Irs Form 1041 Schedule K 1 2017

What is the IRS Form 1041 Schedule K-1

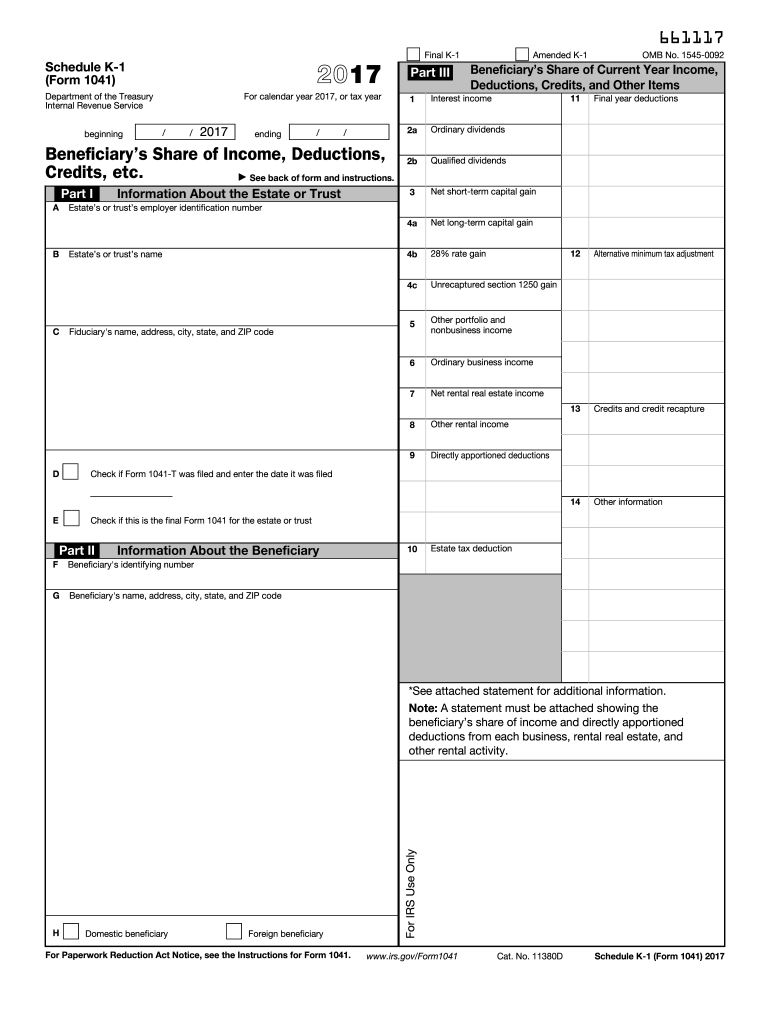

The IRS Form 1041 Schedule K-1 is a tax document used to report income, deductions, and credits from estates and trusts to beneficiaries. This form is essential for beneficiaries to accurately report their share of the estate or trust's income on their personal tax returns. The Schedule K-1 provides detailed information about the income distributed to each beneficiary, including interest, dividends, capital gains, and other types of income. It is crucial for ensuring that beneficiaries meet their tax obligations and properly account for their share of the estate or trust income.

Steps to Complete the IRS Form 1041 Schedule K-1

Completing the IRS Form 1041 Schedule K-1 involves several important steps:

- Gather necessary information about the estate or trust, including its income and expenses.

- Identify the beneficiaries and their respective shares of the income.

- Fill out the form by entering the estate or trust's information, including the name, address, and tax identification number.

- Report the income distributed to each beneficiary in the appropriate sections, ensuring accuracy.

- Provide any additional information required, such as deductions and credits applicable to each beneficiary.

- Review the completed form for accuracy before submitting it with the estate or trust's tax return.

How to Obtain the IRS Form 1041 Schedule K-1

The IRS Form 1041 Schedule K-1 can be obtained through several methods. It is available for download directly from the IRS website, where users can access the most current version of the form. Additionally, tax preparation software often includes the Schedule K-1 as part of their offerings, allowing users to fill it out digitally. Consulting with a tax professional can also provide access to the form and guidance on its completion.

Legal Use of the IRS Form 1041 Schedule K-1

The legal use of the IRS Form 1041 Schedule K-1 is essential for compliance with federal tax laws. Beneficiaries must receive their Schedule K-1 to report income accurately on their tax returns. Failure to provide this form can lead to discrepancies in reported income, resulting in potential penalties or audits. It is important for trustees or executors to ensure that the form is completed correctly and distributed to beneficiaries in a timely manner to facilitate proper tax reporting.

Key Elements of the IRS Form 1041 Schedule K-1

Key elements of the IRS Form 1041 Schedule K-1 include:

- Beneficiary Information: Name, address, and taxpayer identification number of each beneficiary.

- Income Distribution: Detailed breakdown of the income types distributed, such as interest, dividends, and capital gains.

- Deductions and Credits: Any deductions or credits that beneficiaries can claim based on the estate or trust's activities.

- Trust or Estate Information: Name, address, and taxpayer identification number of the estate or trust.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1041 Schedule K-1 are crucial for compliance. The form must be filed with the estate or trust's annual tax return, which is typically due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is important for trustees to ensure that beneficiaries receive their Schedule K-1 in advance of this deadline to allow sufficient time for accurate reporting on their personal tax returns.

Quick guide on how to complete irs form 1041 schedule k 1 2017 2018

Discover the simplest method to complete and endorse your Irs Form 1041 Schedule K 1

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior method to complete and endorse your Irs Form 1041 Schedule K 1 and related forms for public services. Our advanced electronic signature solution provides you with all the tools required to handle paperwork swiftly and in compliance with formal standards - robust PDF editing, management, protection, signing, and sharing functionalities readily available within an intuitive interface.

Only a few steps are required to finalize and endorse your Irs Form 1041 Schedule K 1:

- Incorporate the editable template into the editor using the Get Form button.

- Verify what information you need to submit in your Irs Form 1041 Schedule K 1.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Block out sections that are no longer relevant.

- Select Sign to generate a legally valid electronic signature using any method you prefer.

- Include the Date next to your signature and conclude your work with the Done button.

Store your completed Irs Form 1041 Schedule K 1 in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our solution also offers versatile form sharing options. There's no need to print out your forms when submitting them to the appropriate public office - do so via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1041 schedule k 1 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

What should be my strategy, while filling out the option form for the CAP Round 1, for first year engineering admissions in 2017-2018?

You are allowed to fill about 100 choices. So use this fact to your advantage. The most popular strategy adopted by the students is to fill the options one by one with the name of most reputed college.Its like this :First most reputed college - CompSecond most reputed college - Comp.. so on.How to find which college is better than others . Just check the previous year cut offs of the colleges. MHT CET Cutoff 2017Fill the form patiently and carefully. All the Best.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

Create this form in 5 minutes!

How to create an eSignature for the irs form 1041 schedule k 1 2017 2018

How to create an electronic signature for your Irs Form 1041 Schedule K 1 2017 2018 in the online mode

How to create an electronic signature for the Irs Form 1041 Schedule K 1 2017 2018 in Chrome

How to create an electronic signature for putting it on the Irs Form 1041 Schedule K 1 2017 2018 in Gmail

How to create an electronic signature for the Irs Form 1041 Schedule K 1 2017 2018 right from your mobile device

How to make an eSignature for the Irs Form 1041 Schedule K 1 2017 2018 on iOS

How to make an electronic signature for the Irs Form 1041 Schedule K 1 2017 2018 on Android OS

People also ask

-

What is IRS Form 1041 Schedule K 1?

IRS Form 1041 Schedule K 1 is a tax document used to report income, deductions, and credits from estates and trusts. If you are involved in such financial arrangements, understanding how to fill out this form correctly is essential for compliance. Using airSlate SignNow can help simplify the eSigning process, ensuring your IRS Form 1041 Schedule K 1 is processed efficiently.

-

How can airSlate SignNow help with IRS Form 1041 Schedule K 1?

airSlate SignNow makes managing IRS Form 1041 Schedule K 1 easier by allowing users to send, sign, and store these crucial documents digitally. With an intuitive interface, you can quickly gather signatures from all relevant parties, enhancing the overall workflow. This can save you time and reduce the chances of mistakes when filing your taxes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it accessible for organizations of any size. You can choose a plan that fits your budget and requirements, allowing you to manage IRS Form 1041 Schedule K 1 efficiently without breaking the bank. Explore our pricing page for detailed information on available packages.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow complies with all necessary IRS regulations to ensure that your IRS Form 1041 Schedule K 1 is handled securely and according to legal standards. Our software employs advanced security measures, giving you peace of mind as you transmit sensitive tax documents. Trust us to help you manage compliance effectively.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! AirSlate SignNow can integrate seamlessly with various tax preparation software allowing for an efficient workflow when handling IRS Form 1041 Schedule K 1. This eliminates the need for manual data entry, saving time and reducing errors. Check our integrations page to find software that works best for your tax needs.

-

How secure is my data when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses encryption protocols to protect your data while you work with IRS Form 1041 Schedule K 1. You can trust that your sensitive documents are safe from unauthorized access during the signing and storage processes.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides a robust set of document management features, including customizable templates for IRS Form 1041 Schedule K 1, easy tracking of document statuses, and automated notifications. These features streamline the signing process, allowing you to focus more on your business and less on paperwork. Experience efficient document management with our user-friendly tools.

Get more for Irs Form 1041 Schedule K 1

Find out other Irs Form 1041 Schedule K 1

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple