Irs Printable Tax Form Schedule K1 Form1041 2019

What is the IRS Schedule K-1 Form 1041?

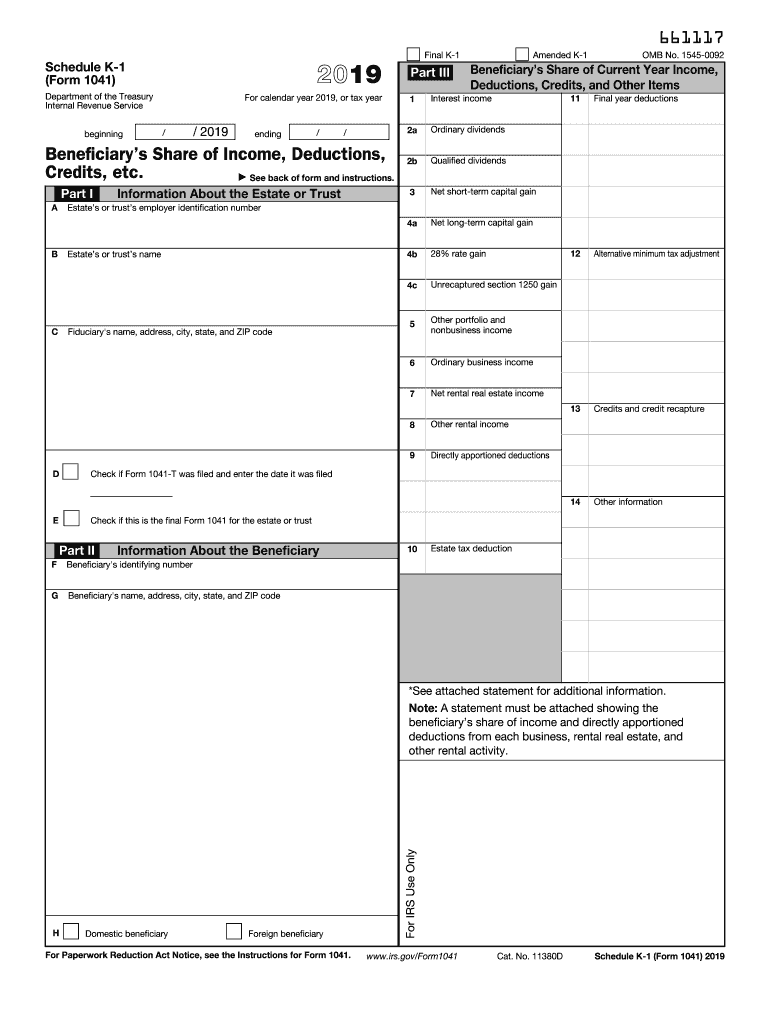

The IRS Schedule K-1 Form 1041 is a tax document used to report income, deductions, and credits from estates and trusts. This form is essential for beneficiaries who receive distributions from an estate or trust. It provides detailed information about the income earned by the estate or trust, which beneficiaries must report on their personal tax returns. The Schedule K-1 is part of the Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. Each beneficiary receives a separate K-1 reflecting their share of the estate's or trust's income.

Steps to Complete the IRS Schedule K-1 Form 1041

Completing the IRS Schedule K-1 Form 1041 involves several important steps:

- Gather necessary information about the estate or trust, including its income and deductions.

- Fill out the identifying information for the estate or trust at the top of the form.

- Report the income items, such as interest, dividends, and capital gains, in the appropriate sections.

- Include any deductions or credits that apply to the beneficiary.

- Distribute the completed K-1 to each beneficiary, ensuring they receive accurate information for their tax filings.

How to Obtain the IRS Schedule K-1 Form 1041

To obtain the IRS Schedule K-1 Form 1041, you can access it through the official IRS website. The form is available for download as a PDF, allowing you to print and complete it manually. Additionally, tax preparation software often includes the Schedule K-1, making it easier to fill out and file electronically. Ensure you have the correct version of the form for the tax year you are reporting.

Legal Use of the IRS Schedule K-1 Form 1041

The IRS Schedule K-1 Form 1041 is legally binding when completed correctly and submitted to the IRS. It serves as an official record of the income and deductions attributed to beneficiaries of an estate or trust. For the K-1 to be considered valid, it must be accurately filled out, signed, and provided to beneficiaries by the estate or trust's fiduciary. Failure to comply with IRS regulations regarding the K-1 can result in penalties for both the estate and the beneficiaries.

Key Elements of the IRS Schedule K-1 Form 1041

The key elements of the IRS Schedule K-1 Form 1041 include:

- Identifying Information: This section includes the name, address, and taxpayer identification number of the estate or trust.

- Beneficiary Information: Details about the beneficiary receiving the K-1, including their name and taxpayer identification number.

- Income Reporting: Various income types, such as ordinary income, capital gains, and other income, must be reported in specific boxes.

- Deductions and Credits: Any deductions or credits that the beneficiary can claim based on their share of the estate or trust's income.

Filing Deadlines / Important Dates for IRS Schedule K-1 Form 1041

The IRS Schedule K-1 Form 1041 must be filed along with Form 1041 by the due date of the estate or trust's tax return. Typically, this deadline is the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, the deadline is April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for fiduciaries to adhere to these deadlines to avoid penalties.

Quick guide on how to complete irs printable tax form schedule k1 form1041

Effortlessly Prepare Irs Printable Tax Form Schedule K1 Form1041 on Any Device

Web-based document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Irs Printable Tax Form Schedule K1 Form1041 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Your Best Option to Modify and Electronically Sign Irs Printable Tax Form Schedule K1 Form1041 with Ease

- Obtain Irs Printable Tax Form Schedule K1 Form1041 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Banish concerns about lost or mislaid files, the frustration of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Irs Printable Tax Form Schedule K1 Form1041 and maintain outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs printable tax form schedule k1 form1041

Create this form in 5 minutes!

How to create an eSignature for the irs printable tax form schedule k1 form1041

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the IRS Schedule K-1 Form 1041?

The IRS Schedule K-1 Form 1041 is used to report income, deductions, and credits from estates and trusts. Beneficiaries receive this form to include in their personal tax returns. Understanding the IRS Schedule K-1 Form 1041 is essential for proper tax reporting.

-

How can airSlate SignNow help with the IRS Schedule K-1 Form 1041?

airSlate SignNow streamlines the process of sending and eSigning the IRS Schedule K-1 Form 1041. With its user-friendly interface, you can easily manage all your documents and ensure they are securely signed and submitted on time.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow includes features such as document templates, custom branding, and secure eSignature options that are ideal for handling tax documents like the IRS Schedule K-1 Form 1041. These features help ensure compliance while improving efficiency.

-

Is airSlate SignNow cost-effective for small businesses managing IRS Schedule K-1 Form 1041?

Yes, airSlate SignNow offers affordable pricing plans that cater to small businesses. By utilizing this solution for the IRS Schedule K-1 Form 1041, businesses can save on printing and mailing costs while benefiting from an efficient eSignature process.

-

Can I integrate airSlate SignNow with my current accounting software for IRS Schedule K-1 Form 1041?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your IRS Schedule K-1 Form 1041. This integration ensures that your financial data is synchronized and up to date.

-

How does airSlate SignNow enhance security for IRS Schedule K-1 Form 1041 transactions?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your IRS Schedule K-1 Form 1041 and other sensitive documents. This commitment to security ensures that your files remain confidential and secure.

-

What are the benefits of using airSlate SignNow for the IRS Schedule K-1 Form 1041 process?

By using airSlate SignNow for the IRS Schedule K-1 Form 1041 process, you can expedite document turnaround times, improve accuracy, and ensure compliance with IRS regulations. This results in a more streamlined workflow that can enhance your overall efficiency.

Get more for Irs Printable Tax Form Schedule K1 Form1041

Find out other Irs Printable Tax Form Schedule K1 Form1041

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free