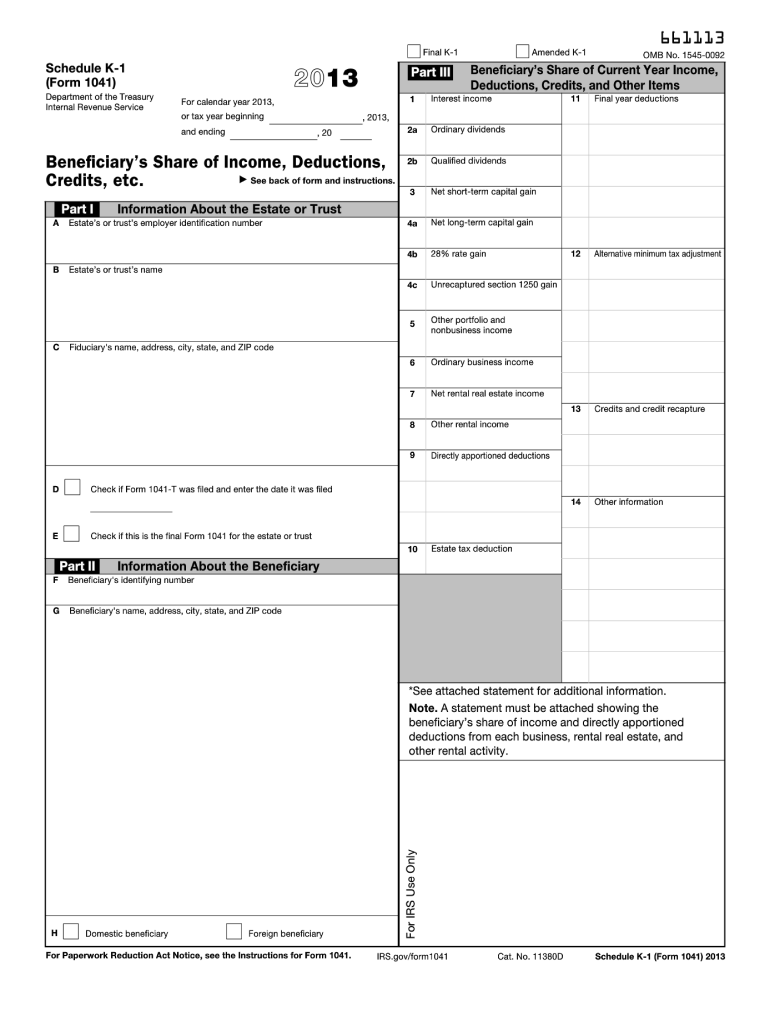

Schedule K 1 Form 2013

What is the Schedule K-1 Form

The Schedule K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for individual tax returns. Unlike traditional income forms, the K-1 is issued by the entity rather than the taxpayer, making it crucial for accurate reporting of income from pass-through entities.

How to use the Schedule K-1 Form

Using the Schedule K-1 Form involves several steps. First, ensure you receive your K-1 from the partnership or S corporation by the tax filing deadline, typically March 15. Once you have the form, review it for accuracy. The information on the K-1 must be reported on your personal tax return, specifically on Form 1040. You will need to include the income, deductions, and credits listed on the K-1 in the appropriate sections of your tax return.

Steps to complete the Schedule K-1 Form

Completing the Schedule K-1 Form requires careful attention to detail. Follow these steps:

- Gather necessary information about the partnership or S corporation, including the entity's tax identification number.

- Fill out your personal information, such as your name, address, and taxpayer identification number.

- Report your share of income, deductions, and credits as indicated on the K-1.

- Ensure that all amounts are accurately transferred to your Form 1040.

- Review the completed form for any errors before submission.

Legal use of the Schedule K-1 Form

The Schedule K-1 Form is legally binding and must be filed accurately to comply with IRS regulations. It is essential for taxpayers to report all income and deductions as outlined in the K-1 to avoid penalties. The IRS requires that all partnerships and S corporations provide K-1s to their partners and shareholders, ensuring transparency in income reporting. Failure to report K-1 income can lead to significant tax liabilities and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form are critical for compliance. Partnerships and S corporations must issue K-1s to their partners or shareholders by March 15 of each year. Taxpayers should ensure they receive their K-1s in time to include the information on their personal tax returns, which are due on April 15. If additional time is needed, taxpayers can file for an extension, but they must still report K-1 income accurately.

Who Issues the Form

The Schedule K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing K-1s to their partners or shareholders. This form details each individual's share of the entity's income, deductions, and credits, ensuring that all parties report their tax obligations correctly. It is essential for taxpayers to verify that they receive their K-1s from the issuing entities to fulfill their tax responsibilities.

Quick guide on how to complete 2013 schedule k 1 form

Complete Schedule K 1 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule K 1 Form on any device through the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Schedule K 1 Form with ease

- Find Schedule K 1 Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Schedule K 1 Form and guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 schedule k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule k 1 form

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a Schedule K 1 Form?

The Schedule K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and LLCs. It provides detailed information about each partner's share of the entity’s earnings or losses. Understanding how to properly fill out the Schedule K 1 Form is essential for accurate tax reporting.

-

How can airSlate SignNow help with Schedule K 1 Forms?

airSlate SignNow simplifies the process of sending and eSigning Schedule K 1 Forms. With its user-friendly interface, you can easily prepare, share, and sign these important documents securely and efficiently. This helps ensure that your tax documentation is processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for Schedule K 1 Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling Schedule K 1 Forms. The pricing is competitive and designed to provide value for organizations looking for an efficient way to manage their document signing processes. You can choose a plan that fits your budget and workflow requirements.

-

Can I integrate airSlate SignNow with other software when managing Schedule K 1 Forms?

Absolutely! airSlate SignNow provides seamless integrations with popular accounting and document management software, making it easier to handle your Schedule K 1 Forms. You can connect with platforms like QuickBooks and CRM systems to streamline your operations and improve workflow efficiency.

-

What are the benefits of using airSlate SignNow for Schedule K 1 Forms?

Using airSlate SignNow for Schedule K 1 Forms offers numerous benefits, including increased speed and efficiency in document handling. You can track the status of your forms in real-time, receive notifications, and ensure secure eSigning. This ultimately enhances your overall productivity by reducing paper clutter and manual processes.

-

Is airSlate SignNow suitable for small businesses handling Schedule K 1 Forms?

Yes, airSlate SignNow is ideal for small businesses that need an affordable and efficient solution for managing Schedule K 1 Forms. Its intuitive design minimizes learning curves and allows teams to focus on what matters most—growing their business. You can easily send, sign, and store your documents without breaking the bank.

-

What features does airSlate SignNow offer for Schedule K 1 Forms?

airSlate SignNow includes features like templates for Schedule K 1 Forms, document tracking, and multi-party signing, which enhance your document management processes. These features ensure that sending and receiving forms is both straightforward and efficient. Additionally, the platform offers a mobile app for on-the-go signing.

Get more for Schedule K 1 Form

- Ma appointment counsel form

- Interrogatories form

- Application for change of name minor commonwealth of form

- Upper marlboro courthouse form

- Parental consent for non petitioning parent civil forms

- Form cn 2 petition for change of name minor

- De 201i testate with a will application maine probate courts form

- Maine de probate form

Find out other Schedule K 1 Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement