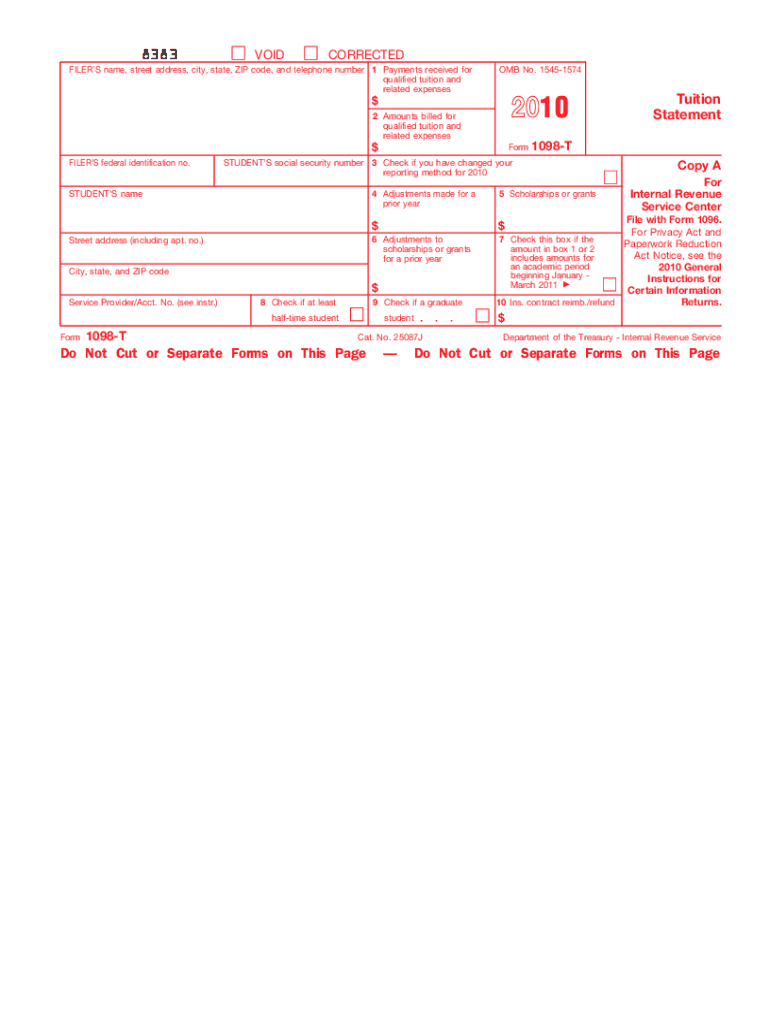

Form 1098 T 2010

What is the Form 1098-T

The Form 1098-T, also known as the Tuition Statement, is an important document used by eligible educational institutions to report qualified tuition and related expenses paid by students. This form is essential for students who may qualify for tax credits such as the American Opportunity Credit or the Lifetime Learning Credit. It provides information about the amount of tuition paid, scholarships or grants received, and other financial details that can affect a taxpayer's return.

How to use the Form 1098-T

Students and taxpayers use the Form 1098-T to determine eligibility for education-related tax benefits. The information on the form helps in calculating the amount of qualified expenses that can be claimed. Taxpayers should include the details from the form when filing their federal income tax returns. It is advisable to keep the form for personal records, as it may be required for future reference or audits.

Steps to complete the Form 1098-T

Completing the Form 1098-T involves several key steps:

- Gather necessary information, including the student’s name, Social Security number, and the institution's details.

- Fill in the amounts for qualified tuition and related expenses, as well as any scholarships or grants received.

- Ensure all information is accurate and matches the records maintained by the educational institution.

- Submit the completed form to the IRS and provide a copy to the student for their tax records.

Legal use of the Form 1098-T

The Form 1098-T is legally recognized as a valid document for reporting educational expenses. It must be completed accurately to comply with IRS regulations. Institutions must provide this form to students by January thirty-first of each year, ensuring that all reported amounts are correct. Misreporting or failing to provide this form can lead to penalties for the institution and potential issues for the student regarding tax credits.

Key elements of the Form 1098-T

Several key elements are included in the Form 1098-T:

- Box 1: Amount of payments received for qualified tuition and related expenses.

- Box 2: Amount billed for qualified tuition and related expenses (not used after 2017).

- Box 5: Scholarships or grants received by the student.

- Student Information: Includes the name, address, and taxpayer identification number of the student.

- Institution Information: Details about the educational institution, including its name and Employer Identification Number (EIN).

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1098-T. Educational institutions must provide the form to students by January thirty-first each year. Additionally, institutions must file the form with the IRS by February twenty-eighth if filing by paper, or by March thirty-first if filing electronically. Missing these deadlines can result in penalties for the institution and complications for students claiming tax credits.

Quick guide on how to complete form 1098 t 2010

Complete Form 1098 T effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 1098 T on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form 1098 T without difficulty

- Obtain Form 1098 T and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight critical sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, lengthy form searches, or errors requiring the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1098 T and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1098 t 2010

Create this form in 5 minutes!

How to create an eSignature for the form 1098 t 2010

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Form 1098 T and who needs it?

The Form 1098 T is a tax document used by educational institutions to report tuition payments and related expenses for students. If you are a student or the parent of a student who has paid qualified tuition and fees, you may need this form to claim educational tax credits on your tax return.

-

How can airSlate SignNow help me manage my Form 1098 T?

airSlate SignNow provides a streamlined platform for electronically signing and sending your Form 1098 T. With our easy-to-use interface, you can ensure that your documents are securely signed and submitted, making tax season much less stressful.

-

Is there a cost associated with using airSlate SignNow for Form 1098 T?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs. Our cost-effective solutions allow individuals and businesses to efficiently manage their Form 1098 T and other documents, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for handling Form 1098 T?

airSlate SignNow includes features such as secure electronic signatures, customizable templates, and document tracking specifically designed for managing documents like Form 1098 T. These features enhance your efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software to manage Form 1098 T?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to easily manage your Form 1098 T alongside your other tools. This integration streamlines your workflow, making it simpler to handle all your documentation needs.

-

What are the benefits of using airSlate SignNow for the Form 1098 T?

Using airSlate SignNow for your Form 1098 T offers numerous benefits, including enhanced security, reduced processing time, and improved compliance. Our platform ensures that your documents are handled efficiently while maintaining the highest standards of privacy.

-

How secure is my information when using airSlate SignNow for Form 1098 T?

Security is a top priority at airSlate SignNow. When you use our platform for your Form 1098 T, all your information is encrypted and stored securely, providing peace of mind that your sensitive data is protected during the signing process.

Get more for Form 1098 T

- Health information technologycentral piedmont cpccedu

- Bosa competency matrix k 12 principal 2docx winona form

- Forms financial aid zucker school of medicine at hofstranorthwell

- Career ampamp transfer center hudson valley community college form

- Apply admission college of arts ampampamp sciences form

- Security incident reporting form

- Visiting scholars program berkeley law university of form

- Application for admission to the paseka school of business form

Find out other Form 1098 T

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile