Form 1041 2010

What is the Form 1041

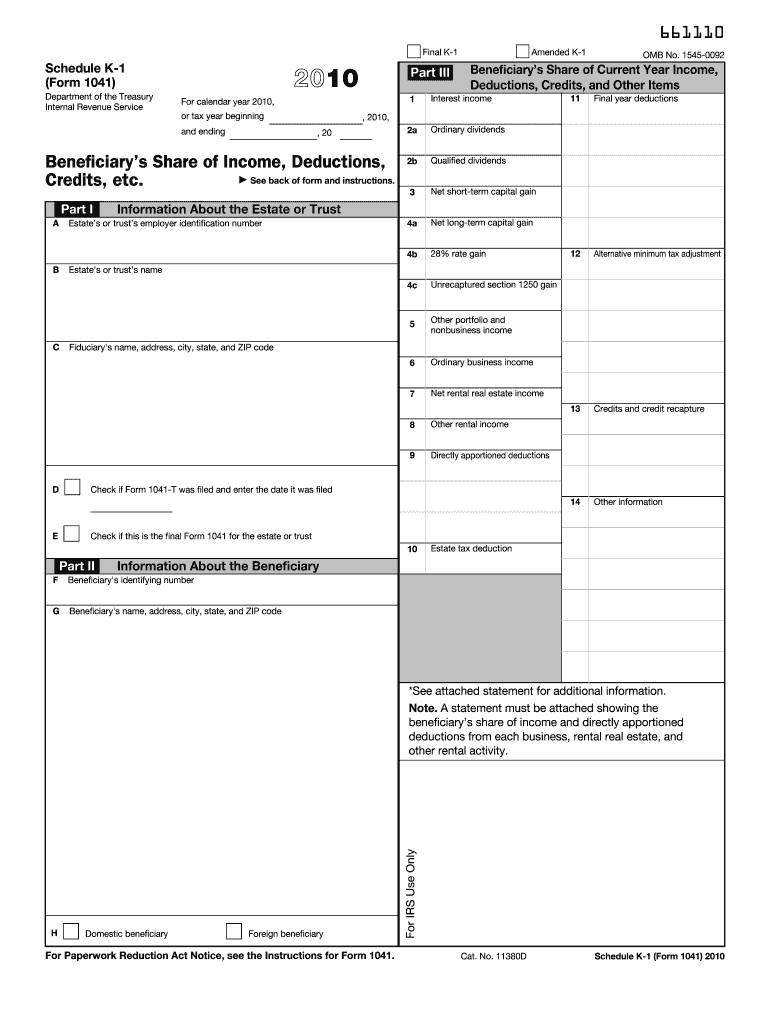

The Form 1041, officially known as the U.S. Income Tax Return for Estates and Trusts, is a tax form used by fiduciaries to report income, deductions, gains, and losses of estates and trusts. This form is essential for ensuring that the income generated by the estate or trust is accurately reported to the Internal Revenue Service (IRS). It is typically filed by the executor of an estate or the trustee of a trust, and it helps determine the tax liability of the estate or trust.

How to use the Form 1041

Using Form 1041 involves several steps to ensure accurate reporting of the estate's or trust's financial activities. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax information. Next, fill out the form by providing details about the estate or trust, including its name, address, and Employer Identification Number (EIN). Report income from various sources, such as interest, dividends, and capital gains, and claim allowable deductions to reduce taxable income. Finally, review the completed form for accuracy before submission to the IRS.

Steps to complete the Form 1041

Completing Form 1041 requires careful attention to detail. Start by downloading the form from the IRS website or using tax software that supports Form 1041. Follow these steps:

- Enter the name, address, and EIN of the estate or trust at the top of the form.

- Report income sources in the appropriate sections, including rental income, dividends, and interest.

- List deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total income and subtract deductions to determine the taxable income.

- Sign and date the form, ensuring all required information is included.

Legal use of the Form 1041

The legal use of Form 1041 is critical for compliance with federal tax laws. The form must be filed for any estate or trust that has gross income of $600 or more during the tax year. Additionally, if the estate has a beneficiary who is a non-resident alien, Form 1041 must be filed regardless of income. Properly completing and submitting the form ensures that the estate or trust meets its tax obligations and avoids potential penalties.

Filing Deadlines / Important Dates

The filing deadline for Form 1041 is typically the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year basis, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to keep track of these dates to avoid late filing penalties.

Required Documents

To successfully complete Form 1041, certain documents are necessary. These may include:

- Financial statements detailing income and expenses of the estate or trust.

- Receipts for deductible expenses.

- Records of distributions made to beneficiaries.

- Previous tax returns for the estate or trust, if applicable.

Having these documents organized will facilitate the accurate completion of the form.

Quick guide on how to complete 2010 form 1041

Complete Form 1041 effortlessly on any device

Online document management has become favored among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers since you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 1041 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 1041 without difficulty

- Locate Form 1041 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your requirements in document management in a few clicks from any device of your choice. Modify and eSign Form 1041 and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1041

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1041

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 1041 and why is it important?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is essential for reporting income, deductions, and credits for estates and trusts, ensuring compliance with tax laws. Understanding how to correctly fill out Form 1041 can help avoid penalties and ensure proper tax management.

-

How can airSlate SignNow assist with signing Form 1041?

airSlate SignNow simplifies the process of signing Form 1041 by allowing users to electronically sign documents securely and efficiently. With our platform, you can easily send Form 1041 for eSignature, track its status, and ensure that all parties have signed before submission, streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for Form 1041?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and provide access to all the essential features required for managing and signing documents like Form 1041. You can choose the plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing Form 1041?

airSlate SignNow provides a range of features tailored for managing Form 1041, including customizable templates, secure cloud storage, and real-time tracking of document status. Our platform also integrates with popular applications, making it easy to manage all your documents in one place.

-

Can I integrate airSlate SignNow with other software for Form 1041 processing?

Absolutely! airSlate SignNow supports integration with numerous applications, including accounting and tax software, to facilitate the processing of Form 1041. This interoperability ensures that you can manage your documents seamlessly and efficiently.

-

What are the benefits of using airSlate SignNow for Form 1041?

Using airSlate SignNow for Form 1041 offers numerous benefits, including enhanced security, reduced processing time, and increased efficiency. Our platform allows for easy collaboration among stakeholders, ensuring that you can complete and file Form 1041 quickly and accurately.

-

Is there customer support available for questions about Form 1041?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions related to Form 1041 and our eSignature services. Our knowledgeable support team is available to help you navigate any challenges you may encounter while using our platform.

Get more for Form 1041

- Ls1575 form

- Non us citizen application kentucky transportation form

- Request for dmv forms to be mailed state of oregon

- County of title issuance form

- Bcia 8016a request for live scan service public schools form

- Blank church church budget pdf 2019 2020 doc template form

- If publication is required bpc 17917 form

- Information request rrcs

Find out other Form 1041

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT