F8949 Example Form 8949 Department of the Treasury 2023

Understanding the 2016 Form 8949

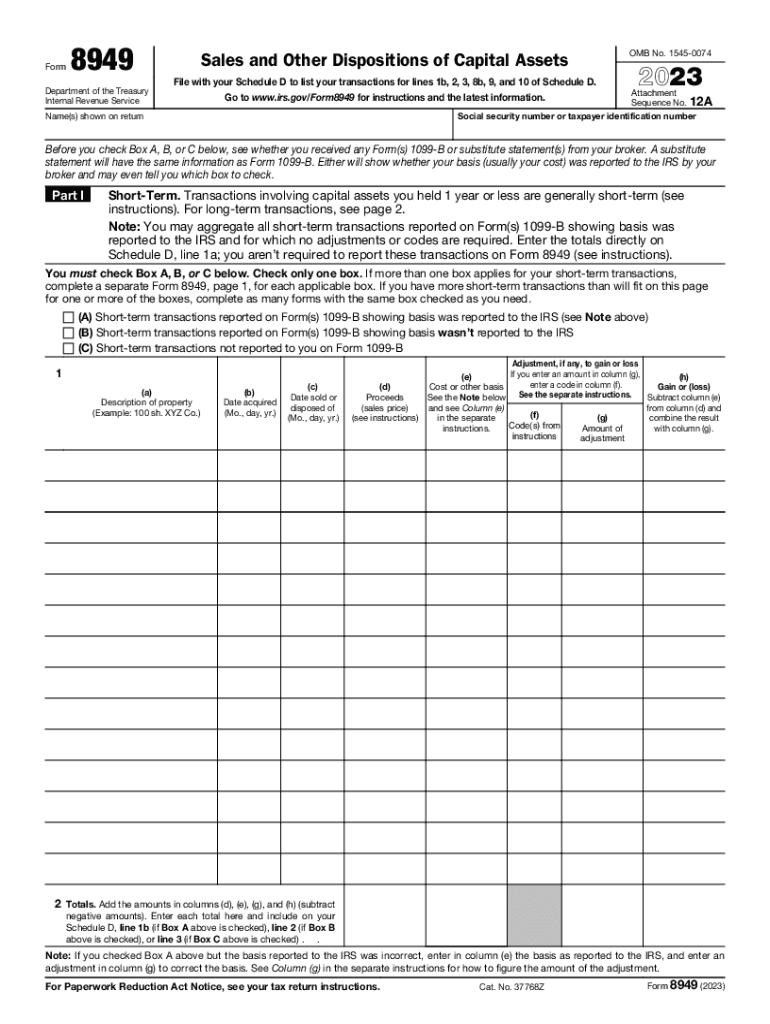

The 2016 Form 8949 is a tax form used by U.S. taxpayers to report sales and exchanges of capital assets. This form helps in calculating capital gains and losses, which are essential for determining your overall tax liability. It is particularly important for individuals who have sold stocks, bonds, or other investments during the tax year. The form allows taxpayers to categorize their transactions into short-term and long-term, based on how long they held the assets before selling them.

Steps to Complete the 2016 Form 8949

Completing the 2016 Form 8949 involves several key steps:

- Gather your records: Collect all relevant documents, such as brokerage statements, that detail your transactions.

- Determine the holding period: Classify each transaction as either short-term (held for one year or less) or long-term (held for more than one year).

- Fill out the form: Enter details for each transaction, including the date acquired, date sold, proceeds, cost or other basis, and any adjustments.

- Calculate gains or losses: Subtract the cost basis from the proceeds to determine your gain or loss for each transaction.

- Transfer totals: Summarize your short-term and long-term gains and losses to the appropriate sections of the form.

IRS Guidelines for Filing Form 8949

The IRS provides specific guidelines for filing the 2016 Form 8949. Taxpayers must ensure that all transactions are accurately reported, as discrepancies can lead to penalties. According to IRS rules, you need to report each sale or exchange of a capital asset, even if you did not receive a Form 1099-B from your broker. Additionally, it is essential to keep records of your transactions for at least three years in case of an audit.

Important Filing Deadlines

The filing deadline for the 2016 Form 8949 aligns with the general tax return due date. For most taxpayers, this is April 15 of the following year. If you require additional time, you can file for an extension, but it is crucial to pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents for Form 8949

To accurately complete the 2016 Form 8949, you will need several documents, including:

- Brokerage statements detailing your transactions.

- Form 1099-B, if applicable, which reports proceeds from broker transactions.

- Records of any adjustments to your gains or losses, such as commissions or fees paid.

Legal Use of Form 8949

The 2016 Form 8949 is legally required for reporting capital gains and losses to the IRS. Failing to file this form when required can result in penalties, including fines and interest on unpaid taxes. It is vital to ensure that all information reported is accurate and complete to comply with federal tax laws.

Quick guide on how to complete f8949 example form 8949 department of the treasury

Easily Create F8949 example Form 8949 Department Of The Treasury on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage F8949 example Form 8949 Department Of The Treasury on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign F8949 example Form 8949 Department Of The Treasury Effortlessly

- Find F8949 example Form 8949 Department Of The Treasury and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select relevant sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign F8949 example Form 8949 Department Of The Treasury and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8949 example form 8949 department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the f8949 example form 8949 department of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 form 8949 and why is it important?

The 2016 form 8949 is used to report capital gains and losses from sales and exchanges of capital assets. It is crucial for accurately filing your taxes to ensure compliance with IRS regulations and to correctly calculate your tax liability. Failing to report these transactions can lead to penalties and delayed refunds.

-

How can airSlate SignNow help with the 2016 form 8949?

airSlate SignNow simplifies the process of signing and sending the 2016 form 8949 electronically. With an easy-to-use, cost-effective solution, you can ensure that your tax documents are securely signed and delivered on time, reducing the hassle associated with traditional paper methods.

-

What features does airSlate SignNow offer for handling tax forms like the 2016 form 8949?

airSlate SignNow includes features like document templates, customizable workflows, and secure e-signature capabilities that streamline the completion and submission of the 2016 form 8949. These features save time and enhance accuracy, making tax season less stressful for users.

-

Is airSlate SignNow cost-effective for individuals managing the 2016 form 8949?

Yes, airSlate SignNow offers competitive pricing plans that cater to both individuals and businesses, making it affordable for managing the 2016 form 8949. The investment provides value through its efficiency and ease of use, ultimately saving users both time and money.

-

Can I integrate airSlate SignNow with other software for the 2016 form 8949?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, ensuring that the 2016 form 8949 can be easily managed alongside your other financial documents. This integration streamlines your workflow and reduces the chances of errors when preparing your taxes.

-

What are the benefits of using e-signatures for the 2016 form 8949?

Using e-signatures for the 2016 form 8949 offers numerous benefits, including enhanced security, convenience, and speed. With airSlate SignNow, you can sign your forms from anywhere, at any time, while ensuring that the documents are legally binding and secure.

-

How does airSlate SignNow ensure the security of my 2016 form 8949?

airSlate SignNow prioritizes security by utilizing encryption technologies and secure cloud storage for all documents, including the 2016 form 8949. This means that your sensitive information is protected at all times, giving you peace of mind while completing your tax filings.

Get more for F8949 example Form 8949 Department Of The Treasury

- Md seller form

- Maryland notice default 497310095 form

- Final notice of default for past due payments in connection with contract for deed maryland form

- Md assignment form

- Notice of assignment of contract for deed maryland form

- Md contract form

- Buyers home inspection checklist maryland form

- Sellers information for appraiser provided to buyer maryland

Find out other F8949 example Form 8949 Department Of The Treasury

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT