Form 8949 Sales and Other Dispositions of Capital Assets 2020

What is the Form 8949 Sales And Other Dispositions Of Capital Assets

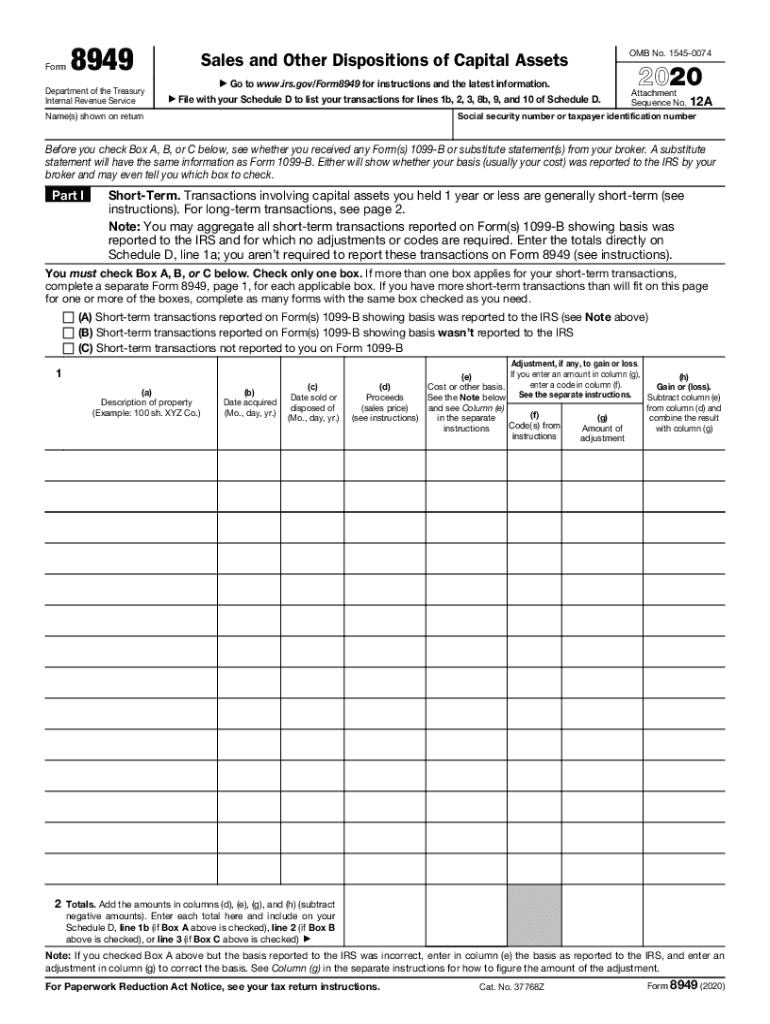

The IRS Form 8949 is used to report sales and other dispositions of capital assets. This form is essential for taxpayers who need to report capital gains and losses from the sale of stocks, bonds, real estate, and other assets. It helps the IRS track the taxpayer's capital transactions and ensures that the correct amount of tax is calculated on these transactions. The form requires detailed information about each transaction, including dates of acquisition and sale, proceeds, cost basis, and any adjustments to gain or loss.

How to use the Form 8949 Sales And Other Dispositions Of Capital Assets

To use the Form 8949, start by gathering all necessary information about your capital transactions. Each transaction should be listed separately on the form, detailing the asset sold, the sale date, the purchase date, the sale proceeds, and the cost basis. It's important to categorize each transaction as either short-term or long-term, as this affects the tax rate applied to any gains. After completing the form, the totals should be transferred to Schedule D of your tax return, which summarizes your overall capital gains and losses.

Steps to complete the Form 8949 Sales And Other Dispositions Of Capital Assets

Completing the Form 8949 involves several steps:

- Gather all records of capital asset transactions for the tax year.

- Determine whether each transaction is short-term (held for one year or less) or long-term (held for more than one year).

- Fill in the required details for each transaction, including the description of the asset, dates of acquisition and sale, proceeds, and cost basis.

- Calculate any adjustments to gain or loss, if applicable.

- Transfer the totals from Form 8949 to Schedule D of your tax return.

IRS Guidelines

The IRS provides specific guidelines for filling out Form 8949. Taxpayers must ensure that all transactions are reported accurately and that the form is completed in accordance with IRS instructions. This includes using the correct format for reporting dates and amounts, as well as adhering to the categorization of transactions. The IRS may require supporting documentation for certain transactions, so it is advisable to keep thorough records.

Filing Deadlines / Important Dates

For the tax year 2020, the deadline for filing Form 8949 is the same as the deadline for your tax return, which is typically April 15 of the following year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to stay informed about any changes to deadlines that may occur due to special circumstances, such as natural disasters or legislative changes.

Penalties for Non-Compliance

Failing to file Form 8949 when required can lead to significant penalties. The IRS may impose fines for late filing, and taxpayers may also face interest on any unpaid taxes. Additionally, inaccuracies on the form can trigger an audit or further scrutiny from the IRS, leading to additional penalties. It is crucial for taxpayers to ensure that their Form 8949 is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete 2020 form 8949 sales and other dispositions of capital assets

Complete Form 8949 Sales And Other Dispositions Of Capital Assets effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without hindrances. Manage Form 8949 Sales And Other Dispositions Of Capital Assets on any platform using airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to change and eSign Form 8949 Sales And Other Dispositions Of Capital Assets without difficulty

- Obtain Form 8949 Sales And Other Dispositions Of Capital Assets and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or errors that require reprinting new copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your choice. Modify and eSign Form 8949 Sales And Other Dispositions Of Capital Assets and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8949 sales and other dispositions of capital assets

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8949 sales and other dispositions of capital assets

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the tax form 8949 for 2020 used for?

The tax form 8949 for 2020 is used to report sales and other dispositions of capital assets. It allows taxpayers to list their capital gains and losses, which are then transferred to Schedule D of your tax return. Understanding how to use this form correctly is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow help with filling out tax form 8949 for 2020?

AirSlate SignNow streamlines the process of filling out tax form 8949 for 2020 by providing templates and an easy-to-use interface. Users can electronically sign documents, ensuring all necessary signatures are collected efficiently. The platform simplifies document management, making it easier to handle tax documents securely and comply with IRS requirements.

-

What pricing plans does airSlate SignNow offer for its services related to tax form 8949 for 2020?

AirSlate SignNow offers several pricing plans that cater to different business needs, making it cost-effective for users preparing the tax form 8949 for 2020. Each plan includes features such as unlimited document signing and customizable templates. You can choose a plan that best fits your usage and budget.

-

Are there any collaboration features available for working on tax form 8949 for 2020?

Yes, airSlate SignNow includes collaboration features that are ideal for teams working on tax form 8949 for 2020. Users can share documents, leave comments, and track the signing status in real-time. This facilitates a smoother workflow, especially when multiple stakeholders are involved in the tax preparation process.

-

Can I integrate airSlate SignNow with other software for tax form 8949 for 2020?

AirSlate SignNow integrates seamlessly with various software solutions, helping users manage the tax form 8949 for 2020 alongside their existing tools. Whether you’re using CRM systems or accounting software, the integration enhances productivity and ensures that all your tax documents are in one place. This flexibility saves time and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for preparing the tax form 8949 for 2020?

Using airSlate SignNow for preparing the tax form 8949 for 2020 provides numerous benefits, including efficiency, security, and ease-of-use. The platform allows for quick document signing and secure cloud storage, reducing the hassle of paper processes. Additionally, its intuitive interface makes it accessible for users of all skill levels.

-

Is there customer support available for issues related to tax form 8949 for 2020?

Yes, airSlate SignNow offers dedicated customer support to assist users with any issues related to the tax form 8949 for 2020. Whether you need help with signing documents or specific questions about the form, the support team is ready to provide assistance. Their goal is to ensure your experience is smooth and effective.

Get more for Form 8949 Sales And Other Dispositions Of Capital Assets

- Form four certificate download

- Tesco clubcard application form

- Notice of intent to claim fillable form

- Texas childrens medical records request form

- Student time sheet form

- Exhibit list la court form

- Debtor questionnaire nancy j whaley standing chapter 13 trustee form

- Fragebogen zur sozialversicherung dieser fragebogen wird in der hochschulbez gestelle f r die korrekte bearbeitung ihrer bez ge form

Find out other Form 8949 Sales And Other Dispositions Of Capital Assets

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors