Form K 1 2014

What is the Form K-1

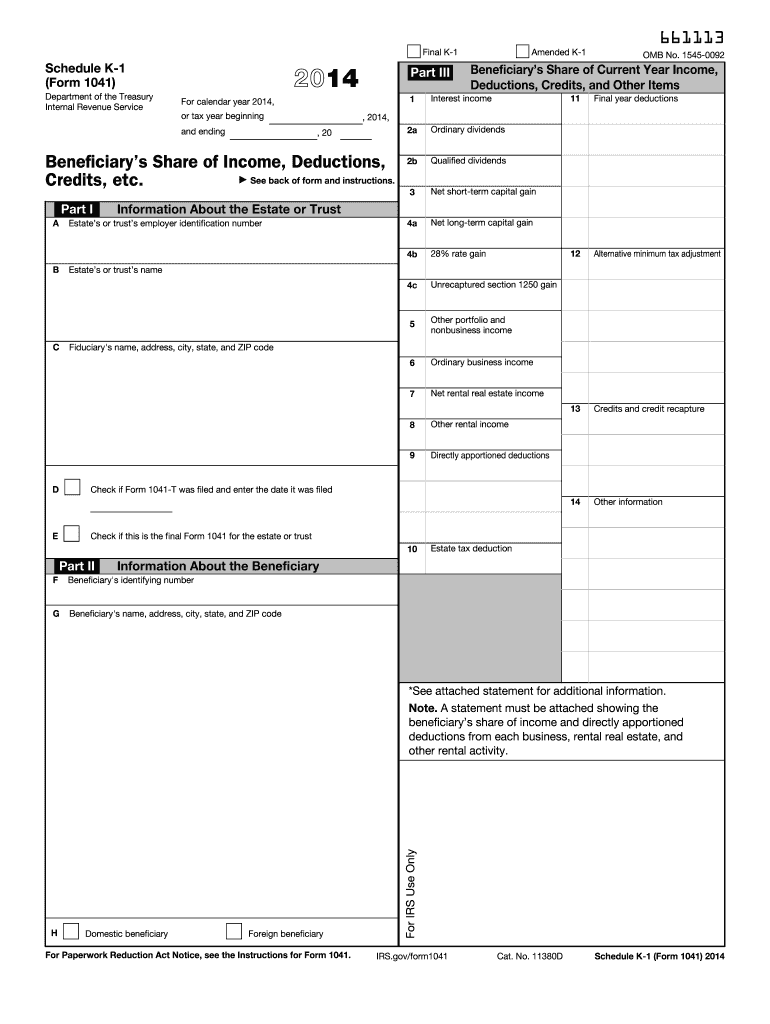

The Form K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income and expenses. The form is essential for individuals who receive income from these entities, as it allows them to accurately report their earnings on their personal tax returns. Each entity must issue a K-1 to its partners or shareholders, ensuring transparency and compliance with IRS regulations.

How to obtain the Form K-1

To obtain the Form K-1, individuals should contact the partnership, S corporation, estate, or trust that generated the income. Each entity is responsible for preparing and distributing the K-1 to its partners or shareholders by the IRS deadline. If you are a partner or shareholder and have not received your K-1, it is advisable to reach out directly to the entity for assistance. Additionally, some entities may provide access to the form through their online portals or accounting software.

Steps to complete the Form K-1

Completing the Form K-1 involves several key steps:

- Review the information provided by the partnership or corporation, including income, deductions, and credits.

- Ensure that your personal information, such as name and Social Security number, is accurate.

- Transfer the relevant amounts from the K-1 to your personal tax return, typically on Schedule E of Form 1040.

- Keep a copy of the K-1 for your records, as it may be needed for future reference or audits.

Legal use of the Form K-1

The Form K-1 is legally binding when accurately completed and submitted according to IRS guidelines. It serves as proof of income and deductions for tax purposes. Taxpayers must ensure that the information reported on the K-1 aligns with their personal tax filings. Failure to accurately report income from a K-1 can lead to penalties and interest from the IRS, making it crucial to handle this form with care.

Filing Deadlines / Important Dates

The filing deadlines for the Form K-1 vary depending on the type of entity. Generally, partnerships and S corporations must issue K-1s to their partners and shareholders by March 15. However, if the entity files for an extension, the deadline may be extended to September 15. It is important for recipients to be aware of these deadlines to ensure timely filing of their personal tax returns.

Examples of using the Form K-1

Individuals may encounter the Form K-1 in various scenarios, such as:

- Receiving income from a family-owned business structured as a partnership.

- Investing in an S corporation that distributes profits to its shareholders.

- Inheriting a trust that generates income reported on a K-1.

In each case, the K-1 provides essential information needed for accurate tax reporting.

Quick guide on how to complete 2014 form k 1 6962074

Easily Prepare Form K 1 on Any Device

Managing documents online has gained immense popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Form K 1 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form K 1 Effortlessly

- Find Form K 1 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Form K 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form k 1 6962074

Create this form in 5 minutes!

How to create an eSignature for the 2014 form k 1 6962074

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is Form K 1 and how is it used?

Form K 1 is a tax document used to report income, deductions, and credits from partnerships and S corporations. This form provides essential information for individuals who have invested in these entities, ensuring accurate tax reporting.

-

How can airSlate SignNow help with Form K 1 management?

airSlate SignNow streamlines the process of sending, signing, and managing Form K 1 documents. Our easy-to-use platform allows businesses to create, distribute, and securely sign Form K 1, improving efficiency and accuracy in your tax documentation.

-

What features are offered by airSlate SignNow for Form K 1 preparation?

Our platform includes features like customizable templates, easy eSignature options, and secure document storage specifically designed for Form K 1. These features ensure that your Form K 1 documents are not only professional but also compliant with tax regulations.

-

Is airSlate SignNow a cost-effective solution for processing Form K 1?

Yes, airSlate SignNow provides a cost-effective solution that signNowly reduces the time and expense involved in processing Form K 1. By eliminating paper documents and automating workflows, businesses can enjoy substantial savings and increased productivity.

-

What are the benefits of eSigning Form K 1 with airSlate SignNow?

eSigning Form K 1 with airSlate SignNow offers numerous benefits, including faster transaction times and enhanced security. The platform ensures that all signatures are legally binding and tamper-proof, protecting both the sender and the recipient.

-

Can I integrate airSlate SignNow with my accounting software for Form K 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for efficient management of Form K 1. This integration helps maintain accurate financial records and streamlines your overall tax preparation process.

-

How does airSlate SignNow ensure the security of my Form K 1 files?

Security is a top priority for airSlate SignNow. Our platform employs industry-standard encryption, multi-factor authentication, and secure cloud storage to protect your Form K 1 files from unauthorized access and data bsignNowes.

Get more for Form K 1

- Application for authority to transact business in illinois form

- Zoning affidavit abc 255 zoning affidavit abc 255 form

- Checklist water and wastewater operator njgov form

- Illinois limited liability company act statement of change of registered agent andor registered office form

- Vat1a application for vat registration the vat1a form is used by distance selling businesses to apply for vat registration

- Telemarketing application rev 2016 1 form

- Foreign limited liability company application instructions 51 10 form

- P60 single sheet 2019 to 2020 p60 single sheet 2019 to 2020 form

Find out other Form K 1

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online