Form 1041 PDF 2018

What is the Form 1041 PDF?

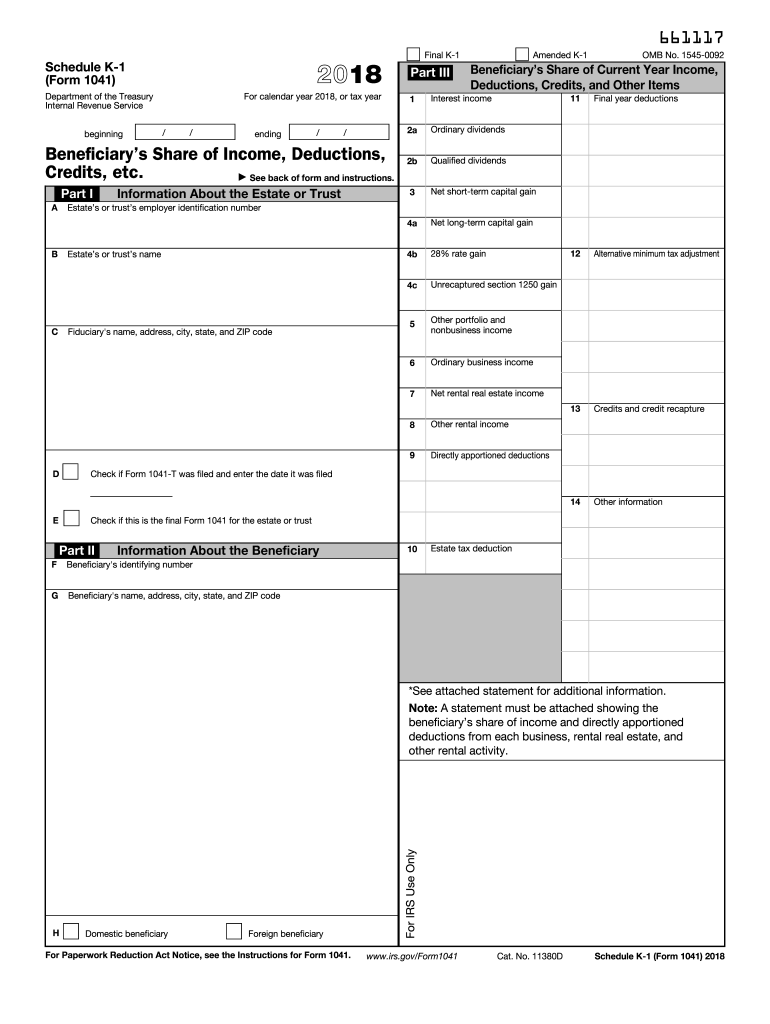

The Form 1041 PDF is a tax document used by estates and trusts in the United States to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage the financial affairs of an estate or trust. It allows them to report the income earned by the estate or trust during the tax year, ensuring compliance with IRS regulations. The Schedule K-1 (Form 1041) is a part of this process, as it is used to report the income distributed to beneficiaries. Understanding this form is crucial for accurate tax reporting and fulfilling legal obligations.

Steps to Complete the Form 1041 PDF

Completing the Form 1041 PDF involves several key steps:

- Gather necessary information regarding the estate or trust, including income, deductions, and distributions.

- Fill out the identification section, including the name and address of the estate or trust, and the employer identification number (EIN).

- Report income from various sources, such as dividends, interest, and capital gains, in the appropriate sections of the form.

- Deduct allowable expenses, including administrative costs and distributions to beneficiaries, to determine the taxable income.

- Complete the Schedule K-1 for each beneficiary to report their share of the income, deductions, and credits.

- Review the form for accuracy and completeness before submitting it to the IRS.

How to Obtain the Form 1041 PDF

The Form 1041 PDF can be obtained directly from the IRS website. Users can download the form and its instructions for free. It is important to ensure that you are using the correct version for the tax year in question, such as the 2017 version. Additionally, many tax preparation software programs include the Form 1041, allowing for easier completion and electronic filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 PDF are crucial for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the estate’s or trust’s tax year. For estates and trusts operating on a calendar year, this means the form is typically due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Extensions may be available, but it is important to file Form 7004 to request an extension before the original due date.

Legal Use of the Form 1041 PDF

The legal use of the Form 1041 PDF is to ensure compliance with federal tax laws governing estates and trusts. It is a legal requirement for fiduciaries to file this form if the estate or trust has gross income of $600 or more for the tax year. Failure to file can result in penalties and interest on unpaid taxes. Additionally, accurate completion of the form is necessary to protect the fiduciary from legal liabilities and to ensure beneficiaries receive their correct share of income.

Form Submission Methods (Online / Mail / In-Person)

The Form 1041 PDF can be submitted in several ways. For electronic filing, many tax preparation software programs allow for direct submission to the IRS. This method is often faster and provides immediate confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate IRS address based on the estate's or trust's location. It is important to ensure that the form is sent to the correct address to avoid delays. In-person submission is not typically available for this form, as it is primarily processed through mail or electronic filing.

Quick guide on how to complete irs form 1041 schedule k 1 2018 2019

Discover the most efficient method to complete and endorse your Form 1041 Pdf

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior method to complete and endorse your Form 1041 Pdf and associated forms for public services. Our advanced eSignature solution equips you with everything necessary to handle documents swiftly and in line with official regulations - comprehensive PDF editing, organization, security, signing, and sharing tools readily available within a user-friendly interface.

Only a few steps are needed to finalize and endorse your Form 1041 Pdf:

- Insert the editable template into the editor by clicking the Get Form button.

- Identify the information you need to enter in your Form 1041 Pdf.

- Traverse between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content using Text boxes or Images from the top toolbar.

- Emphasize what is important or Conceal fields that are no longer relevant.

- Select Sign to create a legally binding eSignature using your preferred method.

- Insert the Date next to your signature and finalize your task by clicking the Done button.

Store your completed Form 1041 Pdf in the Documents folder in your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides versatile file sharing. There's no necessity to print your forms when submitting them at the appropriate public office - accomplish this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1041 schedule k 1 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

Create this form in 5 minutes!

How to create an eSignature for the irs form 1041 schedule k 1 2018 2019

How to generate an electronic signature for the Irs Form 1041 Schedule K 1 2018 2019 in the online mode

How to generate an eSignature for the Irs Form 1041 Schedule K 1 2018 2019 in Google Chrome

How to generate an electronic signature for putting it on the Irs Form 1041 Schedule K 1 2018 2019 in Gmail

How to create an eSignature for the Irs Form 1041 Schedule K 1 2018 2019 right from your mobile device

How to make an electronic signature for the Irs Form 1041 Schedule K 1 2018 2019 on iOS devices

How to create an electronic signature for the Irs Form 1041 Schedule K 1 2018 2019 on Android

People also ask

-

What is the Schedule K-1 Form 1041 2017 used for?

The Schedule K-1 Form 1041 2017 is used to report income, deductions, and credits from estates and trusts to beneficiaries. It provides the necessary information for beneficiaries to report their share of the estate or trust's income on their personal tax returns.

-

How can I fill out the Schedule K-1 Form 1041 2017 using airSlate SignNow?

You can easily fill out the Schedule K-1 Form 1041 2017 using airSlate SignNow's user-friendly interface. Simply upload your document, and utilize our editing tools to complete the necessary fields with accurate information.

-

Is airSlate SignNow compliant with IRS regulations for the Schedule K-1 Form 1041 2017?

Yes, airSlate SignNow is fully compliant with IRS regulations, ensuring that your Schedule K-1 Form 1041 2017 is completed accurately and securely. We prioritize data privacy and adhere to essential compliance standards in document management.

-

What features does airSlate SignNow offer for managing Schedule K-1 Form 1041 2017?

airSlate SignNow offers several features for managing the Schedule K-1 Form 1041 2017, including electronic signatures, cloud storage, and customizable templates. These features streamline the preparation and submission processes, making it easier for users to handle tax documents.

-

Are there any pricing options for using airSlate SignNow to manage Schedule K-1 Form 1041 2017?

Yes, airSlate SignNow offers flexible pricing options to accommodate various business needs when managing the Schedule K-1 Form 1041 2017. Our plans provide access to essential features that make document handling more efficient, with options for monthly or annual subscriptions.

-

Can I integrate airSlate SignNow with other accounting software for Schedule K-1 Form 1041 2017?

Absolutely! airSlate SignNow can be easily integrated with popular accounting software, allowing for seamless management of the Schedule K-1 Form 1041 2017. This integration ensures that your tax documents are aligned with your financial records for better accuracy.

-

What are the benefits of using airSlate SignNow for the Schedule K-1 Form 1041 2017?

Using airSlate SignNow for the Schedule K-1 Form 1041 2017 offers numerous benefits, including increased efficiency, reduced errors, and a streamlined workflow. Additionally, the ability to electronically sign and store documents enhances accessibility and convenience for users.

Get more for Form 1041 Pdf

Find out other Form 1041 Pdf

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online