1098 T Form 2018

What is the 1098 T Form

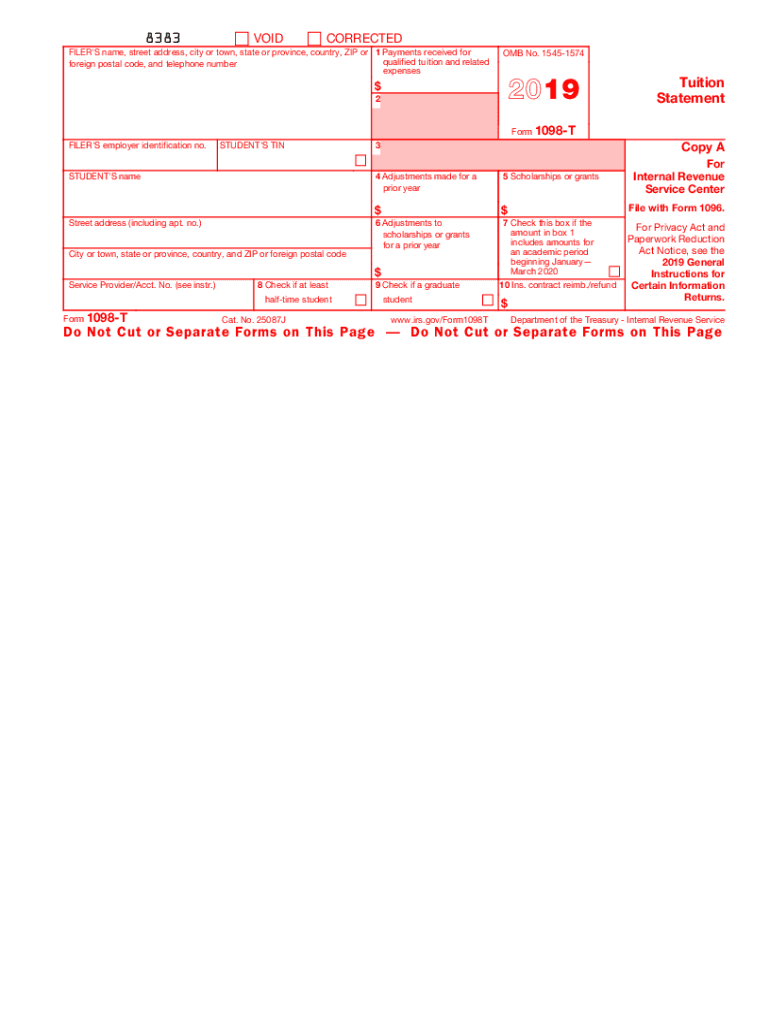

The 1098 T Form is an IRS tax document used by eligible educational institutions to report information about qualified tuition and related expenses paid by students. This form is essential for students and their families, as it helps determine eligibility for education tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The form includes details such as the amount of tuition paid, scholarships received, and adjustments to prior year amounts.

How to complete the 1098 T Form

Completing the 1098 T Form involves several key steps. First, gather all relevant financial documents that detail tuition payments and scholarships. Next, accurately fill in the required fields, including the student’s name, taxpayer identification number, and the institution’s information. Pay close attention to the amounts reported in Box 1 (payments received) and Box 5 (scholarships or grants). Ensure that all entries are accurate to avoid issues with the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1098 T Form is crucial for compliance. Educational institutions must provide the form to students by January 31 of the following tax year. Additionally, they must file the form with the IRS by the end of February if submitting on paper, or by March 31 if filing electronically. Missing these deadlines can result in penalties for the institution and may affect the student's ability to claim tax credits.

Who Issues the Form

The 1098 T Form is issued by eligible educational institutions, including colleges, universities, and vocational schools. These institutions are responsible for providing accurate information regarding tuition payments and scholarships. Students should expect to receive their form directly from their school, either electronically or via mail, depending on the institution’s policies.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1098 T Form. Institutions must adhere to these guidelines to ensure compliance and avoid penalties. The IRS outlines the criteria for qualified tuition and related expenses, as well as the necessary information that must be reported. Familiarizing oneself with these guidelines can help both institutions and students navigate the tax implications of educational expenses.

Key elements of the 1098 T Form

Several key elements are crucial for understanding the 1098 T Form. These include:

- Box 1: Payments received for qualified tuition and related expenses.

- Box 5: Scholarships or grants received by the student.

- Box 2: Adjustments made to prior year amounts, if applicable.

- Student Information: Name, address, and taxpayer identification number.

- Institution Information: Name, address, and employer identification number.

Eligibility Criteria

To be eligible for the benefits associated with the 1098 T Form, students must meet certain criteria. They must be enrolled at an eligible educational institution and must be taking courses that qualify for credit. Additionally, the expenses reported must be for qualified tuition and related expenses, which typically include tuition, fees, and course materials. Understanding these criteria is essential for maximizing potential tax benefits.

Quick guide on how to complete amount in box 1

Discover the most efficient method to complete and sign your 1098 T Form

Are you still spending time creating your official paperwork on paper instead of online? airSlate SignNow offers a superior way to finalize and endorse your 1098 T Form and related forms for public services. Our advanced electronic signature tool provides everything you require to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, management, security, signing, and sharing features are all available in a user-friendly interface.

Only a few steps are needed to complete and sign your 1098 T Form:

- Upload the editable template to the editor by clicking the Get Form button.

- Review the information you need to include in your 1098 T Form.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Spotlight what is essential or Obscure sections that are no longer relevant.

- Select Sign to create a legally binding electronic signature using your preferred method.

- Insert the Date next to your signature and finish your task with the Done button.

Store your completed 1098 T Form in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our system also offers versatile file sharing options. There’s no need to print your templates when you need to submit them at the appropriate public office - send them via email, fax, or request a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct amount in box 1

FAQs

-

What is it like in Tokyo, Japan?

It’s very different than living in any other city I’ve lived in (Boston, Los Angeles, and San Francisco). Here are some unique things I noticed, in no particular order:Having 24-hour convenience stores for food and basic necessities makes life very… convenient.Trash and recycling needs to be thoroughly sorted by type (e.g. combustible, non-combustible, PET bottle etc…) before taken out on its designated day. Failure to sort your trash properly will result in your trash being put back on your doorstep :( I never figured out how they could tell whose bag of trash was whose.There aren’t very many public trash cans so you need to carry your trash around until you got home to dispose of it properly.Subways and buses are frequent and almost always run on schedule. Even a few minutes of delay can cause restlessness.Riding on the subway is very quiet. Chatting loudly and talking on your phone is discouraged.Sexual harassment on subways is not uncommon. During rush hour, busy subways lines usually provide a female only car.People won’t tell you if you’re in their way or inconveniencing them. If you’re blocking the “walk” side of an escalator, people usually just wait (impatiently) behind you until you notice and move.I always carried cash with me. A lot of local stores don’t accept credit card.You go to international supermarkets to buy American and European goods.Meat is expensive.Some areas are extremely hipster and very obsessed with coffee. (I guess this is not that different from cities I’ve lived in…)It’s almost always acceptable (and normal) to drink beer with dinner.Restaurants don’t serve wine often, but if they do, you can only choose between white or red. You only see wine selections at wine bars or high class restaurants.Usually only men go by themselves to ramen and beef bowl shops. Going in by yourself as a female can be quite uncomfortable. Lately though, ramen stores targeted to females (modern decor and healthier/“lighter” flavors) have been popping up and are becoming more popular.On the other hand, going to a cake shop by yourself as a female is normal and acceptable. It is pretty uncommon to see a guy eat at a cake shop, let alone by himself.Saying or hearing things like “Because I’m a man…” or “Because you are a woman…” is pretty common and acceptable, I guess.You can microwave the plastic wrap.I would refer to myself and the person I’m talking to in the third person.Service is great. Retail and restaurant workers generally treat their guests very well and are very attentive. For example, if you buy sweets from the food level of a large department store, they will always take the extra minute to wrap it very nicely for you.It’s uncommon to find soap in bathrooms.It is extremely safe. I used to leave my laptop at a cafe to keep my spot and go out for lunch. I’ve heard that petty crimes have been increasing lately though.There are very different norms and customs around working, see Kristin Au's answer to What were the biggest surprises when working in Japan?Hitting on people/ being hit on by random people happens a lot. One time I was walking home from a long day of work and errands when a middle-aged salary man starting walking next to me and very bluntly asked me “Onee-san, would you like to accompany me to dinner?”There are a few “designated” nampa, or pick-up, places, including in front of the Tsutaya at the famous Shibuya Crossing. I have never experienced it but have heard that there are people (usually males) who hang out there to nampa as a hobby as well as people (usually females) who stand around waiting to be hit on.People will set up events, called goukons, to find a boyfriend/ girlfriend. One girl and one guy, who are acquaintances, will each recruit the same number of girls and guys (usually around 2 to 4 people) to go to dinner, usually at an izakaya, or Japanese pub. After dinner, the girls and guys will pair up via a “deciding” game or by taking turns to choose who they want to be with. Afterwards, they will either do a group activity or separate pair activities. Goukons are pretty common-place, and have even been used as settings for commercials.Books at bookstores are usually plastic wrapped. Sometimes there might be a “sample” book you could take a look through.Almost everything has a mascot. My office building’s mascot was a tiger Doraemon.

-

What is the worst mistake you can make in salary negotiations?

I’ve been an employer. And I’ve been an employee. And I’ve been on the board of a staffing agency and advised dozens of other companies on hires. I’ve seen every salary negotiation possible.99.9% of hires make mistakes in the salary negotiations. That’s perfectly fine. They have a bigger vision for their careers and they are excited about the job so the tendency is to just agree and get to work. I get it.But nobody is offended by a good negotiation. If a company is motivated to hire you and you are motivated to work at a company, then a good discussion about the job makes everyone happier.VERY IMPORTANT: A good salary negotiation is win-win. Both sides get more motivated. the pie gets larger.MISTAKE #1: Having a smaller list.It’s not just about the money. The side with the bigger list of terms wins. Because then you can give up the nickels in exchange for the dimes.Things to be negotiated: vacation time, medical leaves, bonuses, what requirements are in place for promotions, what’s the non-compete, employee ownership (in some cases), potential profit participation, moving expenses, etc.Again, the bigger list wins.MISTAKE #2: Negotiate at the right time.This is a secret weapon nobody uses.Carl Icahn, one of the greatest negotiators in business history, has a trick. Let’s borrow his trick from him.He schedules negotiations late in the day. Then he sleeps all day.Every human experiences “willpower depletion”. They have the willpower to avoid cake in the morning, but they run out by evening.If you are offered a job in the morning, say, “This is great. Let me go over it and figure out logistics and family issues and call you back later.” Then SLEEP. Then call back as late in the day as possible to negotiate.MISTAKE #3: Thinking too short-term.You’re not going to be there for two weeks and then quit. Ask about the long-term.What is the potential for the company? What is the potential for someone in your division to rise up in the company? Is the company doing well?Have a vision for your career path. This directly motivates how much money and other things you might need up front.MISTAKE #4: Saying Yes too fastThe best negotiation I ever had was when I said, “let me think about it”. And then waiting.And really thinking about it. Making my list. Doing due diligence. Really thinking if there are other offers. Or potential offers.Your value on the job market works like value on every other market: supply and demand. Really determine what the supply is for your services and if you can potentially be in demand.When you first get interest in being made an offer, you have to determine immediately what the supply is. If supply is zero, you put yourself in a bad position.But regardless, you can act like supply is great by being patient and saying first, “Let me go over all of this. It’s a lot to take in. I’m really grateful for the offer. How about we talk in a day or so.”Trust me: this is a scary thing to say but it has worked for me at least three different times and I was scared to death each time.Mistake #5: Bad MathWhat are people with comparable skills making in the industryWhat monetary value do you bring to the company (really your salary should be a function of that).If you were a freelancer or a company doing the work, what would you charge? Your salary + perks should be in the ballpark.Prepare by doing all the math.MISTAKE #6: Pretending to be smartKnow-it-alls lose.Always ask for advice first. “If you were me being offered this job, what would you ask for?”Or, “You guys are the experts on how one can grow and flourish and bring the most value to your company. What should I ask for and how do you see me growing in the company? Can we outline that out?”You can say, “Because I like this company a lot and want to accept this, I trust that you will help me figure out the right things to ask for here. Is there anything I’m missing?”This gives them the chance to negotiate against themselves.Mistake #7: People don’t ask “How”?If they offer too little or no moving expenses or no vacation or no path to promotion, simply ask: “How?”For instance: Other people in the industry are making $X. I know that I offer $Y in value. Can you walk me through how I can accept $Z that you are offering?”They will keep talking and the numbers will change. Trust me on this.Mistake #8: Don’t take advantage if they show weaknessMany people are powerless. But they don’t want to be. Particularly when you tell them .If you ask for something and they say, “We can’t. This is HR guidelines”. Say, “Hmmm, are you guys powerless to do anything about this?”Nobody wants to feel powerless. They will make changes or work this through HR.Mistake #9: Many people don’t mirror.If they say, “We will offer $100,000 but can’t go a penny higher” repeat back to them, “you can’t go a penny higher”.They will continue talking. If they don’t then…..Mistake #10: Too much talking.Be silent until they talk. Nobody likes an uncomfortable silence. Be silent for as long as it takes for them to talk again. Let it be uncomfortable. DO NOT TALK.Mistake #11: Using round numbers.Assuming you’ve done your homework on what industry standards are and what value you bring and how much you think you should be making, it’s ok to start with a salary number.But don’t say $100,000.Say, $103,500.Something specific. This shows you’ve done the work. Make sure you can back it up to get to that number. Round numbers are negotiated. Specific numbers, backed up by evidence, are not negotiated.AND DO THIS:This one was told to me by Chris Voss, the former chief hostage negotiator of the FBI.Use Your Late Night FM DJ Voice.Practice it right now. Pretend you’re a late night FM DJ. “And now we’re going to listen to some slooowww jazz.”“Listen. I’d like to talk about the salary of $103,500 but also we need to talk about the path to bonuses and my potential promotion path within the company.” Late night FM DJ voice.Do the preparation, have the bigger list, be patient, be silent, think long-term, get them to negotiate against themselves in the various ways described here, and use your late night FM DJ voice.I promise you the pie will get larger for everyone.Finally, and most important : getting fired is a negotiation also. If you are ever terminated, say “No”. The negotiations begin there.———Here are the other 10 worst things you can do in a negotiation

-

Is it necessary to fill out Form 15G/Form 15H if my service is less than 5 years? I need to withdraw the amount.

Purposes for which Form 15G or Form 15H can be submitted. While these forms can be submitted to banks to make sure TDS is not deducted on interest, there a few other places too where you can submit them. TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service.

-

Can you add 5 odd numbers to get 30?

It is 7,9 + 9,1 + 1 + 3 + 9 = 30Wish you can find the 7,9 and 9,1 in the list of1,3,5, 7,9 ,11,13,151,3,5,7, 9,1 1,13,15

-

What would you do if a perfect stranger stopped by your house, gave you a bag containing a million dollars, said to you, "Take it, it's yours", and then walked away?

Did you know that a million dollars in U.S. currency weighs just ten kilograms? It's true. A freshly-minted $100 bill weighs in at slightly over a gram, and 100 of them is ten thousand dollars. 100 of those stacks, and there's your million.It’s not often that 10 kilograms - 22 lbs of anything can change your life. But on February 25th, 2014, that’s exactly what happened. Day 1: $1,000,000 As the man in the gray suit walks away, I shout after him “Hey, come back here. Who are you? What’s this all about?” He does not look back and quickens his pace. Between the choice of chasing down a stranger, or securing what appeared to be stacks of currency, I chose the currency. We can resolve the issue of his identity later, but a loose sack of cash is, well, a loose sack of cash. I look through the contents again. Bundles of US$100 bills, stacked a hundred bills deep, wrapped in standard $10,000 bank bands. A quick count revealed that there were precisely a hundred of those stacks in the bag, and spot-check riffle-counts of the $10k bands suggest that there are no short-stacks within. These were full bands of $10,000 apiece of non sequential USD$100 bills, and I was holding what appears to be a million even in cash. And it feels like just as many question are swirling in my head, as I feel my pulse pounding in my skull. Who was that guy? Why me? What is this all about? But the most urgent thoughts swim past the dizzying deluge of unanswerable questions. Fakes. It’s one thing to inadvertently be the recipient of counterfeit currency; as you’re reading this very sentence, a clerk at a retail store somewhere in your city just accepted a counterfeit bill and made change from the real money in the till. But to be in possession of a life-changing amount of counterfeit currency of the United States of America? Well, that’s sort of thing that can bring the full might and wrath of their law enforcement apparatus on your head. My emotions swing wildly between the elation of instantaneous wealth, and sheer terror that I was minutes away from being snatched from my home and corralled into a Federal holding cell, where I will grow old within its walls. Terror was the stronger of the two emotions, and I quickly went to work. First things first: the bag had to go. If there is a GPS tracking device embedded in its seams, it would take too long for me to root it out. Better to incinerate it, and make sure that whatever trail it was laying stops at a dead-end for its pursuers. I pour the stacks of bills into an empty duffle back from my garage, and lock the bag in my condo. There’s an abandoned marina just a mile from my home and I get in my car and drive straight to the docks, at the top of the posted speed limit. After pouring enough Kerosene on the bag to see the shimmering mist of petroleum evaporate above it, I lit a book of matches and threw it in the middle of the mass. A satisfying “Whoomph” lights up the fire, and I watch the edges of the bag curl and burn - sizzling in the midmorning sun. As the remnants of the bag’s embers swirl around the scorched mark on the docks, I drive back to my condo, pulse still pounding in my skull.I still haven’t figured out if the bills are real or not, but if this morning’s bag-drop was an attempt to pin a piece of deeply incriminating evidence bearing a tracking device … well that plan has been thwarted. Or delayed, at the very least. What do I do? What should I do? Call the authorities? Consider how it would sound: “Hi, Police? Somebody dropped a million dollars in cash at my home. I don’t know if it’s fake or not. Please help.” Would you believe such a ridiculous story? I wouldn't. Any reasonable law enforcement dispatcher would consider the caller legally insane, and I'd be arrested on the spot and sent to psychiatric care. If the money was real, it’d be seized and I'll never see it or spend it. If it was fake, they’d find a way to stick “possession of counterfeit currency” charge on me, and I'll be shoved into a Federal concrete box, draining the best years of my life away, only to be released when I can’t chew solid food any more. No. The only recourse is to handle this myself. I call an old college friend practicing criminal defense law in New York City: “Hey Roger, it’s Kai. How’ve you been?” “I'm cool. It's been a while. What’s up man.” “We should catch up soon in person. But I’m calling because I need something.” “Ok, shoot.” I swallow hard - it’s difficult to even say the words: “Who’s the best CrimDef lawyer you know in California, who defends against Federal charges?” A moment. His voice lowers noticeably. “Shit, man. You in some kind of trouble?” “I’m not sure yet.” I said, truthfully. “But I need someone experienced and smart ... someone who you’d hire, if you’re facing serious attention from the Feds." He lets out a long exhale. “Vincent King. Former rockstar DOJ prosecutor in D.C. Had a change of heart halfway through his rotation in Maryland, when he was securing Life sentences for “interstate drug transportation” charges on young Black kids who were busted muling for the cartels. Was offered a fast-track promotion straight to the U.S. Attorney’s office but went rogue. He set up independent shop in San Francisco, fighting Fed cases. Heavy hitter clients, but makes a point of refusing to represent anyone accused of murder or human trafficking. Intimate knowledge of Federal prosecutorial procedures and evidence-collection protocol. Smart. Methodical. Very expensive.” “Perfect.” “I did mention ‘very expensive?’” “You did.” “I’ll send his contact information now.” =================================“I’m sorry - Mr. King is in court all day and won’t be back in the office. His earliest appointment is tomorrow morning after a client meeting. Shall I book him for 11am for you?” “Yes, thank you Marta.” “We’ll see you tomorrow at 11 then.” I look at the digital clock in my kitchen - it reads 10:44am. Just me and a stack of bills which may or may not be fake, no formal legal representation for over 24 hours. It’s going to be a long day. Taking even a few of these bills to a bank to corroborate their authenticity is out of the question. If a bank officer confirms they are fraudulent, I’ll be arrested on the spot, and since I haven’t hired counsel, I’d be at the mercy of the Public Defender’s Office - the most overworked and underpaid division of the American Criminal Justice system. No, thank you. The next number I dial is an old friend, Robert Kendrick, sole proprietor of ‘Secher Nbiw - The Golden Path,’ a gold bullion dealer with a whimsical Dune reference in the name of his shop. I’ve known Robert for over a decade; his business deals in large amounts of (mostly) legal cash. By necessity, he has a high-end currency counter/ counterfeit detection device in his office, which can swiftly count and verify large sums of money with precision. “Bobby, it’s me.” “Hey, what’s up.” “Can I come to your office - like right now?” “Sure, what do you need?” “I, uh, came into some money. Long story, and I really don’t want to get too much into the details … but I’m wondering if you’d be willing to run the bills through your counter for me? I’m not 100% sure they’re real, and I’d like a discreet way of verifying them. If they are, I’m going to pick up some bullion as well.” “Sure man. Happy to help. How much money are we talking about?”“$60,000” I flinch at that - I hate lying to friends, but at this point, I have no idea who to trust. Though if you want to be technical about it, I did come across $60,000. I am just simply not telling Kendrick about the other $940,000 that accompanied the $60k in the satchel that dropped into my life just three hours ago. “Come on by.” I pull apart a few $10,000 currency bands and start plucking random $100 bills from the middle of every 10k stack to assemble a randomized sample of the entire million. 100 bills, wrap it up. 100 bills, wrap it up. 100 bills, wrap it up. Three bands, thirty thousand dollars, randomized and fully assembled to be tested for authenticity. “Half” of my alleged $60k windfall. The rest of the loose bills are refolded back so there remains 97 stacks of $10k racks, re-wrapped and properly sorted. In 30 minutes, I will figure out if I’m rich, or holding on to enough illicit contraband to send me to Federal Prison for the rest of my life. =============================The Golden Path, like most bullion dealers, work out of small, highly secured office covered by multiple layers of security. At any given moment, Robert may have several hundred thousand dollars in cash or gold, silver and platinum bullion on the premise, it pays to be careful. One of the few civilians in California with a Concealed Carry Weapons permit, Kendrick and I met on pistol gun range ten years ago; we bonded over shooting .45 ACP slugs down-range. He and I spent countless hours debating the relative merits of his preference for single-action 1911s, vs my bias toward double-action SIG-Sauer P220s. In the bullion business, you learn to know the boundaries of money-laundering laws, and know how to walk right up to the edge without triggering reporting thresholds. Drop US$10,000 in cash or more at a car dealership, bank or bullion dealer in a single day’s transaction, and the U.S. authorities gets very interested in the source of your funds. By law, these business that receive such sums of cash must fill out invasive forms to tie the transaction to you and your Social Security Number. Keep cash transactions below US$10,000, and you can avoid much of that intense scrutiny. “Welcome back man. I haven’t seen you in a while.” A discreet man, Kendrick does not inquire further about the source of the cash. In the business of buying and selling gold bullion, you learn to comply with the letter of the law, while avoiding conversational topics that can jeopardize one’s own plausible deniability. While his clientele is mostly legitimate, I’m certain the most lucrative of his customers are criminals - and he smart enough to know not to ask the sort of questions that open up a line of liability for him. So long as the proper theatrics of anti-money-laundering protocols are observed, everyone is technically in the clear. I hand him the three $10k stacks and he pulls the bands off them and puts the entire block in his high-speed currency counter. After a second, the machine spools up and the digital counter swiftly runs from zero to three hundred. Thirty thousand dollars. “It’s real.” It’s real. His words hang in the air for a moment, and it takes a moment for them to sink in. One million dollars. Genuine currency of the United States of America, the most recognized and accepted form of money in the world - denominated in crisp, non-sequential bills. I hold my face as neutral as possible, but my excitement made me slightly dizzy, and I am glad I was sitting down. “What’s the spot price of Gold today?” Kendrick’s eyes drift to his laptop computer, where the current day’s commodities prices were fed to him via a live stream. “$1334 Ask, $1335 Bid.” I nodded my understanding.Precious metals bullion trade in troy ounces, and prices are quoted on a per troy oz basis; depending on the specific type of bullion (bars, coins, make), there are different markups from the quoted price. Depending on the specific form, Gold is typically marked up by USD$20 to $60 over the day’s quoted Bid price, and sells for $5~10 over the Ask. “What do you have in inventory right now for gold?” “The usual. South African Kugerrands. American Eagles. Canadian Maples. Oh, I do have a lovely Credit Suisse 5oz bar that somebody just sold to me, and I’m happy to let it go for $25/oz over spot.” I quickly did the mental math calculation. With the hard-cap spending limit of $10,000 before I trigger any mandatory anti-money-laundering paperwork, $1335/oz works out to about seven troy ounces of bullion I can buy, without forcing Robert to fill out invasive forms about me and my identity. “I’ll take the 5oz Credit Suisse bar, and two American Gold Eagles.” Kendrick pulls out a calculator and taps in the numbers, “So five troy ounces at 25 over spot plus Eagles at $50 over spot works out to nine thousand six hundred and -“ “Take ten grand and keep the change.” I interrupt. “I will be back for more.” He raises his eyebrow, but says nothing. “Thank you. I’ll be right back.” He counts back $20,000 and hands it to me, taking the $10,000 in the back room of his office and returning with the 5oz Swiss bar and two heavy 1oz American Eagles, along with a receipt for US$9675. I pause for a moment and hand him back one of the $10,000 stacks. “I know the limit is $10k in transactions per day. Consider this pre-payment for a purchase tomorrow. Your call, on a mix of anything up that totals up to $9500. Keep the rest for you and Katie.” A barely-perceptible smile flickers across his face, then his face was clear again. “Sure thing.” There’s nothing like the feeling of holding physical gold - the density, color and heft of the metal is like no other substance on earth, and it is no wonder that since its discovery, every culture on Earth treated gold with awe and respect. With 18 hours left before I can understand my legal options, there’s only two things I know for certain: 1. The money is real. 2. At least one person knows exactly where I live, and where the money was dropped off. I need to get mobile. I need to get mobile and off the grid ASAP.... to be continuedIf you'd like to be the first to get updates to this story, please add me kai chang 張敦楷 (kaichang) on Twitter. Part 2 (of 10) is being written right now, will be announced on Twitter. Please follow for updates on the saga of the Quora Millionaire! :D

-

How much amount to fill in amount of transaction column of form 60/61?

You are required to write the amount for which you are filling this form. Nil in case of debit card requests as now it is mandatory to have PAN card to apply for a debit card from the Bank.

-

What do Liberals/Democrats want to see happen to guns? What laws/restrictions do they want passed and why?

I am a liberal. I voted for Dukakis, for God’s sake. I am so far left that Bernie Sanders does not go far enough.Image: USNewsI don’t need to restrict firearms. There are tens of millions of other liberals to ask for that. I would like to see:National reciprocity for concealed carry permits. Wait for Heller to be overturned or a new Amendment for a rebuttal. Meanwhile, Heller should be enforced as surely as gay marriage, women’s suffrage and abolition of Black slavery.Allow private sellers access to the National Instant Criminal Background Check System (NICS). You want to require background checks for all firearms sales, including private face-to-face? Then individuals need free access to NICS like licensed dealers and law enforcement have. People should have this choice available to them already.Prosecute those who lie on background screenings. “In almost every case, these people can be prosecuted” (Politifact), but only 0.055% prosecution rate for those who fail. What’s the purpose of screening for prohibited persons such as convicted felons, if those prohibited persons are not prosecuted for breaking federal or state law by lying on forms? In my state, applicants must pay for their own federal background check and fingerprint check and registry. They shouldn’t.Uphold the thousands of existing gun laws against criminals, instead of penalizing law abiding citizens with new ones. If a violent felon is convicted to 15 years for illegal possession of a firearm, why are they now out to commit more crimes? (FAMM - Families Against Mandatory Minimums) Yes, keeping people out of the system saves money and may be good for families. So how does making more gun laws to break and creating millions more criminals with the stroke of a pen help? If you are willing to release a non-violent felon who illegally possessed a firearm because we should care about the impact on their families (FAMM), why do you want to jail a non-violent gun owner simply because he has a magazine that holds over 10 rounds?Increase penalties for use of a firearm in crimes. Sorry FAMM, and I do care about impacted family members of convicted criminals (FAMM - Why Should I Care?). As a liberal, I would increase social supports for underprivileged families so women and children do not need to be dependent on or stay with criminals, have convicts imprisoned within more reasonable distance of their homes, and allow/encourage family visits. With accommodations and family friendly events, even. If they don’t agree using an illegal handgun in commission of a robbery means an extra ten years on top of the robbery charge, perhaps criminals shouldn’t use guns or rob people.Free or affordable firearms handling and safety training to promote safer handling and storage of firearms, to avoid being a burden to exercise a Constitutional right, for the same reason people argue against requiring voter IDs for inner city minorities.Require secure storage of firearms to prevent access by unauthorized persons when not ready for immediate use. You sleep with your loaded handgun to be ready for a home invasion? I do. You keep an AR-15 or shotgun at hand at the computer? Sometimes. But I put them in the safe when I shower or leave home, because I’m the only one allowed to touch my guns. I have the keys for my safes and locks. I have private home security and various kinds of gun owner and liability insurance, too. If you can afford a $400 firearm and $18 a box for ammunition, you can afford a lock if one doesn’t come with your gun, or you can buy a small safe or clamp style cover for the trigger housing or action. Note: not electronic smart guns that fail when you need it.AR15 Lock, IC-Lock Ejection Port Gun Lock $27Image: ic13arms, eBay (I am not a representative or stakeholder of IC-LOCK.)Life Jacket Locking Firearm Safety Case LJ3 Shotgun Case $15.99Image: eBay (I am not a representative or stakeholder of Life Jacket.)I’ve taken time off work, and paid thousands of dollars to travel thousands of miles to go to the classes, taken the tests (100%), shot on the range (90-ish?), passed the federal background checks (in addition to all other background checks and random drug tests to be an education and health care worker), paid the fees, yet can carry a concealed weapon in only 33 states, and not my home state. What other Constitutional right does not apply nationwide?In my state at the time I first got my permit to acquire a firearm, state certified Hunter Education classes or other state approved firearms training (e.g. armed law enforcement or military service) were required prior to applying for a permit. The cost for the classes was normally $100, but the fee was waived due to a donation or grant. I was trained for free. Hell, if some donor is willing and able to shell out $100 per student, why can’t they give an extra $10 for a gun lock or $40 for a pistol safe? I bought my own 14 rifle safe and a pistol safe, but that was my choice.[Fun fact: at my hunter education class (2008), I noticed the older brother of a high school classmate in attendance. Purely by coincidence while looking at a sex offender registry much later, there he was. His listing is still current. Two counts, Sex Assault III, 2001. He’s a convicted felon and wouldn’t pass a background check.]Note I did not say, promote ownership of firearms. There may be firearms in 4 out of 10 homes in the US. Your children and loved ones are around guns accessible from other homes or while in other homes, regardless of lack of guns in your own home, vault like security for firearms you do own, or legal status of firearms in your community. Widespread firearms handling and safety training will have a societal benefit, even if it is as simple as children learning Don’t touch! Tell an adult! if they see a firearm unattended.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

Create this form in 5 minutes!

How to create an eSignature for the amount in box 1

How to generate an eSignature for the Amount In Box 1 in the online mode

How to generate an electronic signature for your Amount In Box 1 in Google Chrome

How to generate an electronic signature for putting it on the Amount In Box 1 in Gmail

How to generate an eSignature for the Amount In Box 1 from your smartphone

How to make an electronic signature for the Amount In Box 1 on iOS

How to make an eSignature for the Amount In Box 1 on Android devices

People also ask

-

What is the 1098 T Form and why is it important?

The 1098 T Form is a tax document used to report qualified tuition and related expenses for students. It's essential for both students and educational institutions as it helps in claiming educational tax credits. Understanding the 1098 T Form can lead to signNow savings on your tax return.

-

How can airSlate SignNow help me with the 1098 T Form?

With airSlate SignNow, you can easily eSign and send the 1098 T Form electronically, streamlining the process for both students and educational institutions. Our platform ensures secure and quick delivery, helping you manage important documents without hassle.

-

Is there a cost associated with using airSlate SignNow for the 1098 T Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit your needs, including options for individual users and businesses. The cost-effective solutions ensure that you can manage the 1098 T Form and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the 1098 T Form?

Absolutely! airSlate SignNow seamlessly integrates with popular software solutions, allowing you to manage the 1098 T Form alongside your existing systems. This integration enhances productivity and simplifies document management.

-

What features does airSlate SignNow offer for handling the 1098 T Form?

airSlate SignNow provides features such as electronic signatures, document templates, and secure storage, specifically designed to facilitate the management of the 1098 T Form. These features empower users to complete their documentation efficiently and securely.

-

How secure is the 1098 T Form when using airSlate SignNow?

The 1098 T Form is protected with advanced encryption and security protocols when using airSlate SignNow. This ensures that sensitive information remains confidential and secure throughout the signing and sending process.

-

Can I track the status of my 1098 T Form with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of the 1098 T Form in real-time. You will receive notifications when the document is viewed and signed, ensuring you stay informed throughout the process.

Get more for 1098 T Form

Find out other 1098 T Form

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile