Income Tax Hw Need to Complete Form 8949 and 2024-2026

Understanding IRS Form 8949

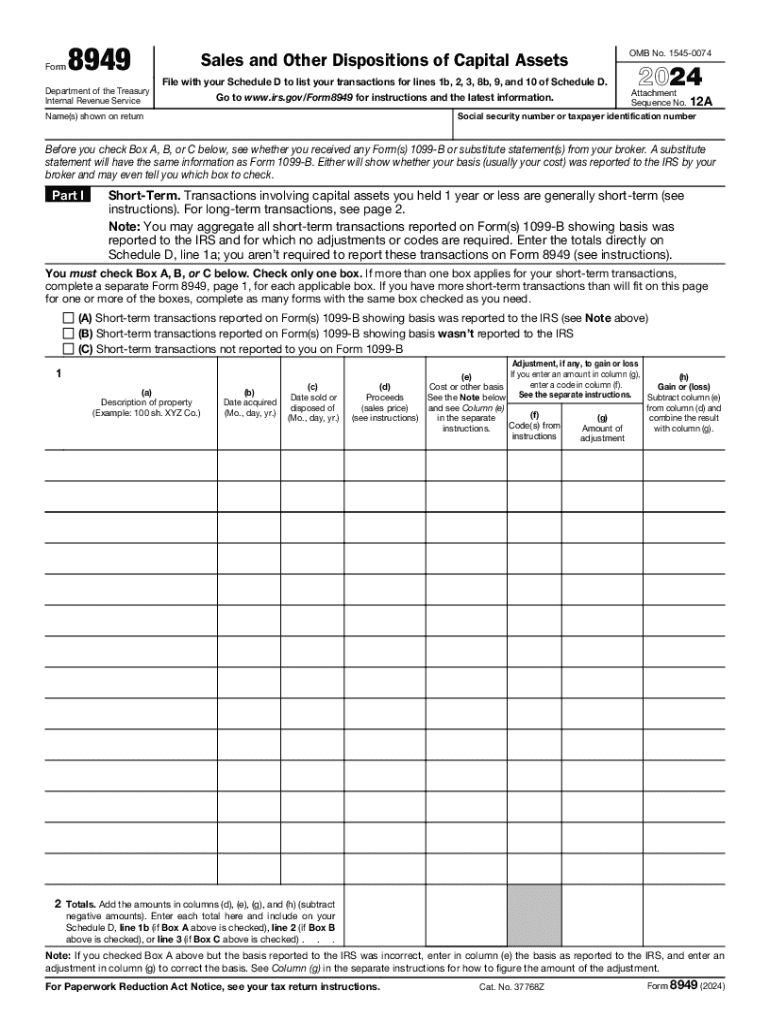

IRS Form 8949 is used to report capital gains and losses from the sale of assets, including stocks, bonds, and real estate. Taxpayers must complete this form to provide the IRS with detailed information about their transactions. The form helps ensure accurate reporting of gains and losses, which is essential for calculating the correct tax liability. Each transaction must be listed individually, detailing the date acquired, date sold, proceeds, cost basis, and any adjustments to gain or loss.

Steps to Complete IRS Form 8949

Completing IRS Form 8949 involves several key steps:

- Gather Documentation: Collect records of all transactions, including purchase and sale dates, amounts, and any associated costs.

- Determine Transaction Type: Classify each transaction as either short-term or long-term based on the holding period.

- Fill Out the Form: Enter the required information for each transaction in the appropriate sections of the form.

- Calculate Totals: Sum the total gains and losses for both short-term and long-term transactions.

- Transfer Totals: Transfer the totals to Schedule D of your tax return, which summarizes your capital gains and losses.

Required Documents for IRS Form 8949

To accurately complete IRS Form 8949, taxpayers need several documents:

- Transaction Records: Statements from brokers or financial institutions detailing each transaction.

- Purchase Receipts: Documentation of the original purchase price of the assets sold.

- Sale Receipts: Evidence of the sale price, including any commissions or fees paid.

- Prior Year Forms: Any previous forms related to capital gains or losses that may affect current reporting.

IRS Guidelines for Form 8949

The IRS provides specific guidelines for completing Form 8949. Taxpayers must report each transaction accurately and ensure that the information matches the records provided by their brokers. The IRS requires that taxpayers use the correct codes to indicate the nature of adjustments to gains or losses. Familiarity with these guidelines is essential to avoid errors that could lead to penalties or audits.

Filing Deadlines for IRS Form 8949

IRS Form 8949 must be filed as part of your annual tax return. The typical deadline for individual taxpayers is April 15 of each year, although this may vary if the date falls on a weekend or holiday. It is important to stay informed about any changes to deadlines, especially in years when tax law changes may affect filing requirements.

Penalties for Non-Compliance with Form 8949

Failure to file IRS Form 8949 accurately or on time can result in penalties. The IRS may impose fines for incorrect reporting of capital gains and losses. Additionally, taxpayers may face interest charges on any unpaid taxes due to errors or omissions. Understanding these potential penalties emphasizes the importance of careful and accurate completion of the form.

Handy tips for filling out Income Tax Hw Need To Complete Form 8949 And online

Quick steps to complete and e-sign Income Tax Hw Need To Complete Form 8949 And online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to e-sign and share Income Tax Hw Need To Complete Form 8949 And for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct income tax hw need to complete form 8949 and

Create this form in 5 minutes!

How to create an eSignature for the income tax hw need to complete form 8949 and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8949 and why is it important?

IRS Form 8949 is used to report sales and other dispositions of capital assets. It is crucial for accurately reporting capital gains and losses on your tax return. Understanding how to fill out IRS Form 8949 can help you avoid penalties and ensure compliance with tax regulations.

-

How can airSlate SignNow help with IRS Form 8949?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending IRS Form 8949. With our solution, you can streamline the process of preparing and submitting this important tax document, ensuring that it is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8949?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage IRS Form 8949 and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS Form 8949?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easier to manage IRS Form 8949 and other important documents, enhancing your workflow and ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for IRS Form 8949?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage IRS Form 8949 alongside your existing tools. This integration capability enhances productivity and ensures that your document management process is efficient.

-

How secure is airSlate SignNow when handling IRS Form 8949?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including IRS Form 8949. You can trust that your sensitive information is safe and secure while using our platform.

-

What are the benefits of using airSlate SignNow for IRS Form 8949?

Using airSlate SignNow for IRS Form 8949 offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. Our platform simplifies the eSigning process, making it easier for you to complete and submit your tax documents on time.

Get more for Income Tax Hw Need To Complete Form 8949 And

Find out other Income Tax Hw Need To Complete Form 8949 And

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe