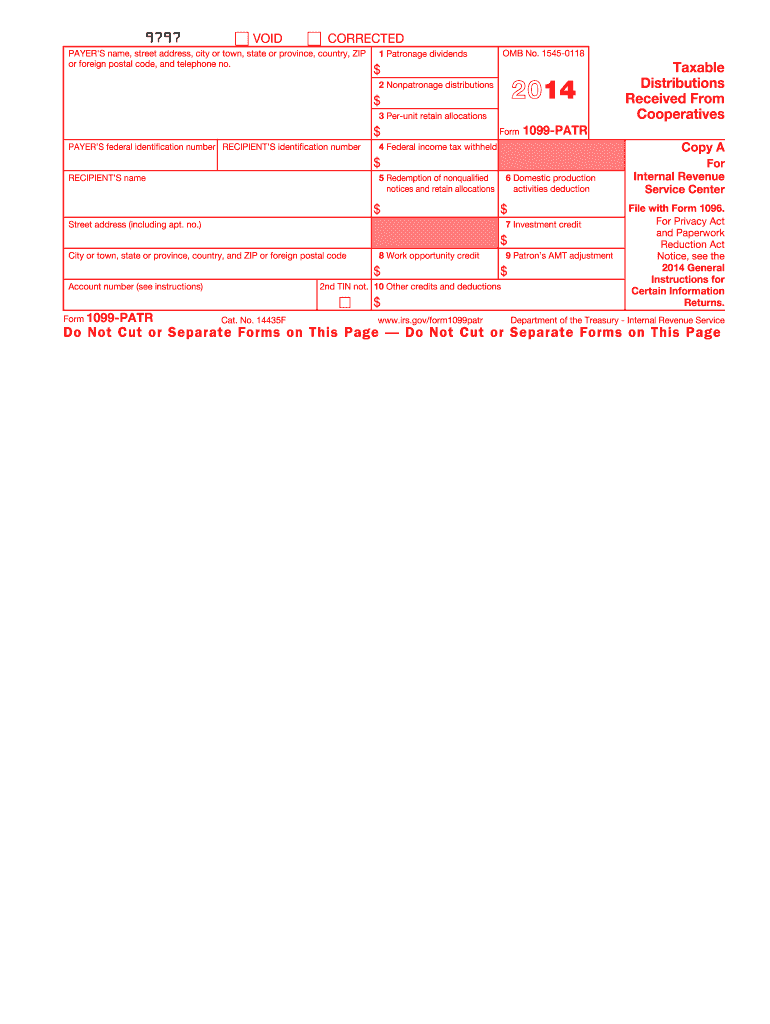

1099 Form 2014

What is the 1099 Form

The 1099 Form is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. It is primarily used by businesses to report payments made to independent contractors, freelancers, and other non-employees. The most common variant is the 1099-MISC, which covers miscellaneous income, while the 1099-NEC is specifically for reporting non-employee compensation. Each type of 1099 Form serves a unique purpose, ensuring that the Internal Revenue Service (IRS) receives accurate information regarding income distribution.

How to use the 1099 Form

Using the 1099 Form involves several steps. First, determine the appropriate type of 1099 Form based on the nature of the payment. Next, gather the necessary information, including the recipient's name, address, and taxpayer identification number (TIN). After completing the form with accurate details, submit it to the IRS and provide a copy to the recipient. It is essential to ensure that all information is correct to avoid penalties and ensure compliance with tax regulations.

Steps to complete the 1099 Form

Completing the 1099 Form requires careful attention to detail. Follow these steps:

- Identify the correct form type (e.g., 1099-MISC, 1099-NEC).

- Collect the recipient's information, including their name, address, and TIN.

- Fill out the form, including the amount paid and the nature of the payment.

- Review the completed form for accuracy.

- Submit the form to the IRS by the designated deadline.

- Send a copy of the form to the recipient for their records.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 Form. It is crucial to familiarize yourself with these guidelines to ensure compliance. The IRS requires that forms be filed by January thirty-first of the year following the tax year in which payments were made. Additionally, businesses must keep accurate records of all payments made throughout the year to facilitate the completion of the 1099 Form. Penalties may apply for late filings or inaccuracies, so adherence to IRS guidelines is essential.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are critical for compliance. Generally, the due date for submitting the form to the IRS is January thirty-first. If the form is filed electronically, the deadline may extend to March second. Recipients must also receive their copies by January thirty-first. Marking these important dates on your calendar can help ensure timely filing and avoid penalties associated with late submissions.

Penalties for Non-Compliance

Failing to comply with the requirements for the 1099 Form can lead to significant penalties. The IRS imposes fines for late filings, which can increase based on how late the form is submitted. Additionally, inaccuracies on the form can result in further penalties. It is essential to take the filing process seriously and ensure that all information is accurate and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2014 1099 form

Effortlessly Prepare 1099 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage 1099 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily Edit and eSign 1099 Form Without Hassle

- Acquire 1099 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or inaccuracies that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1099 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1099 form

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is a 1099 Form and why is it important?

A 1099 Form is a tax document used to report income received by individuals who are not employees. It's important because it helps the IRS track income and ensure that self-employed individuals report their earnings accurately. Utilizing airSlate SignNow can streamline the process of preparing and sending 1099 Forms, making tax season less stressful.

-

How can I electronically sign my 1099 Form using airSlate SignNow?

With airSlate SignNow, you can easily eSign your 1099 Form by uploading the document and adding your signature electronically. The process is intuitive and allows for secure signing in just a few clicks, ensuring that your 1099 Form is both compliant and quickly sent to the necessary parties.

-

What features does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow provides several features for managing 1099 Forms, including customizable templates, bulk sending, and automated reminders. These features help simplify document management and ensure timely filing, ultimately saving time and reducing the risk of errors associated with manual processing.

-

Is it cost-effective to use airSlate SignNow for sending 1099 Forms?

Yes, using airSlate SignNow is a cost-effective solution for sending 1099 Forms. With flexible pricing plans, you can choose a package that fits your budget while enjoying features that facilitate easier document processing, compliance, and tracking, making it an excellent investment for businesses of any size.

-

Can airSlate SignNow integrate with my accounting software for 1099 Form submission?

Absolutely! airSlate SignNow offers integrations with many accounting software platforms, allowing for seamless submission and management of your 1099 Forms. This integration ensures that your financial records stay up-to-date and organized, simplifying your accounting tasks during tax season.

-

What benefits does airSlate SignNow provide for businesses handling 1099 Forms?

airSlate SignNow provides numerous benefits for businesses handling 1099 Forms, including enhanced security, faster processing times, and the ability to track document status in real-time. These advantages not only streamline the workflow but also help maintain compliance with tax regulations, ultimately supporting your business's efficiency.

-

How does electronic signature on a 1099 Form comply with legal standards?

An electronic signature on a 1099 Form using airSlate SignNow complies with all legal standards set forth by the ESIGN Act and UETA. This means your eSigned documents are legally binding and can be used as valid evidence in case of disputes, providing peace of mind when handling important tax documents.

Get more for 1099 Form

- Flaglerschools form

- Josef silny form

- 24 month stem opt extension for students on f 1 visas form

- Employees authorization of direct deposit of pay svsu form

- Colorado application fee waiver form

- Middlesex comm college transcript pdf form

- Biennial controlled substance inventory form

- Marketing project request form

Find out other 1099 Form

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online