Irs Form 8949 2013

What is the IRS Form 8949

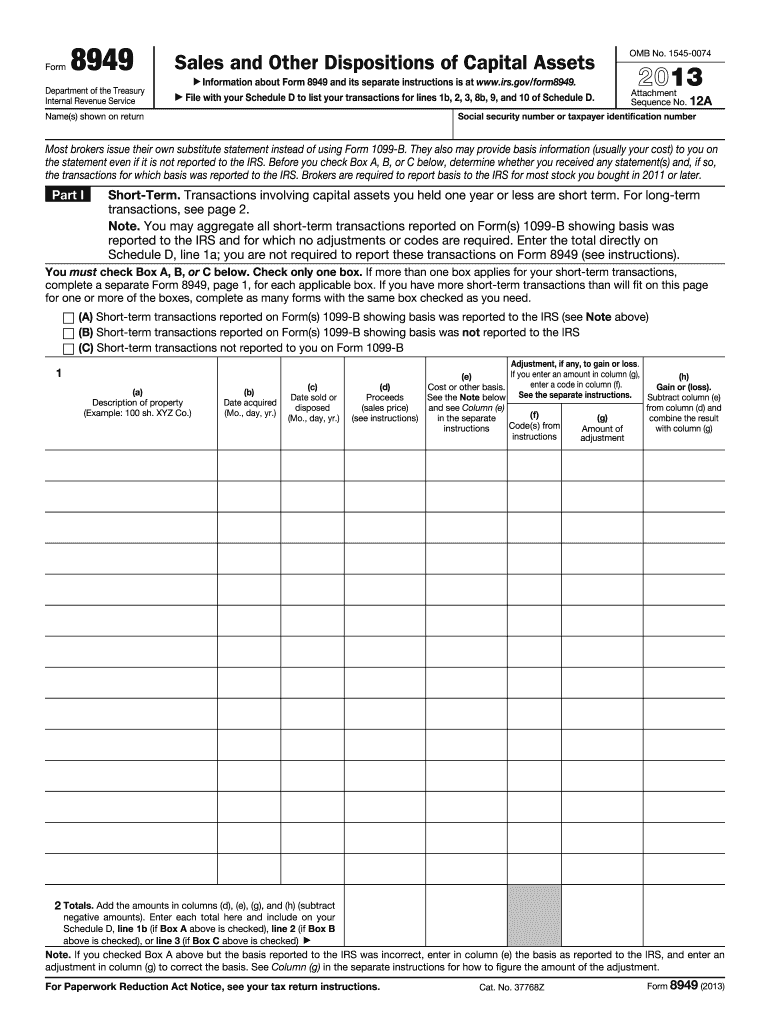

The IRS Form 8949 is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the amount of tax owed on these transactions. It allows taxpayers to detail each sale or exchange of capital assets, including stocks, bonds, and real estate. The information reported on Form 8949 is then summarized on Schedule D of the individual income tax return.

How to use the IRS Form 8949

To use the IRS Form 8949, taxpayers must first gather all relevant information regarding the capital assets sold during the tax year. This includes the date of acquisition, date of sale, proceeds from the sale, cost basis, and any adjustments to gain or loss. Each transaction must be listed separately on the form. After completing Form 8949, the totals are transferred to Schedule D, which summarizes capital gains and losses for the tax return.

Steps to complete the IRS Form 8949

Completing the IRS Form 8949 involves several key steps:

- Gather Information: Collect details about each asset sold, including dates, proceeds, and cost basis.

- Choose the Correct Box: Determine whether the transactions are short-term or long-term and select the appropriate section on the form.

- List Transactions: Enter each transaction in the designated sections, ensuring accuracy in all figures.

- Calculate Totals: Sum the total gains and losses for both short-term and long-term transactions.

- Transfer Totals: Move the totals to Schedule D to complete the tax filing process.

Key elements of the IRS Form 8949

The IRS Form 8949 contains several key elements that taxpayers must understand:

- Transaction Date: The date the asset was acquired and sold.

- Proceeds: The amount received from the sale of the asset.

- Cost Basis: The original value of the asset, including purchase price and any additional costs.

- Adjustments: Any necessary adjustments to gain or loss, such as commissions or fees.

- Gain or Loss: The difference between proceeds and cost basis, indicating whether the transaction resulted in a profit or a loss.

Legal use of the IRS Form 8949

The IRS Form 8949 is legally recognized for reporting capital gains and losses to the Internal Revenue Service. It must be completed accurately to ensure compliance with tax laws. Failing to report transactions correctly can result in penalties or audits. Using a reliable electronic signature solution can help ensure that the form is completed and submitted securely, maintaining compliance with regulations such as the ESIGN Act.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines related to the IRS Form 8949. The form is typically due on April fifteenth of each year, coinciding with the federal income tax return deadline. If taxpayers file for an extension, they may have until October fifteenth to submit their forms. It is crucial to keep track of these dates to avoid late filing penalties.

Quick guide on how to complete 2013 irs form 8949

Complete Irs Form 8949 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly and seamlessly. Manage Irs Form 8949 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Irs Form 8949 with ease

- Locate Irs Form 8949 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 8949 while ensuring excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form 8949

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form 8949

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS Form 8949 and why do I need it?

IRS Form 8949 is used to report sales and exchanges of capital assets, such as stocks and bonds, to the IRS. It is crucial for accurately calculating capital gains and losses, ensuring compliance with tax regulations. Utilizing airSlate SignNow can streamline the process of electronically signing and submitting your IRS Form 8949.

-

How can airSlate SignNow help me with IRS Form 8949?

airSlate SignNow simplifies the process of completing and signing IRS Form 8949 by providing an intuitive platform for electronic signatures. You can easily upload your form, add necessary signatures, and send it securely, saving you time and reducing paperwork. This ensures that your IRS Form 8949 is processed smoothly and efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8949?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. By adopting our solution for signing IRS Form 8949, you can access features such as unlimited document signing and advanced security at a competitive price. We encourage prospective users to review the pricing options to find the best fit for their requirements.

-

Can I integrate airSlate SignNow with other applications for IRS Form 8949?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and tax software, allowing for a streamlined workflow when handling IRS Form 8949. This integration facilitates easy access to your documents and enhances collaboration, making the signing process more efficient.

-

What features does airSlate SignNow offer for managing IRS Form 8949?

airSlate SignNow provides several features to help you manage IRS Form 8949 effectively. These include customizable templates, document tracking, and secure cloud storage for easy retrieval. Additionally, our platform supports bulk sending, which is ideal for businesses needing to manage multiple forms simultaneously.

-

Is airSlate SignNow secure for signing IRS Form 8949?

Yes, airSlate SignNow prioritizes the security of your documents, including IRS Form 8949. We implement advanced encryption protocols and compliance with industry standards to ensure that your information is safe and protected. You can confidently sign and manage your forms knowing they are secure.

-

How does eSigning IRS Form 8949 with airSlate SignNow work?

eSigning IRS Form 8949 with airSlate SignNow is a simple process. After uploading your form, you can designate signers, add signature fields, and send the document for signing. Once completed, the signed IRS Form 8949 is automatically stored in your account, ready for submission.

Get more for Irs Form 8949

- Publication 1179 rev 06 2015 general rules and specifications for substitute forms 1096 1098 1099 5498 and certain other

- 2007 form 1120s k1

- Social security benefits worksheet fillable 2005 form

- 2005 w 3 form

- Irs form 911 fillable 2011

- 2011 form household

- Taxable income before adjustments and special deductions form

- 2011 8453 form

Find out other Irs Form 8949

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now