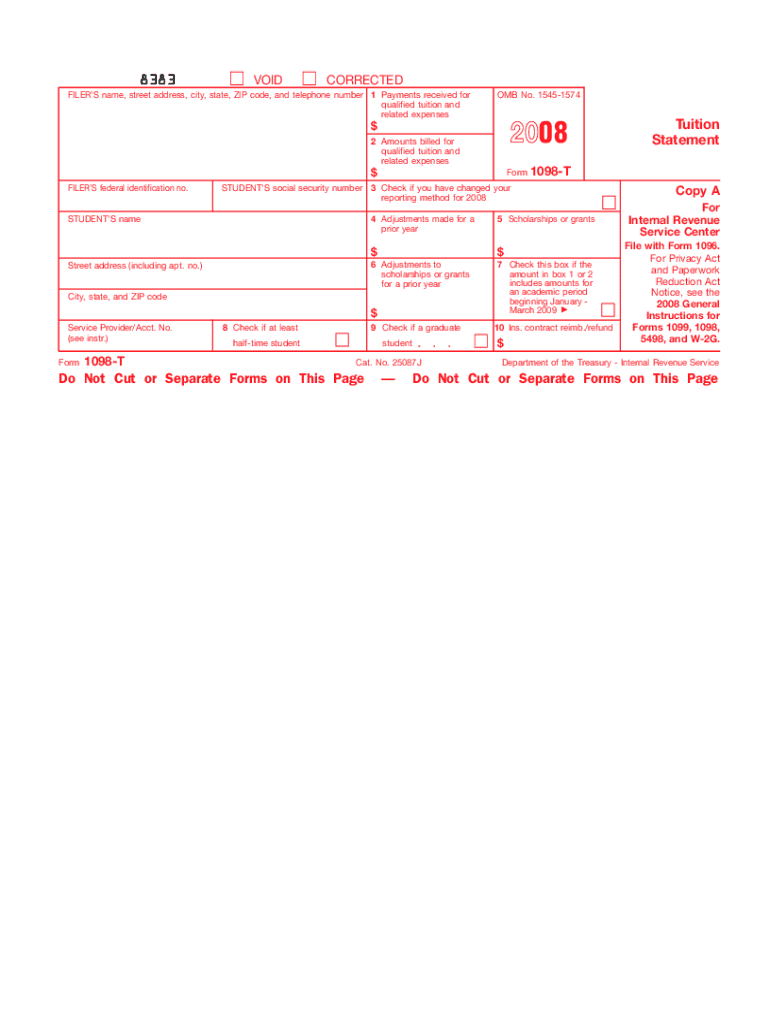

1098 T Form 2008

What is the 1098-T Form

The 1098-T form is a tax document used in the United States to report qualified tuition and related expenses that eligible educational institutions receive from students. This form is essential for students who are eligible for education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The information provided on the 1098-T helps students and their families understand their educational expenses and can assist in accurately filing their federal income tax returns.

How to Use the 1098-T Form

Using the 1098-T form involves several steps to ensure that the information reported is accurate and beneficial for tax purposes. First, students should review the form to confirm that all reported amounts are correct. This includes checking the amounts for qualified tuition and fees, as well as any scholarships or grants received. Next, students should use the information to determine eligibility for tax credits. It is advisable to consult IRS guidelines or a tax professional to ensure proper use of the form in conjunction with their tax return.

Steps to Complete the 1098-T Form

Completing the 1098-T form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including tuition payment receipts and any scholarship or grant information.

- Verify that the institution has provided the 1098-T form by the end of January each year.

- Check the form for accuracy, ensuring that the amounts for qualified tuition and related expenses are correct.

- Consult IRS guidelines to determine which credits you may qualify for based on the information provided.

- Complete your federal tax return using the information from the 1098-T form.

Legal Use of the 1098-T Form

The 1098-T form is legally required for eligible educational institutions to report tuition payments and scholarships. It serves as a critical document for students to claim education-related tax credits. To ensure compliance, institutions must follow IRS regulations regarding the issuance and reporting of the form. Students should also be aware of their responsibilities in accurately reporting the information on their tax returns to avoid potential penalties.

Filing Deadlines / Important Dates

Timely filing is crucial when it comes to the 1098-T form. Educational institutions must provide the 1098-T forms to students by January 31 each year. Students should aim to file their tax returns by the April 15 deadline to avoid penalties. It is important to keep track of these dates to ensure that all necessary documentation is submitted in a timely manner.

Who Issues the Form

The 1098-T form is issued by eligible educational institutions, including colleges, universities, and vocational schools that participate in federal student aid programs. These institutions are responsible for reporting the tuition payments received from students and any scholarships or grants that were applied. Students should expect to receive their 1098-T forms directly from their educational institutions, typically by the end of January each year.

Quick guide on how to complete 1098 t 2014 form

Prepare 1098 T Form easily on any device

Online document management has gained popularity among organizations and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents quickly without delays. Handle 1098 T Form on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign 1098 T Form effortlessly

- Locate 1098 T Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign 1098 T Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 t 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1098 t 2014 form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 't 2008'?

airSlate SignNow is a powerful eSignature solution designed to simplify document management for businesses. With a focus on providing a cost-effective solution, it enables users to send and sign documents seamlessly. The reference to 't 2008' indicates a specific model or use case that businesses often consider when seeking trustworthy eSignature services.

-

What features does airSlate SignNow offer for 't 2008' users?

For 't 2008' users, airSlate SignNow provides a robust suite of features, including templates, real-time tracking, and workflow automation. These features streamline the signing process and enhance productivity. Additionally, integrations with popular business tools make it easier to incorporate into existing workflows.

-

How much does airSlate SignNow cost compared to 't 2008' pricing?

airSlate SignNow offers competitive pricing packages tailored to businesses of all sizes. When compared to other solutions, such as those operating around the 't 2008' framework, SignNow remains a cost-effective choice. Subscribers can choose from monthly or annual plans, allowing flexibility in budgeting.

-

What are the benefits of using airSlate SignNow for 't 2008' applications?

The benefits of using airSlate SignNow for 't 2008' applications include enhanced document security and improved compliance. The platform ensures that all documents are securely signed and stored, meeting the necessary legal standards. This peace of mind allows businesses to focus on their core operations.

-

Can I integrate airSlate SignNow with other tools while focusing on 't 2008'?

Absolutely! airSlate SignNow offers extensive integrations with popular software applications while addressing 't 2008' specific needs. Whether you use CRM systems or other productivity tools, you can expect seamless connectivity that enhances your overall workflow. This flexibility saves time and reduces manual data entry.

-

Is airSlate SignNow compliant with regulations concerning 't 2008'?

Yes, airSlate SignNow is fully compliant with various regulatory standards, ensuring it meets the requirements for 't 2008' standards. This includes adherence to eSignature laws and data protection regulations. Users can confidently utilize the platform knowing that their documents are handled securely and in compliance.

-

How does airSlate SignNow enhance the document workflow for 't 2008' enterprises?

airSlate SignNow signNowly enhances document workflows for 't 2008' enterprises by providing automated reminders and quick access to signed documents. This efficiency minimizes turnaround time and ensures timely completion of transactions. Ultimately, businesses experience improved operational efficiency and a smoother document flow.

Get more for 1098 T Form

Find out other 1098 T Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors