscription. This allows prospective customers to assess how well our platform meets their eSigning needs without any financial obligation. To get started, simply sign up on our website.

Get more for Form 990 PF IRS Tax Forms

- Motion to approve reaffirmation agreement kentucky form

- Certificate of service of plan kentucky form

- Correction statement and agreement kentucky form

- Kentucky statement form

- Flood zone statement and authorization kentucky form

- Name affidavit of buyer kentucky form

- Name affidavit of seller kentucky form

- Non foreign affidavit under irc 1445 kentucky form

Find out other Form 990 PF IRS Tax Forms

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer