Schedule K Irs Fillable Forms 2012

What is the Schedule K IRS Fillable Forms

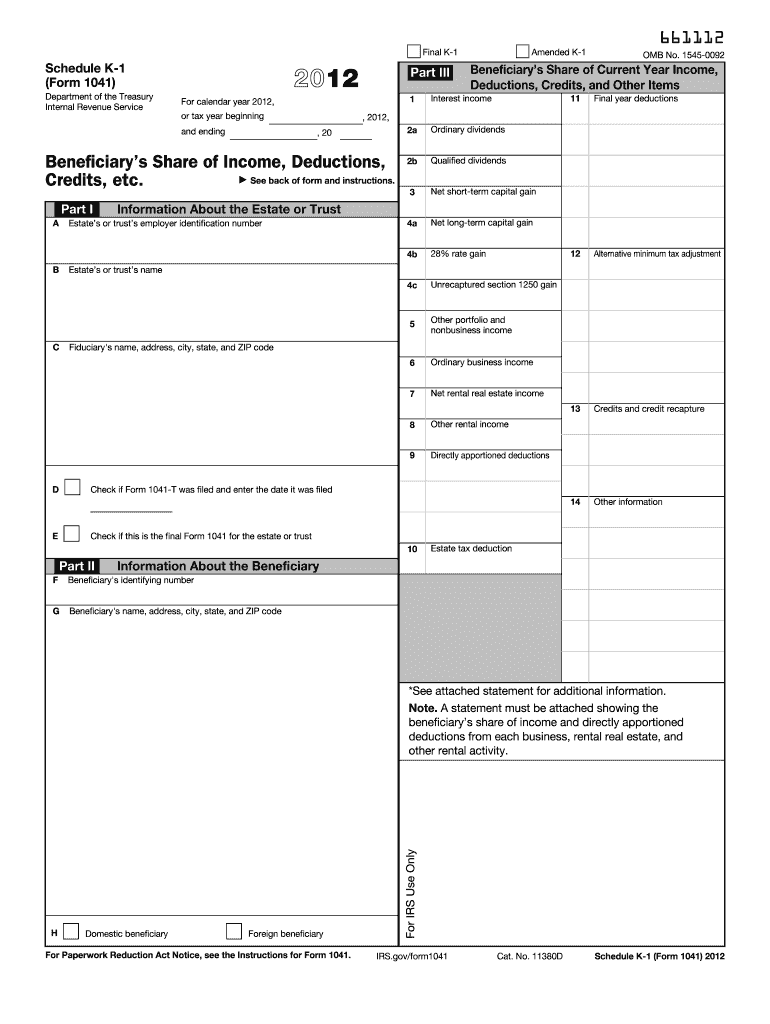

The Schedule K IRS fillable forms are essential documents used for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. These forms help ensure that the income earned from these entities is accurately reported to the IRS. The information collected on these forms is crucial for partners or shareholders to report their share of income or loss on their individual tax returns. The fillable format allows users to complete the forms electronically, making the process more efficient and reducing the likelihood of errors.

How to use the Schedule K IRS Fillable Forms

Using the Schedule K IRS fillable forms involves several steps. First, access the form through a reliable platform that offers fillable options. Once you have the form open, input the required information, including your name, taxpayer identification number, and details about your share of income or loss. Ensure that you follow the instructions provided within the form to complete each section accurately. After filling out the form, review it for any errors or omissions before saving or printing it for submission.

Steps to complete the Schedule K IRS Fillable Forms

Completing the Schedule K IRS fillable forms can be streamlined by following these steps:

- Access the fillable form from a trusted source.

- Enter your personal information, including your name and taxpayer identification number.

- Fill in the details regarding the income, deductions, and credits as specified in the form.

- Review all entries to ensure accuracy and completeness.

- Save the completed form in a secure location.

- Print the form if necessary for submission or retain it for your records.

Legal use of the Schedule K IRS Fillable Forms

The Schedule K IRS fillable forms are legally recognized for tax reporting purposes when completed according to IRS guidelines. To ensure that the form is legally valid, it must be signed and dated appropriately. Utilizing a digital platform that complies with eSignature laws can enhance the legal standing of the completed document. It is important to retain copies of the filled forms for your records, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K IRS fillable forms vary depending on the type of entity involved. Generally, partnerships and S corporations must file their forms by the fifteenth day of the third month following the end of their tax year. For example, if your tax year ends on December thirty-first, your form would be due by March fifteenth of the following year. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Examples of using the Schedule K IRS Fillable Forms

Examples of using the Schedule K IRS fillable forms include reporting income from a partnership or an S corporation. For instance, if you are a partner in a business that earned $100,000 in profits, you would report your share, based on your partnership agreement, on the Schedule K form. Similarly, shareholders of an S corporation would use the form to report their share of the corporation's income, deductions, and credits. These examples illustrate how the form facilitates accurate income reporting for various business structures.

Quick guide on how to complete schedule k irs fillable forms 2012

Effortlessly Prepare Schedule K Irs Fillable Forms on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly and without issues. Handle Schedule K Irs Fillable Forms on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Schedule K Irs Fillable Forms with Ease

- Obtain Schedule K Irs Fillable Forms and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, painstaking form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Schedule K Irs Fillable Forms while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k irs fillable forms 2012

Create this form in 5 minutes!

How to create an eSignature for the schedule k irs fillable forms 2012

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What are Schedule K IRS fillable forms?

Schedule K IRS fillable forms are tax documents used to report income, deductions, and credits for partnerships and S corporations. These fillable forms simplify the tax filing process by allowing taxpayers to enter information directly into the form electronically. With airSlate SignNow, you can easily manage and eSign these forms to ensure compliance and accuracy.

-

How can I access Schedule K IRS fillable forms using airSlate SignNow?

You can access Schedule K IRS fillable forms directly through the airSlate SignNow platform. Simply navigate to our library of forms and select the desired Schedule K. From there, you can fill out, customize, and eSign your form, making the tax filing process more efficient.

-

Are Schedule K IRS fillable forms compatible with other software?

Yes, Schedule K IRS fillable forms generated through airSlate SignNow are compatible with various accounting and tax software programs. This integration streamlines your workflow by allowing you to export completed forms effortlessly. Our platform ensures that your data is easily transferable and accessible when you need it.

-

What features does airSlate SignNow offer for Schedule K IRS fillable forms?

AirSlate SignNow offers a range of features for Schedule K IRS fillable forms, including electronic signing, collaboration tools, and automated workflows. These features help enhance productivity and ensure that all parties involved can access and complete the forms efficiently. You can track document status and manage your forms from a single dashboard.

-

How much does it cost to use airSlate SignNow for Schedule K IRS fillable forms?

AirSlate SignNow offers competitive pricing plans tailored to your needs for accessing Schedule K IRS fillable forms. We provide various subscription options that cater to individuals and businesses alike, ensuring you receive the best value for your usage. Explore our plans to find one that fits your budget.

-

Can I save my progress on the Schedule K IRS fillable forms?

Yes, with airSlate SignNow, you can easily save your progress on Schedule K IRS fillable forms. This feature allows you to return to your document whenever it's convenient for you without losing any entered data. This flexibility ensures that you can complete your form at your own pace.

-

Is it secure to eSign Schedule K IRS fillable forms with airSlate SignNow?

Absolutely. AirSlate SignNow prioritizes security and ensures that all eSignatures on Schedule K IRS fillable forms are legally binding and protected. Our platform uses advanced encryption and security measures to safeguard your sensitive information throughout the signing process.

Get more for Schedule K Irs Fillable Forms

- Js 44 civil cover sheet federal district court georgia form

- Georgia lead based paint form

- Lead based disclosure 497303976 form

- Notice of lease for recording georgia form

- Cancellation lien notice form

- Cancellation of preliminary lien notice for final payment sect 44 14 362 corporation or llc georgia form

- Georgia waiver payment form

- Georgia waiver release form

Find out other Schedule K Irs Fillable Forms

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple