Printable Irs Tax Form 8949 2017

What is the Printable IRS Tax Form 8949

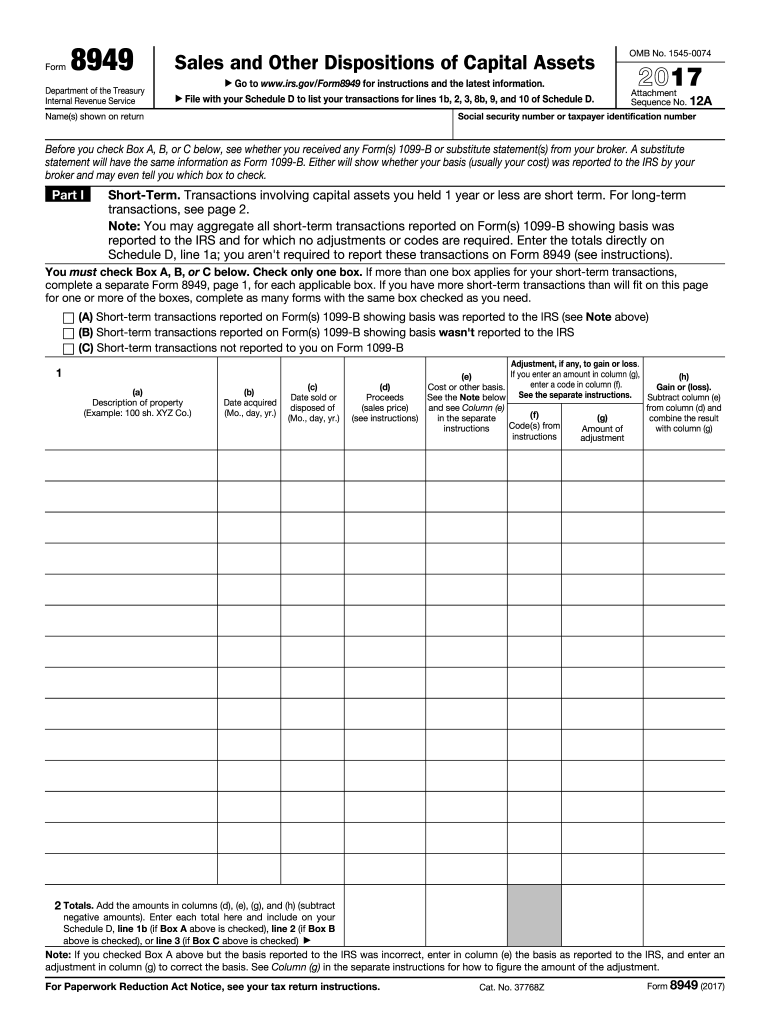

The Printable IRS Tax Form 8949 is a crucial document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the tax owed on these transactions. It allows individuals to detail each transaction, including the date of acquisition, date of sale, proceeds, and cost basis. The information on Form 8949 is then transferred to Schedule D, which summarizes the total capital gains and losses for the tax year.

How to use the Printable IRS Tax Form 8949

Using the Printable IRS Tax Form 8949 involves several steps. First, gather all necessary documentation related to your asset transactions, such as purchase and sale records. Next, fill out the form by entering each transaction in the appropriate section, which is divided into short-term and long-term categories. Ensure that you provide accurate details for each sale, including the asset type and the corresponding financial figures. After completing the form, transfer the totals to Schedule D and include it with your tax return.

Steps to complete the Printable IRS Tax Form 8949

Completing the Printable IRS Tax Form 8949 requires careful attention to detail. Follow these steps:

- Gather all relevant transaction records, including purchase and sale documents.

- Determine whether each transaction is short-term or long-term based on the holding period.

- Fill in the required fields for each transaction, including dates, proceeds, and cost basis.

- Calculate the gain or loss for each transaction and ensure accuracy.

- Transfer the totals from Form 8949 to Schedule D.

Legal use of the Printable IRS Tax Form 8949

The Printable IRS Tax Form 8949 must be used in compliance with IRS regulations. Taxpayers are legally obligated to report all capital gains and losses accurately. Failure to do so can result in penalties or audits. It is essential to ensure that the form is filled out completely and correctly, reflecting all transactions within the tax year. Keeping accurate records and using the most current version of the form is vital for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Printable IRS Tax Form 8949 align with the general tax return deadlines. Typically, individual taxpayers must submit their tax returns, including Form 8949, by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay updated on any changes to deadlines announced by the IRS, especially in the context of extensions or special circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Printable IRS Tax Form 8949 can be submitted through various methods. Taxpayers have the option to file electronically using tax preparation software, which often simplifies the process. Alternatively, the form can be printed and mailed to the IRS. For those who prefer in-person submissions, visiting a local IRS office may be an option, although this is less common. Regardless of the method chosen, ensure that the form is submitted by the appropriate deadline to avoid penalties.

Quick guide on how to complete printable irs tax form 8949 2017

Unearth the simplest method to complete and sign your Printable Irs Tax Form 8949

Are you still spending time preparing your official documents on physical copies instead of doing it online? airSlate SignNow presents a superior approach to complete and sign your Printable Irs Tax Form 8949 and similar forms for public services. Our intelligent electronic signature solution equips you with all you need to handle documents swiftly while adhering to formal standards - robust PDF editing, management, protection, signing, and sharing features all available within an intuitive interface.

Just a few steps are needed to complete and sign your Printable Irs Tax Form 8949:

- Upload the fillable template to the editor using the Get Form button.

- Review the information required in your Printable Irs Tax Form 8949.

- Move between fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your data.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Redact fields that are no longer relevant.

- Press Sign to create a legally valid electronic signature using your preferred method.

- Insert the Date next to your signature and conclude your work with the Done button.

Store your completed Printable Irs Tax Form 8949 in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile file sharing. There’s no need to print your forms if you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct printable irs tax form 8949 2017

FAQs

-

Do I need to submit a 1099B to the IRS if I fill out the 8949 with broker summaries?

The IRS receives copies of any of your 1099s, you don’t need to submit them. However you do need to fill out the 8949 with all transactions, not summaries. Most tax programs like Turbotax will allow you to import the transactions and save you a lot of time. Tradelog ( specialty program) is by far the best trader’s tax program.As to the 400 pages, you can submit them by efile through Turbotax or by mail. It doesn’t matter.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How many tax forms does a small startup usually have to fill for the IRS?

It depends. Have you set up a separate legal entity, such as a C corporation or an LLC? Are you operating as a sole proprietor? Are you referring specifically to income tax returns? Depending on what kind of business you have, you may include additional schedules, election statements, informational forms to supplement your income tax returns.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the printable irs tax form 8949 2017

How to make an electronic signature for your Printable Irs Tax Form 8949 2017 online

How to make an electronic signature for your Printable Irs Tax Form 8949 2017 in Chrome

How to make an electronic signature for signing the Printable Irs Tax Form 8949 2017 in Gmail

How to generate an electronic signature for the Printable Irs Tax Form 8949 2017 from your smartphone

How to make an eSignature for the Printable Irs Tax Form 8949 2017 on iOS devices

How to create an eSignature for the Printable Irs Tax Form 8949 2017 on Android devices

People also ask

-

What is the Printable Irs Tax Form 8949?

The Printable Irs Tax Form 8949 is a tax form used by individuals to report capital gains and losses from the sale of assets. This form is essential for accurately calculating your taxable income and ensuring compliance with IRS regulations.

-

How can I obtain the Printable Irs Tax Form 8949?

You can easily obtain the Printable Irs Tax Form 8949 through the IRS website or by using an electronic signature solution like airSlate SignNow. The platform allows you to fill out, sign, and send the form seamlessly online.

-

Is there a fee associated with using airSlate SignNow for the Printable Irs Tax Form 8949?

airSlate SignNow offers various pricing plans, including a free trial that enables you to see how easy it is to manage the Printable Irs Tax Form 8949. Subscription options are also available to suit different business needs, making it a cost-effective solution.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Printable Irs Tax Form 8949 enhances efficiency and accuracy. With features like document tracking, templates, and eSigning capabilities, you can streamline your filing process and reduce the risk of mistakes.

-

Can I integrate airSlate SignNow with other software for managing my taxes?

Yes, airSlate SignNow features numerous integrations with popular accounting and tax software. This allows you to import and export data related to your Printable Irs Tax Form 8949 seamlessly, improving your workflow.

-

How does eSigning work with the Printable Irs Tax Form 8949?

eSigning the Printable Irs Tax Form 8949 through airSlate SignNow is straightforward. Simply upload the completed form, add the necessary signatures, and send it securely. This ensures that your forms are legally binding and easy to store.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a variety of features for tax document management, including customizable templates for the Printable Irs Tax Form 8949, automated workflows, and analytics for tracking document status. These features help simplify your tax filing experience.

Get more for Printable Irs Tax Form 8949

- Section 26 2 stars answer key form

- Uil elementary number sense test pdf form

- State of north carolina residential property and owners association disclosure statement instructions to property owners 1 ncrec form

- Printable rock cycle worksheets form

- Dd 2052 form

- Silver spring 20902 form

- Money transfer agreement template form

- Moneyfriend loan agreement template form

Find out other Printable Irs Tax Form 8949

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent