8949 Form 2012

What is the 8949 Form

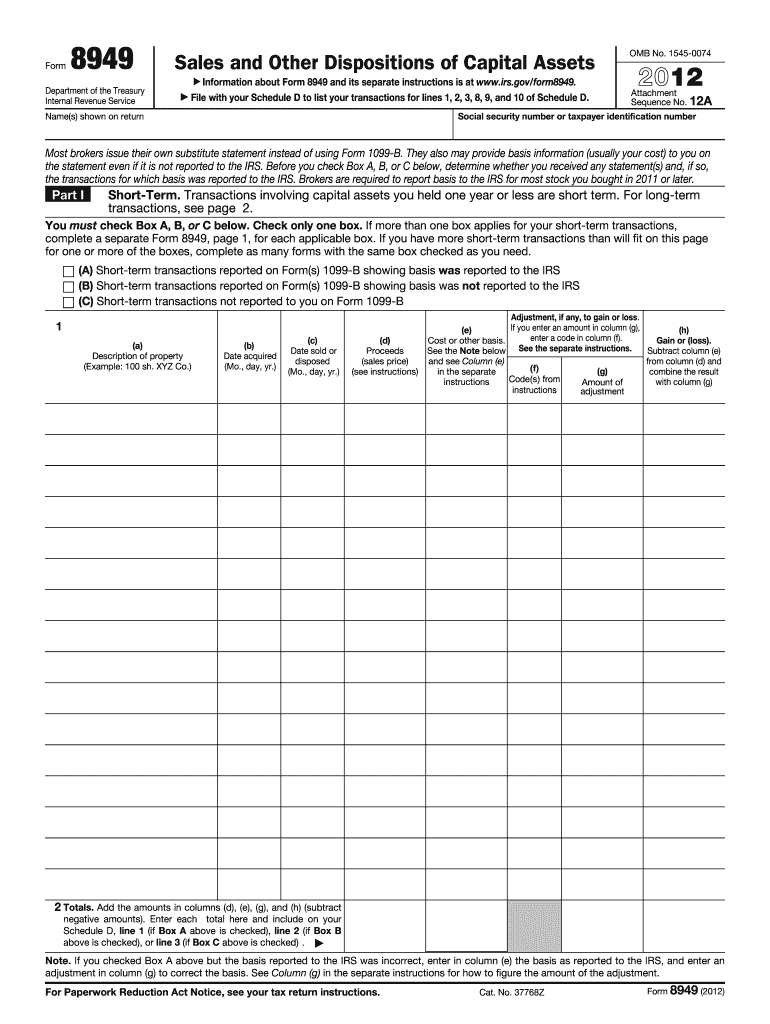

The 8949 Form is a tax document used in the United States to report capital gains and losses from the sale of assets. This form is essential for individuals and businesses that have sold stocks, bonds, or other investment properties during the tax year. By accurately completing the 8949 Form, taxpayers can calculate their overall gain or loss, which is then transferred to the Schedule D of their tax return. Understanding the purpose of this form is crucial for compliance with IRS regulations and for ensuring that taxpayers pay the correct amount of tax on their investment income.

How to use the 8949 Form

Using the 8949 Form involves several steps to ensure accurate reporting of capital gains and losses. First, gather all relevant information regarding your asset transactions, including purchase and sale dates, amounts, and any adjustments. Next, categorize your transactions into short-term and long-term based on the holding period. Short-term transactions are those held for one year or less, while long-term transactions are held for more than one year. After categorization, complete the form by entering the details of each transaction in the appropriate sections. Finally, ensure that the totals from the 8949 Form are correctly reflected on your Schedule D when filing your tax return.

Steps to complete the 8949 Form

Completing the 8949 Form requires careful attention to detail. Follow these steps:

- Gather transaction records, including purchase and sale information.

- Determine whether each transaction is short-term or long-term.

- Fill out the form by entering the details for each transaction, including asset description, date acquired, date sold, proceeds, cost basis, and adjustments if applicable.

- Calculate the total gain or loss for each category and enter these totals at the bottom of the form.

- Transfer the totals to Schedule D of your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the 8949 Form, which are essential for compliance. Taxpayers must ensure that they accurately report all transactions and adhere to the rules regarding short-term and long-term gains. The IRS also requires that taxpayers maintain adequate records to support the information reported on the form. This includes documentation such as brokerage statements and receipts. Familiarizing yourself with these guidelines will help prevent errors and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the 8949 Form align with the general tax return deadlines in the United States. Typically, individual taxpayers must submit their tax returns, including the 8949 Form, by April fifteenth of each year. If April fifteenth falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates is vital for timely compliance.

Digital vs. Paper Version

The 8949 Form can be completed and submitted in both digital and paper formats. The digital version allows for easier calculations and can be submitted electronically, which may expedite processing times. Many tax software programs support the 8949 Form, making it convenient for users to file their taxes online. Conversely, the paper version requires manual completion and mailing to the IRS. Taxpayers should choose the method that best suits their needs, considering factors such as convenience, accuracy, and personal preference.

Quick guide on how to complete 2012 8949 form

Finalize 8949 Form with ease on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly option to conventional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without any holdups. Manage 8949 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 8949 Form effortlessly

- Find 8949 Form and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign 8949 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 8949 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 8949 form

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 8949 Form and why is it important?

The 8949 Form is a tax form used by individuals to report capital gains and losses from the sale of securities or property. It's important because accurately filing this form helps you comply with IRS regulations and calculate your net capital gain or loss for tax purposes.

-

How can airSlate SignNow assist with the 8949 Form?

airSlate SignNow simplifies the process of completing the 8949 Form by allowing you to electronically sign documents, ensuring a quick and efficient submission. With its user-friendly interface, you can create, edit, and manage your forms with ease.

-

Are there any costs associated with using airSlate SignNow for the 8949 Form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available that provide additional features for managing documents, including the 8949 Form. Pricing varies based on the level of functionality and number of users, making it a cost-effective choice for businesses.

-

Is it safe to use airSlate SignNow for signing the 8949 Form?

Absolutely! airSlate SignNow prioritizes security by utilizing encryption and complies with industry standards to safeguard your sensitive information. You can trust that your signed 8949 Form and other documents are secure when using our platform.

-

Can I integrate airSlate SignNow with other applications to manage my 8949 Form?

Yes, airSlate SignNow seamlessly integrates with various applications and tools such as Google Drive, Dropbox, and others. This means you can easily manage your 8949 Form alongside your existing workflows, enhancing productivity and efficiency.

-

What features does airSlate SignNow offer for the 8949 Form?

airSlate SignNow provides features like document templates, real-time collaboration, and automated workflows that enhance the management of the 8949 Form. These tools streamline the preparation process and allow multiple users to collaborate efficiently.

-

Can I track the status of my 8949 Form submission with airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your 8949 Form submissions. The platform offers real-time notifications and tracking features, so you always know where your document stands in the signing process.

Get more for 8949 Form

Find out other 8949 Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free