K 1 Form 2015

What is the K-1 Form

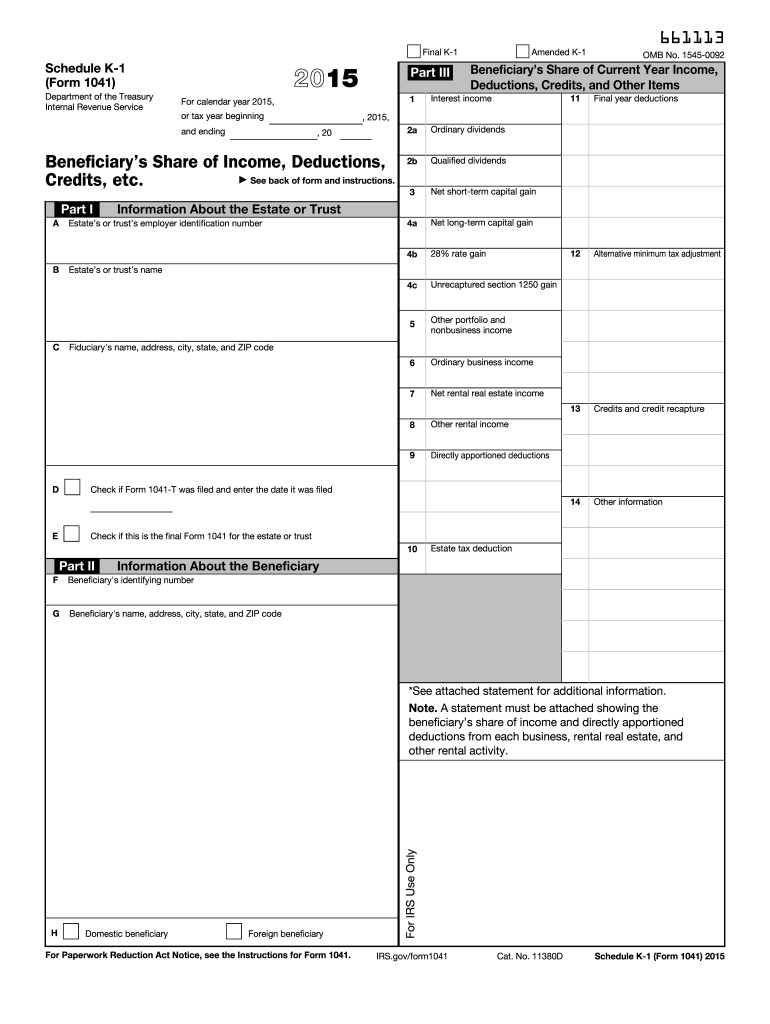

The K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Each partner or shareholder receives a K-1 to report their share of the entity's income on their personal tax returns. The K-1 Form is essential for ensuring accurate tax reporting and compliance with IRS regulations. It provides detailed information about the income earned from the entity, which can include interest, dividends, capital gains, and other types of income.

How to use the K-1 Form

To effectively use the K-1 Form, taxpayers should first receive their K-1 from the partnership or S corporation. Once received, individuals must review the form for accuracy, ensuring that all reported amounts align with their records. The information on the K-1 must then be transferred to the appropriate sections of the individual’s tax return, typically Form 1040. It is crucial to include all income reported on the K-1 to avoid discrepancies with the IRS.

Steps to complete the K-1 Form

Completing the K-1 Form involves several key steps:

- Gather necessary information about the partnership or S corporation, including name, address, and Employer Identification Number (EIN).

- Identify the type of income to report, such as ordinary business income, rental income, or capital gains.

- Fill out the K-1 by entering the appropriate amounts in the designated boxes, ensuring accuracy in reporting.

- Distribute the completed K-1 to all partners or shareholders by the IRS deadline.

Legal use of the K-1 Form

The K-1 Form is legally binding and must be completed in accordance with IRS regulations. It is essential for partners and shareholders to accurately report their share of income to avoid potential penalties. The IRS requires that all entities file K-1s for their partners or shareholders, ensuring compliance with federal tax laws. Failure to provide accurate information can result in audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 Form are critical for compliance. Partnerships and S corporations must provide K-1s to their partners and shareholders by March 15 each year. If the entity files for an extension, the deadline may be extended, but K-1s must still be distributed to recipients by the extended due date. Taxpayers should be aware of these deadlines to ensure timely filing of their personal tax returns.

Who Issues the Form

The K-1 Form is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the K-1 to each partner or shareholder. It is important for the issuing entity to ensure that the information on the K-1 is accurate and reflects the correct income allocation for each recipient. This process is vital for maintaining transparency and compliance with tax regulations.

Quick guide on how to complete 2015 k 1 form 6963809

Easily Prepare K 1 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage K 1 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign K 1 Form Effortlessly

- Find K 1 Form and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign K 1 Form and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 k 1 form 6963809

Create this form in 5 minutes!

How to create an eSignature for the 2015 k 1 form 6963809

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a K 1 Form and how is it used?

The K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information on your share of income, which you will then report on your personal tax return. Understanding the K 1 Form is essential for accurate tax reporting.

-

How can airSlate SignNow help with the K 1 Form?

airSlate SignNow offers a streamlined solution for electronically signing and sending the K 1 Form securely. With our user-friendly interface, you can quickly prepare, share, and track your K 1 Form, ensuring that all necessary parties receive it promptly and securely.

-

Is there a cost to use airSlate SignNow for the K 1 Form?

Yes, airSlate SignNow provides various pricing plans to fit your needs, including options specifically for businesses that frequently manage documents like the K 1 Form. Our pricing is designed to be cost-effective, ensuring you get value while simplifying your document signing process.

-

Can I integrate airSlate SignNow with other accounting software for managing K 1 Forms?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your K 1 Form alongside your other financial documents. This integration streamlines your workflow, making it easier to track and file your tax documents.

-

What features does airSlate SignNow offer for handling the K 1 Form?

airSlate SignNow offers features such as eSigning, document templates, and real-time tracking, making it ideal for managing the K 1 Form. These features help ensure that your documents are signed efficiently and that you can monitor the status of your forms at any time.

-

Is it safe to send a K 1 Form through airSlate SignNow?

Yes, sending a K 1 Form through airSlate SignNow is secure. Our platform uses advanced encryption and security measures to protect your sensitive information, ensuring that your forms are transmitted safely and remain confidential.

-

Can I customize the K 1 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the K 1 Form to meet your specific needs. You can create templates, add custom fields, and modify the document layout, providing a tailored experience for your business and clients.

Get more for K 1 Form

- Attestation u1 form

- Forklift pm service visually inspect and advise check form

- Parking permit application boston university bu form

- Athlete information sheet 395018306

- Gs serv mk602379raindd resound goverment services page form

- Submission form blood and semen tests of horses for import

- Fetch specialty ampampamp cancer veterinary centers 717 w form

- Data collection form zurich intermediary

Find out other K 1 Form

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease