1099 PDF 2023

What is the 1099 PDF?

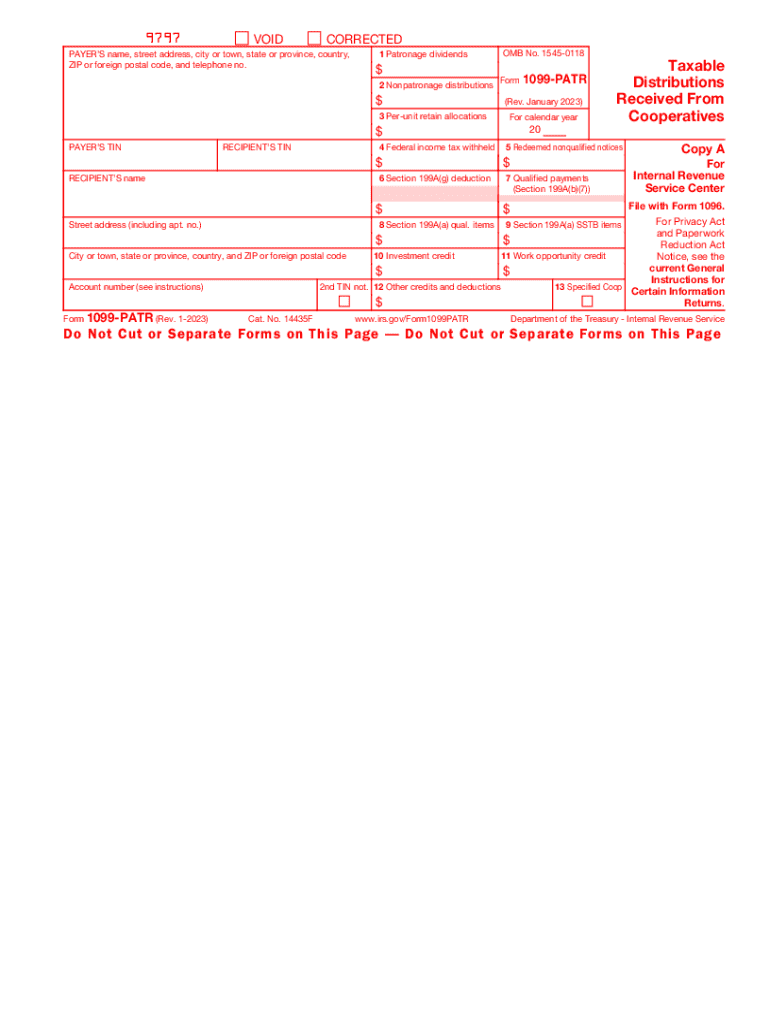

The 1099 PDF is a tax form used in the United States to report various types of income other than wages, salaries, and tips. It is part of the 1099 series of forms issued by the Internal Revenue Service (IRS). The most common variant is the 1099-MISC, which reports miscellaneous income, but there are several other types, including the 1099-NEC for non-employee compensation and the 1099-PATR for patronage dividends. Each type of 1099 serves a specific purpose and is crucial for accurate income reporting.

Key elements of the 1099 PDF

The 1099 PDF includes several important elements that taxpayers need to be aware of when reporting income. Key components include:

- Payer Information: The name, address, and taxpayer identification number (TIN) of the entity issuing the 1099.

- Recipient Information: The name, address, and TIN of the individual or business receiving the income.

- Income Amount: The total amount of income paid to the recipient during the tax year, which is reported in specific boxes depending on the type of 1099.

- Box Designations: Each box on the form corresponds to different types of income or deductions, such as rents, royalties, or dividends.

Steps to complete the 1099 PDF

Completing the 1099 PDF involves several straightforward steps:

- Gather all necessary information, including payer and recipient details, as well as the total income amount.

- Select the appropriate type of 1099 form based on the nature of the income.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the form for any errors before submission.

- Submit the completed form to the IRS and provide a copy to the recipient by the due date.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1099 PDF. It is essential to adhere to these guidelines to avoid penalties. Some key points include:

- Forms must be filed by the deadline, which is typically January thirty-first for most 1099 forms.

- Accurate reporting is crucial; incorrect information can lead to audits and penalties.

- Keep copies of all submitted forms for at least three years in case of an audit.

Filing Deadlines / Important Dates

Timely filing of the 1099 PDF is critical. Important deadlines include:

- January thirty-first: Deadline for providing the recipient with their copy of the 1099.

- February twenty-eighth: Deadline for filing paper forms with the IRS.

- March thirty-first: Deadline for filing electronically with the IRS.

Who Issues the Form

The 1099 PDF is typically issued by businesses, financial institutions, or other entities that have paid income to individuals or other businesses during the tax year. Common issuers include:

- Employers who hire independent contractors.

- Cooperatives paying patronage dividends.

- Financial institutions reporting interest payments.

Quick guide on how to complete 1099 pdf

Complete 1099 Pdf effortlessly on any device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as it allows you to access the necessary template and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly and without interruptions. Manage 1099 Pdf on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related process now.

The easiest way to edit and electronically sign 1099 Pdf with ease

- Find 1099 Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to secure your updates.

- Select your preferred method to share your form, be it via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1099 Pdf and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 pdf

Create this form in 5 minutes!

How to create an eSignature for the 1099 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 PAT and how does it relate to my 1040 tax form?

A 1099 PAT is a tax form used to report certain types of income. When filling out your 1040, it is essential to know where to report this income to ensure accurate tax submissions. Specifically, the 1099 patr where to report on 1040 typically falls under the 'Other Income' section.

-

How does airSlate SignNow help with managing 1099 PAT documents?

airSlate SignNow simplifies the process of creating and signing 1099 PAT documents online. With our platform, you can easily send these forms for eSignature, which ensures they are completed correctly and efficiently. This solution provides peace of mind when preparing to report your 1099 patr where to report on 1040.

-

What features does airSlate SignNow offer for tax document management?

Our platform offers features such as customizable templates, secure eSigning, and real-time tracking. These tools enhance the efficiency of managing tax documents like the 1099 PAT. By utilizing these features, you can ensure you know exactly where to report your 1099 patr where to report on 1040.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. We offer flexible pricing plans that accommodate different needs, making it easy for small businesses to stay on top of their tax documentation, including understanding the 1099 patr where to report on 1040.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates with various accounting software systems, making it easier to manage your financial documents. This integration allows for smoother processes and ensures you are accurately reporting your 1099 patr where to report on 1040.

-

What are the benefits of using eSignature for my 1099 PAT documents?

Using eSignature for 1099 PAT documents enhances security and reduces processing time. It eliminates the need for physical paperwork and provides a streamlined process to ensure timely submission. This means you can focus on accurately determining where to report your 1099 patr where to report on 1040.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes user security, employing encryption and compliance with industry standards. Your personal and financial data, including any tax documents like the 1099 PAT, are safeguarded. This security allows you to confidently prepare to report your 1099 patr where to report on 1040.

Get more for 1099 Pdf

- Stfcu form

- Form approved omb no 0960 0413 psychiatric review

- Foreign affairs trouble the nation answer key form

- Old penitentiary activity sheet idaho state historical society history idaho form

- Duration recording sheet form

- Cobra or state continuation of coverage application anthem form

- Written for child custody agreement template form

- Written social work agreement template form

Find out other 1099 Pdf

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT