Form 8949 Sales and Other Dispositions of Capital Assets 2011

What is the Form 8949 Sales And Other Dispositions Of Capital Assets

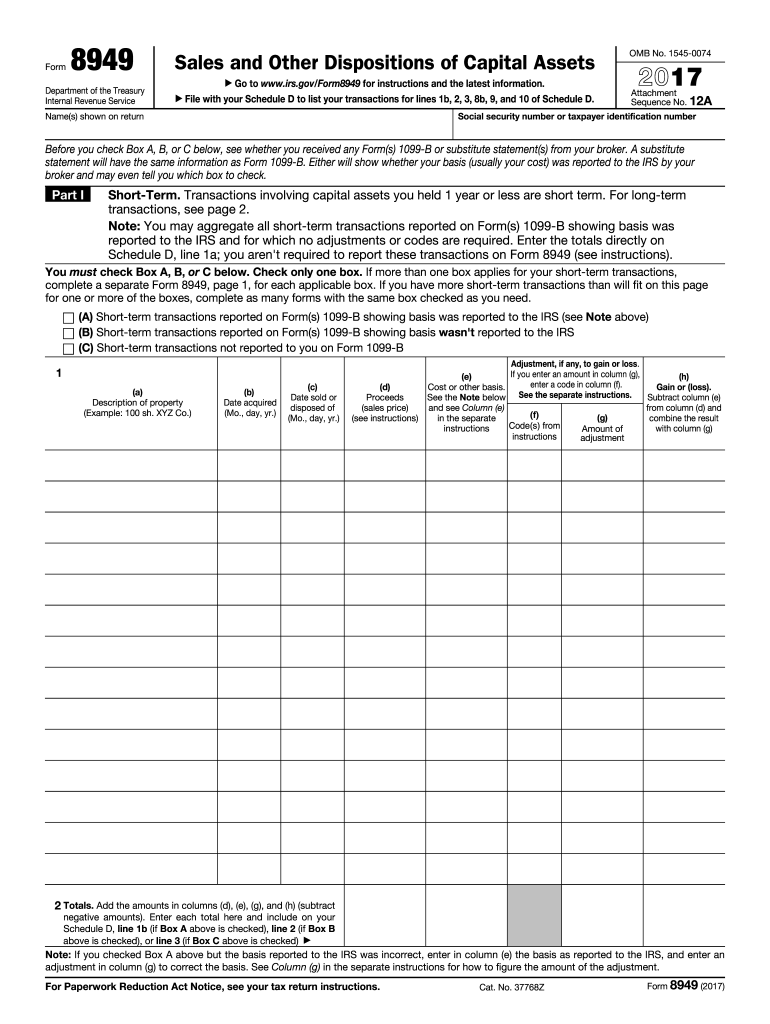

The Form 8949, titled Sales and Other Dispositions of Capital Assets, is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of capital assets. This form is essential for accurately calculating taxable income and ensuring compliance with IRS regulations. It is typically used alongside Schedule D, which summarizes the total capital gains and losses reported on Form 8949. By detailing each transaction involving capital assets, taxpayers can provide the IRS with a comprehensive view of their financial activities related to investments and property sales.

Steps to complete the Form 8949 Sales And Other Dispositions Of Capital Assets

Completing the Form 8949 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your capital asset transactions, including purchase and sale records. Next, categorize each transaction as either short-term or long-term based on the holding period of the asset. For each transaction, enter the details in the appropriate section of the form, including the asset description, date acquired, date sold, proceeds, cost or other basis, and adjustments, if any. Finally, calculate the gain or loss for each transaction and transfer the totals to Schedule D for further reporting.

Legal use of the Form 8949 Sales And Other Dispositions Of Capital Assets

The Form 8949 serves a legal purpose in the context of U.S. tax law. It must be filed by taxpayers who have sold or exchanged capital assets during the tax year. Accurate completion of this form is crucial, as it helps determine the correct amount of tax owed or refund due. Failure to report capital gains or losses can lead to penalties or audits by the IRS. The form must be kept on file for a certain period, as it may be required for future reference or in case of an audit.

Filing Deadlines / Important Dates

Timely filing of the Form 8949 is critical to avoid penalties and interest. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individuals. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of extensions that may apply, allowing additional time to file. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

The Form 8949 can be submitted through various methods, providing flexibility for taxpayers. It can be filed electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, taxpayers may choose to print the completed form and mail it to the IRS. In-person submission is generally not an option for individuals, as the IRS does not accept walk-in filings for tax forms. It is essential to ensure that the chosen submission method aligns with IRS guidelines to avoid processing delays.

Examples of using the Form 8949 Sales And Other Dispositions Of Capital Assets

Examples of transactions reported on the Form 8949 include the sale of stocks, bonds, real estate, and other capital assets. For instance, if an individual sells shares of a corporation at a profit, they would report the sale on this form, detailing the purchase price, sale price, and any associated costs. Similarly, if a property is sold for less than its purchase price, the loss would also be recorded. These examples illustrate the form's role in capturing the financial outcomes of various investment activities, which are crucial for accurate tax reporting.

Quick guide on how to complete 2017 form 8949 sales and other dispositions of capital assets

Complete Form 8949 Sales And Other Dispositions Of Capital Assets effortlessly on any device

Digital document management has become widely adopted by corporations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Form 8949 Sales And Other Dispositions Of Capital Assets on any platform using airSlate SignNow’s apps for Android or iOS and simplify any document-related operation today.

The easiest way to edit and eSign Form 8949 Sales And Other Dispositions Of Capital Assets seamlessly

- Locate Form 8949 Sales And Other Dispositions Of Capital Assets and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then press the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8949 Sales And Other Dispositions Of Capital Assets and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 8949 sales and other dispositions of capital assets

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 8949 sales and other dispositions of capital assets

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 8949 Sales And Other Dispositions Of Capital Assets?

Form 8949 Sales And Other Dispositions Of Capital Assets is a tax form used by individuals to report sales and exchanges of capital assets. It helps taxpayers accurately report their capital gains and losses to the IRS. Completing this form correctly is crucial for ensuring compliance and determining the right tax obligations.

-

How does airSlate SignNow support the completion of Form 8949 Sales And Other Dispositions Of Capital Assets?

airSlate SignNow offers templates and electronic signature capabilities that simplify the process of filling out Form 8949 Sales And Other Dispositions Of Capital Assets. Users can easily create, share, and eSign their documents, ensuring that all necessary information is accurately captured and securely transmitted. This streamlines the process of tax reporting and enhances document management.

-

What pricing options are available for using airSlate SignNow for Form 8949?

airSlate SignNow provides various pricing plans tailored to meet the needs of businesses handling Form 8949 Sales And Other Dispositions Of Capital Assets. Whether you're a small business or a large enterprise, you can find a plan that aligns with your volume of document management. Each plan offers essential features, ensuring cost-effectiveness and value.

-

Can I integrate airSlate SignNow with other software for managing Form 8949?

Yes, airSlate SignNow offers integration capabilities with various software platforms, including accounting and tax preparation tools, to facilitate the management of Form 8949 Sales And Other Dispositions Of Capital Assets. These integrations enhance workflow efficiency by allowing data to flow seamlessly between platforms, reducing the risk of errors when preparing tax documents.

-

What are the benefits of using airSlate SignNow for Form 8949?

Using airSlate SignNow for Form 8949 Sales And Other Dispositions Of Capital Assets signNowly simplifies the documentation process. The platform's intuitive interface and advanced features, such as automatic notifications and secure storage, help ensure accuracy and compliance, ultimately saving you time and reducing stress during tax season.

-

Is airSlate SignNow secure for handling sensitive documents like Form 8949?

Absolutely. airSlate SignNow employs industry-leading security measures to protect sensitive documents, including Form 8949 Sales And Other Dispositions Of Capital Assets. With features like encryption, secure access controls, and compliance with data protection regulations, users can trust that their tax information is handled safely and securely.

-

How easy is it to create Form 8949 using airSlate SignNow?

Creating Form 8949 Sales And Other Dispositions Of Capital Assets using airSlate SignNow is straightforward thanks to its user-friendly templates. Users can quickly fill in their details, make necessary edits, and send the document for eSignature all within a few clicks, making tax reporting a hassle-free experience.

Get more for Form 8949 Sales And Other Dispositions Of Capital Assets

- Application for a license to operate a child care facility form

- Permit corrections form

- To download the athletic forms school district of osceola county

- Initiallangclass 101314doc form

- Mergedfile birthday form

- Palm beach school district badge renewal form

- District school board of pasco county mis form 162 new

- Frs form

Find out other Form 8949 Sales And Other Dispositions Of Capital Assets

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast