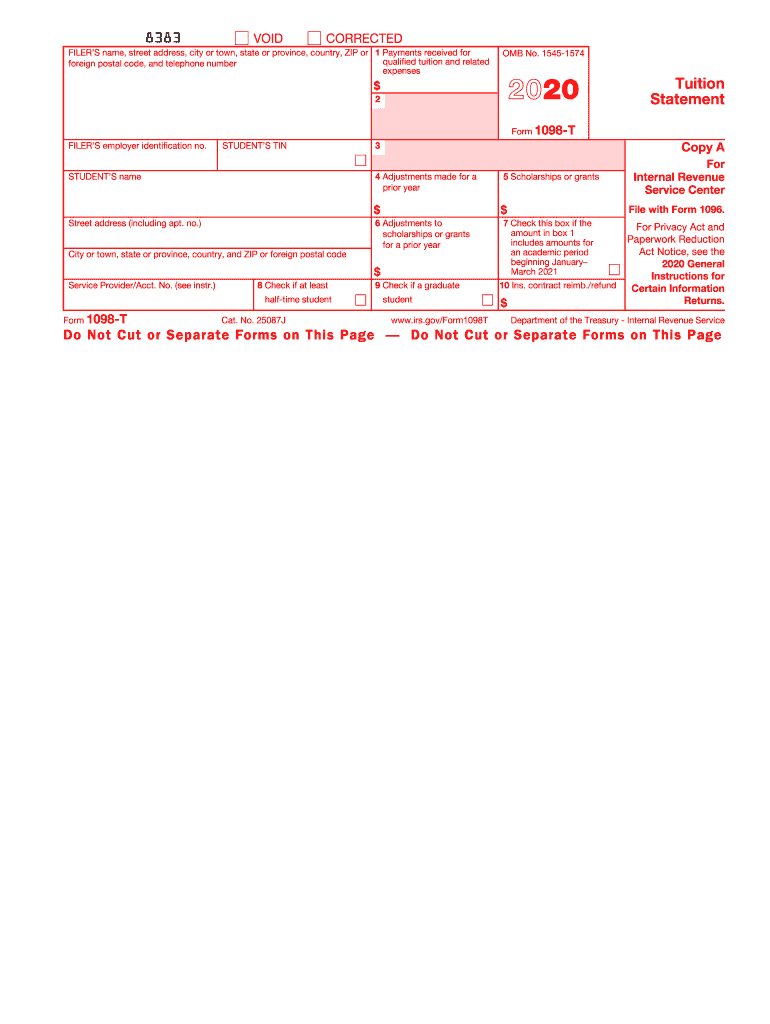

Form 1098 T Tuition Statement 2020

What is the Form 1098-T Tuition Statement

The Form 1098-T, also known as the Tuition Statement, is an important document issued by eligible educational institutions in the United States. It provides information about qualified tuition and related expenses that students incur during the tax year. This form is essential for students and their families as it helps in claiming education-related tax credits such as the American Opportunity Credit and the Lifetime Learning Credit. The information reported on the 1098-T includes amounts billed for qualified tuition, scholarships received, and adjustments made to previous years’ amounts.

How to Use the Form 1098-T Tuition Statement

To effectively use the Form 1098-T, taxpayers should review the information provided carefully. The form includes details about the amounts paid for tuition and fees, which can be used to determine eligibility for education tax credits. Taxpayers should keep the form with their tax records and refer to it when completing their tax returns. It is also advisable to consult IRS guidelines or a tax professional to understand how the information affects their specific tax situation.

Steps to Complete the Form 1098-T Tuition Statement

Completing the Form 1098-T involves several steps:

- Gather all necessary information, including the student’s identification details and the educational institution’s information.

- Enter the amounts billed for qualified tuition and related expenses in the appropriate boxes.

- Include any scholarships or grants received by the student that may reduce the amount of tuition paid.

- Review the form for accuracy and ensure all required fields are completed.

- Submit the form to the IRS along with your tax return by the designated filing deadline.

Key Elements of the Form 1098-T Tuition Statement

The Form 1098-T contains several key elements that are crucial for taxpayers:

- Box 1: Shows the total payments received for qualified tuition and related expenses.

- Box 2: Indicates the amount billed for qualified tuition and related expenses (not used after 2017).

- Box 5: Reports any scholarships or grants received by the student.

- Box 4: Reflects any adjustments made for prior years.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 1098-T. Educational institutions are required to provide the form to students by January 31 of the following tax year. Taxpayers must include the information from the 1098-T when filing their federal tax return, typically due by April 15. If additional time is needed, taxpayers can file for an extension, but they should be aware that any taxes owed are still due by the original deadline.

Who Issues the Form

The Form 1098-T is issued by eligible educational institutions, which can include colleges, universities, and vocational schools that qualify for federal student aid programs. These institutions are responsible for reporting the tuition payments and related expenses incurred by students. Students should ensure that they receive this form from their educational institution, as it is necessary for accurately filing their taxes and claiming any applicable education credits.

Quick guide on how to complete 2020 form 1098 t tuition statement

Complete Form 1098 T Tuition Statement effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without delays. Handle Form 1098 T Tuition Statement on any device with airSlate SignNow's Android or iOS applications and improve any document-centric process today.

How to modify and eSign Form 1098 T Tuition Statement effortlessly

- Find Form 1098 T Tuition Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1098 T Tuition Statement and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1098 t tuition statement

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1098 t tuition statement

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a 1099g 2017 and why is it important?

A 1099g 2017 form is used to report certain types of income received by individuals, including state tax refunds and unemployment benefits. It's crucial for taxpayers as it helps them accurately report their income and assess any tax liabilities for the year 2017. Understanding the details of your 1099g 2017 is essential for effective tax filing.

-

How can airSlate SignNow assist with 1099g 2017 documents?

airSlate SignNow simplifies the process of sending and eSigning 1099g 2017 documents. Our platform allows you to securely send out these forms for electronic signatures, ensuring that your tax-related documents are managed efficiently and safely. This streamlines your workflow and saves valuable time during the tax season.

-

What features does airSlate SignNow offer for managing 1099g 2017 forms?

With airSlate SignNow, you can access features like automated workflows, document templates, and real-time tracking for your 1099g 2017 forms. Our user-friendly interface allows you to create, send, and manage these documents with ease. Additionally, you can collect digital signatures quickly, enhancing your productivity.

-

Is airSlate SignNow a cost-effective solution for managing 1099g 2017 forms?

Absolutely! airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for managing your 1099g 2017 forms. By choosing our services, you can reduce paper costs and administrative workload, ultimately saving money while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for 1099g 2017 processing?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software to streamline your 1099g 2017 processing. This connectivity allows you to synchronize data and reduce the need for duplicate entries, enhancing overall efficiency. Check our integration options to find the best solutions for your business.

-

What benefits can businesses gain from using airSlate SignNow for 1099g 2017 forms?

By using airSlate SignNow for your 1099g 2017 forms, businesses can enjoy faster processing times, enhanced security, and improved accuracy. Our platform reduces the risk of errors commonly associated with paper forms and boosts your team's productivity by automating the signing process. These benefits enable you to focus on other vital areas of your business.

-

How secure is the signing process for 1099g 2017 documents with airSlate SignNow?

The security of your 1099g 2017 documents is a top priority at airSlate SignNow. We use advanced encryption and authentication measures to ensure that all your signed documents are secure and compliant with legal standards. You can trust our platform to protect sensitive information throughout the signing process.

Get more for Form 1098 T Tuition Statement

Find out other Form 1098 T Tuition Statement

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document