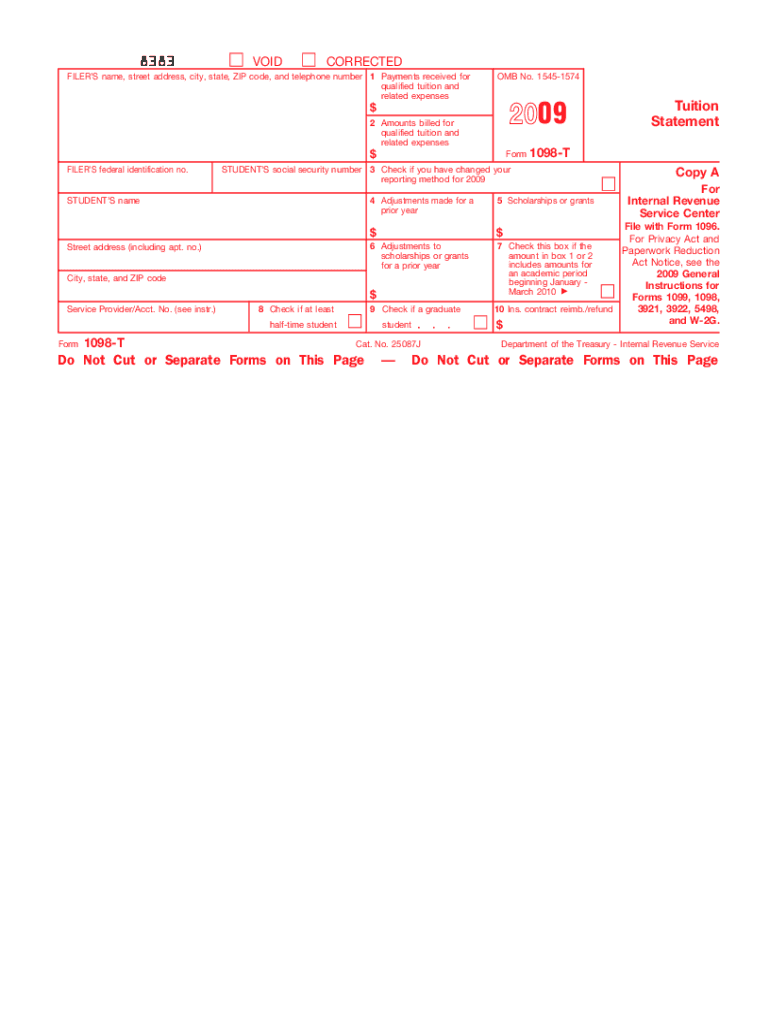

1098 T Form 2009

What is the 1098 T Form

The 1098 T Form, officially known as the Tuition Statement, is a tax document used in the United States to report qualified tuition and related expenses for students enrolled in eligible educational institutions. This form is primarily issued by colleges and universities to provide information to both the Internal Revenue Service (IRS) and the student. It helps students and their families claim education-related tax benefits, such as the American Opportunity Credit and the Lifetime Learning Credit.

How to use the 1098 T Form

To effectively use the 1098 T Form, students should first ensure they receive it from their educational institution, typically by January 31 of each year. Once received, the information on the form can be utilized when filing federal income tax returns. Students should review the form for accuracy, particularly the amounts reported in Box 1, which reflects payments received for qualified tuition and related expenses. This information is crucial for determining eligibility for tax credits.

Steps to complete the 1098 T Form

Completing the 1098 T Form involves several key steps:

- Gather necessary documentation, including tuition payment receipts and enrollment status.

- Review the form for accuracy, ensuring that all amounts and personal information are correct.

- Consult IRS guidelines to determine eligibility for tax credits based on the reported amounts.

- Include the form information when filing your federal tax return, either manually or through tax software.

Key elements of the 1098 T Form

The 1098 T Form contains several important elements:

- Box 1: Reports payments received for qualified tuition and related expenses.

- Box 2: Previously used to report amounts billed; now generally not applicable.

- Box 5: Reports scholarships and grants received by the student.

- Student Information: Includes the student’s name, Social Security number, and the educational institution’s details.

Filing Deadlines / Important Dates

Filing deadlines related to the 1098 T Form are crucial for students. Educational institutions must provide the form to students by January 31 each year. Students should file their federal tax returns by April 15, unless they apply for an extension. It is advisable to keep track of these dates to ensure timely filing and to avoid penalties.

Who Issues the Form

The 1098 T Form is issued by eligible educational institutions, including colleges, universities, and vocational schools that participate in federal student aid programs. These institutions are responsible for reporting tuition payments and related expenses to both the IRS and the student. Students should ensure they receive this form from their institution to accurately report their educational expenses.

Quick guide on how to complete 2009 1098 t form

Manage 1098 T Form easily across any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle 1098 T Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest method to modify and electronically sign 1098 T Form effortlessly

- Obtain 1098 T Form and click on Retrieve Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Complete button to preserve your changes.

- Select your preferred delivery method for the form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1098 T Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 1098 t form

Create this form in 5 minutes!

How to create an eSignature for the 2009 1098 t form

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is a 1098 T Form and how is it used?

The 1098 T Form is a document used by educational institutions to report tuition payments and related expenses to the IRS. It is essential for students and parents when filing tax returns to ensure they can claim educational credits. Understanding the details and uses of the 1098 T Form is crucial for maximizing tax benefits associated with education.

-

How can airSlate SignNow help me with my 1098 T Form?

airSlate SignNow simplifies the process of electronic signing and sending the 1098 T Form. With our platform, you can quickly prepare and send the 1098 T Form to students or parents who need to eSign it. This feature streamlines the workflow and ensures timely submissions.

-

Is airSlate SignNow compliant with regulations for handling 1098 T Forms?

Yes, airSlate SignNow complies with all relevant regulations for securely handling documents like the 1098 T Form. Our platform ensures that sensitive information is transmitted with encryption and stored securely, giving users peace of mind regarding data protection and compliance.

-

What are the pricing options for using airSlate SignNow for the 1098 T Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small institution or a large organization needing to handle multiple 1098 T Forms, we have a plan that fits your budget. Check our website for detailed pricing information and see how you can save money while using our eSignature solutions.

-

What features does airSlate SignNow offer for creating a 1098 T Form?

With airSlate SignNow, you can easily create, edit, and send the 1098 T Form using customizable templates. Our intuitive interface allows you to add fields for signatures, dates, and other essential information, making document preparation a breeze. This feature ensures you generate accurate 1098 T Forms efficiently.

-

Can airSlate SignNow integrate with other applications for handling 1098 T Forms?

Absolutely! airSlate SignNow supports integration with various applications to facilitate the management of 1098 T Forms. Whether you use CRM, accounting software, or other document management tools, our integrations can streamline your processes and enhance productivity.

-

What are the benefits of using airSlate SignNow for my 1098 T Form?

Using airSlate SignNow for your 1098 T Form provides benefits such as enhanced security, time-saving document management, and improved efficiency in gathering required signatures. Our platform also allows for easy tracking of document status, ensuring that nothing falls through the cracks during tax season.

Get more for 1098 T Form

- Assumption of risk release and indemnification agreement field tripsdoc form

- Verification form for students with disabilities the university

- Wcu id form

- 410 706 8212 fax form

- Employee tuition assistance application human resources form

- The university of trinidad and tobago office of the utt form

- Augustaedu form

- Sod studio rental agreement university of utah dance form

Find out other 1098 T Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free