1098 T Form 2016

What is the 1098 T Form

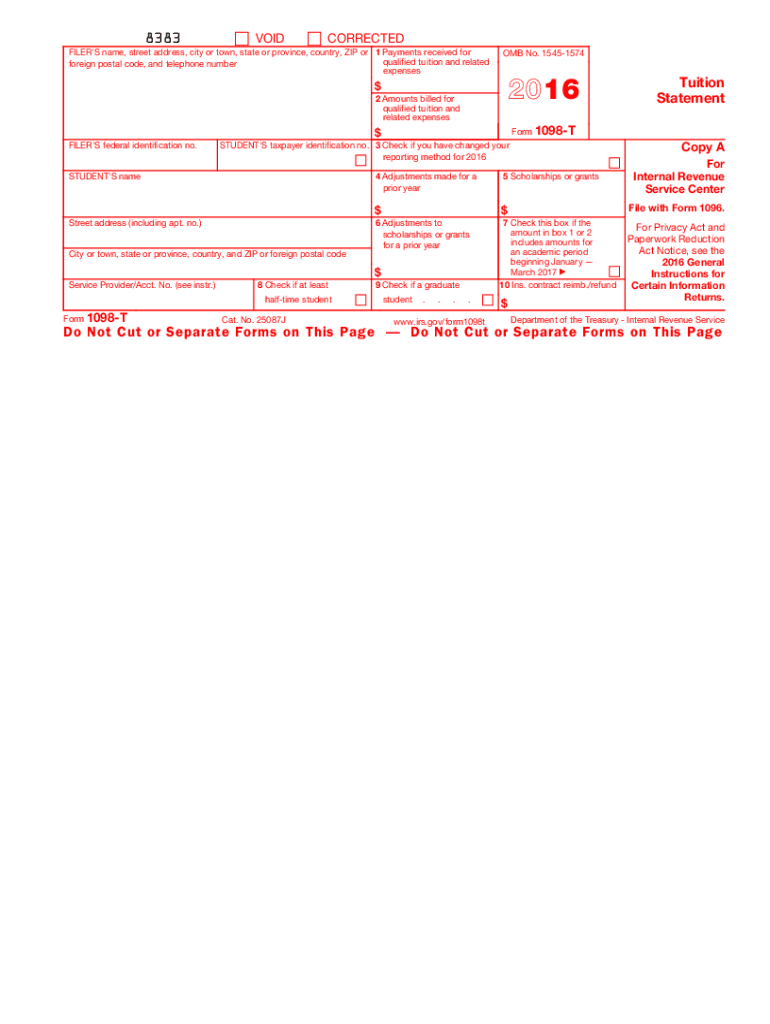

The 1098 T Form is a tax document used in the United States to report qualified tuition and related expenses for students enrolled in eligible educational institutions. This form is typically issued by colleges and universities to students and the IRS. It provides essential information for taxpayers to claim education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098 T Form includes details such as the amount billed for tuition, scholarships received, and adjustments made for prior years.

How to use the 1098 T Form

To effectively use the 1098 T Form, taxpayers should first ensure they receive it from their educational institution. Once received, review the information for accuracy, including your personal details and the amounts reported. This form is critical for claiming education tax credits on your federal tax return. When preparing your tax return, input the relevant figures from the 1098 T Form into the appropriate sections of your tax software or paper forms. It is advisable to keep a copy of the form for your records, as it may be needed for future reference or audits.

Steps to complete the 1098 T Form

Completing the 1098 T Form involves several steps. First, gather all necessary information, including your Social Security number and the details of your educational institution. Next, fill in the required fields, which typically include your name, address, and the amounts related to tuition and scholarships. Be sure to check for any adjustments that may apply to prior years. After completing the form, review it for accuracy before submitting it to the IRS along with your tax return. If you are unsure about any part of the form, consider consulting a tax professional for guidance.

Who Issues the Form

The 1098 T Form is issued by eligible educational institutions, including colleges, universities, and vocational schools. These institutions are responsible for providing accurate information regarding tuition and related expenses to both students and the IRS. Typically, institutions will send out the 1098 T Form by January 31 of the following year, allowing students sufficient time to prepare their tax returns. If you do not receive your form by this date, it is advisable to contact your school's financial office to ensure it was issued correctly.

Filing Deadlines / Important Dates

Filing deadlines for the 1098 T Form align with the general tax filing deadlines in the United States. The educational institution must provide the form to students by January 31 of the year following the tax year. Students should file their tax returns by April 15, unless they file for an extension. It is important to be aware of these dates to ensure timely filing and to avoid penalties. Keeping track of these deadlines helps in maximizing potential tax credits associated with education expenses.

Key elements of the 1098 T Form

The 1098 T Form contains several key elements that are essential for both students and the IRS. These elements include the institution's name, address, and Employer Identification Number (EIN), as well as the student's name, address, and Social Security number. The form also details the amounts billed for qualified tuition and related expenses, any scholarships or grants received, and adjustments for prior years. Understanding these key elements is crucial for accurately reporting education expenses and claiming potential tax benefits.

Quick guide on how to complete 1098 t form 2016

Effortlessly Prepare 1098 T Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle 1098 T Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Edit and eSign 1098 T Form with Ease

- Find 1098 T Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign 1098 T Form to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 t form 2016

Create this form in 5 minutes!

How to create an eSignature for the 1098 t form 2016

How to generate an electronic signature for your 1098 T Form 2016 in the online mode

How to generate an eSignature for the 1098 T Form 2016 in Google Chrome

How to generate an eSignature for signing the 1098 T Form 2016 in Gmail

How to make an eSignature for the 1098 T Form 2016 from your smartphone

How to make an eSignature for the 1098 T Form 2016 on iOS devices

How to create an electronic signature for the 1098 T Form 2016 on Android devices

People also ask

-

What is a 1098 T Form and why is it important?

The 1098 T Form is a tax document that educational institutions provide to students, detailing qualified tuition and related expenses. It's important for students and their parents as it helps them claim education-related tax credits. Understanding how to utilize the 1098 T Form can lead to signNow tax savings.

-

How can airSlate SignNow help me with my 1098 T Form?

With airSlate SignNow, you can easily prepare, send, and eSign your 1098 T Form digitally. Our platform streamlines the process, ensuring that your document is securely signed and filed efficiently. You’ll save time and reduce paperwork while staying compliant with tax regulations.

-

Is there a cost associated with using airSlate SignNow for 1098 T Forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget and allows unlimited access to features for managing your 1098 T Form and other documents. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for handling 1098 T Forms?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including accounting and tax preparation tools. This integration allows you to easily manage your 1098 T Form alongside your other financial documents, enhancing your workflow efficiency.

-

What features does airSlate SignNow offer for managing 1098 T Forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning for your 1098 T Form. These features simplify the signing process and ensure that your documents are handled securely and efficiently.

-

How secure is airSlate SignNow for sensitive documents like the 1098 T Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and compliance measures to protect all sensitive documents, including the 1098 T Form. You can rest assured that your personal and financial information is safe with us.

-

Can I track the status of my 1098 T Form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your 1098 T Form in real-time. You’ll receive notifications when the document is viewed, signed, or completed, giving you peace of mind throughout the signing process.

Get more for 1098 T Form

Find out other 1098 T Form

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding