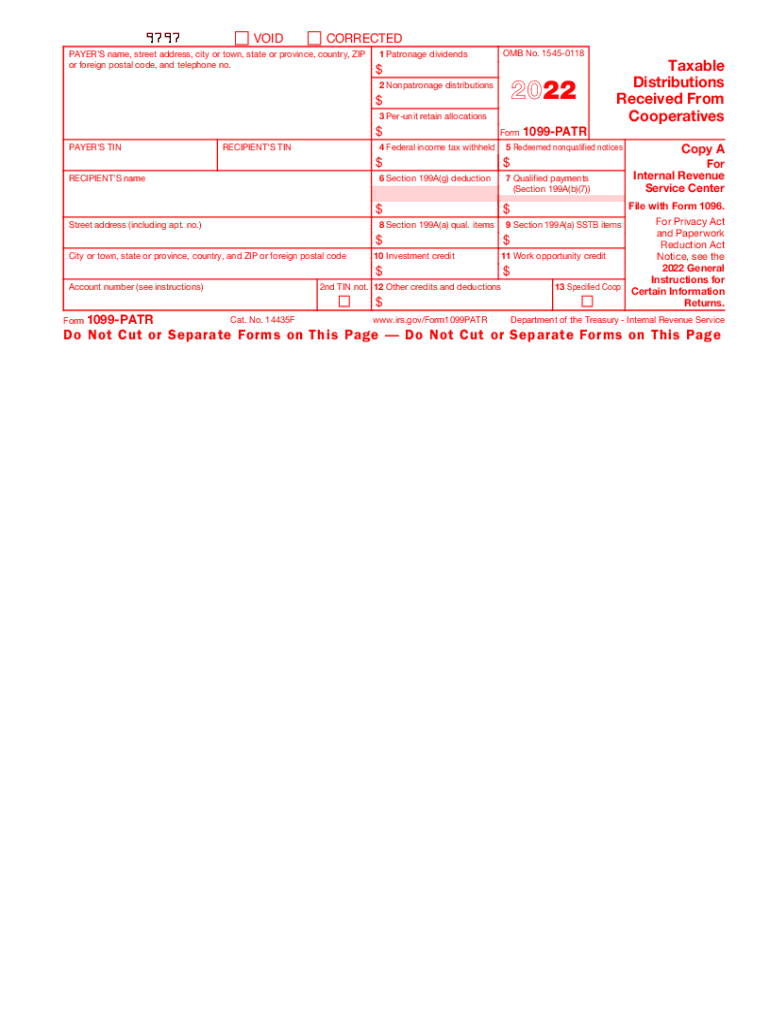

Milestone 4 1099s Form Attention Copy a of This Form 2022

What is the 1098-T Form?

The 1098-T form, also known as the Tuition Statement, is an essential document used by eligible educational institutions to report qualified tuition and related expenses paid by students. This form is crucial for students and their families when filing federal income tax returns, as it helps determine eligibility for education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098-T includes important information such as the institution's name, the student's identification number, and the amounts billed for qualified tuition and fees.

How to Use the 1098-T Form

To effectively use the 1098-T form, students should first ensure they receive it from their educational institution, typically by January 31 of each year. Once obtained, students should review the form for accuracy, checking that all amounts are correctly reported. When filing taxes, the information on the 1098-T will be used to claim eligible education credits. It's advisable to keep the form for record-keeping purposes, as it may be needed for future reference or audits.

Steps to Complete the 1098-T Form

Completing the 1098-T form involves several key steps:

- Gather all necessary documents, including tuition payment receipts and financial aid records.

- Fill in the student's personal information, such as name, address, and Social Security number.

- Enter the amounts for qualified tuition and related expenses in the appropriate boxes on the form.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS along with your tax return, if applicable.

IRS Guidelines for the 1098-T Form

The IRS has specific guidelines regarding the 1098-T form that educational institutions must follow. These include requirements for reporting qualified tuition and related expenses, deadlines for providing the form to students, and the need for accurate record-keeping. Institutions must ensure that the form is issued correctly to avoid penalties and to facilitate students' ability to claim tax credits. Students should familiarize themselves with these guidelines to ensure compliance and maximize their tax benefits.

Filing Deadlines for the 1098-T Form

Filing deadlines for the 1098-T form are critical for both educational institutions and students. Educational institutions must provide the form to students by January 31 each year. Additionally, institutions must file the form with the IRS by the last day of February if filing on paper or by March 31 if filing electronically. Students should be aware of these deadlines to ensure they receive their forms on time and can file their taxes accurately and promptly.

Penalties for Non-Compliance with 1098-T Requirements

Failure to comply with the IRS requirements regarding the 1098-T form can result in penalties for educational institutions. These penalties may include fines for late filing or failure to provide accurate information. Students may also face challenges in claiming education tax credits if the form is not properly issued. It is important for both institutions and students to understand these potential penalties to ensure compliance and avoid unnecessary financial repercussions.

Quick guide on how to complete milestone 4 1099s form attention copy a of this form

Prepare Milestone 4 1099s Form Attention Copy A Of This Form effortlessly on any device

Online document management has gained momentum among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Milestone 4 1099s Form Attention Copy A Of This Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Milestone 4 1099s Form Attention Copy A Of This Form easily

- Obtain Milestone 4 1099s Form Attention Copy A Of This Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Milestone 4 1099s Form Attention Copy A Of This Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct milestone 4 1099s form attention copy a of this form

Create this form in 5 minutes!

People also ask

-

What is a 1098 t form, and why do I need it?

A 1098 t form is a tax document used to report tuition payments made by or on behalf of a student. It's essential for both the student and the educational institution to accurately report tax information. Using airSlate SignNow, you can easily eSign and send your 1098 t forms, ensuring compliance and accuracy.

-

How can airSlate SignNow help me with my 1098 t documentation?

airSlate SignNow simplifies the process of managing your 1098 t forms by providing an electronic signing solution that is secure and efficient. With features like customizable templates and automated workflows, you can streamline the documentation process, improving accuracy and saving time.

-

Is there any cost associated with using airSlate SignNow for 1098 t forms?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, with competitive rates for eSigning 1098 t forms. These plans provide access to powerful features that streamline document management, ultimately saving you time and resources in the handling of tax forms.

-

Can I integrate airSlate SignNow with my existing accounting software for 1098 t forms?

Absolutely! airSlate SignNow supports integration with a wide range of accounting software, making it easy to handle 1098 t forms alongside your other financial documents. This seamless integration ensures that all your important data remains organized and accessible.

-

What security measures does airSlate SignNow provide for 1098 t documents?

Security is a top priority for airSlate SignNow. When you eSign and manage your 1098 t documents, they are protected with advanced encryption, ensuring that your sensitive information remains safe from unauthorized access. Additionally, audit trails keep track of all actions taken on your documents.

-

How long does it take to get a 1098 t form signed using airSlate SignNow?

Using airSlate SignNow, the process of getting your 1098 t form signed is typically completed in just a few minutes. The platform allows for quick electronic signatures, eliminating the need for physical mailing and reducing delays in document processing.

-

Can I track the status of my 1098 t forms in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your 1098 t forms. You can easily monitor the status of your documents, seeing whether they have been viewed, signed, or completed, giving you greater control over your document workflow.

Get more for Milestone 4 1099s Form Attention Copy A Of This Form

Find out other Milestone 4 1099s Form Attention Copy A Of This Form

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free