Get the About Form 8949Internal Revenue Service IRS Gov 2021

Understanding IRS Form 8949

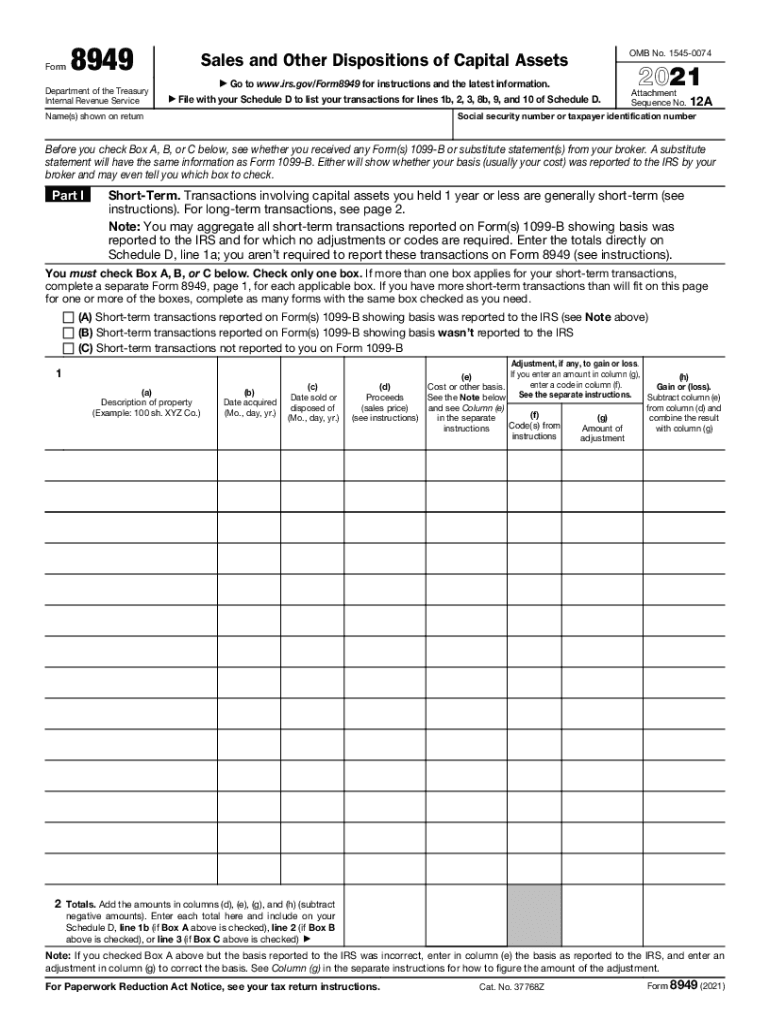

IRS Form 8949 is a tax form used by individuals and businesses to report capital gains and losses from the sale of assets. This form is essential for taxpayers who have sold stocks, bonds, or other investments during the tax year. It helps the Internal Revenue Service (IRS) track the financial transactions of taxpayers and ensures that they accurately report their income from these sales. The form requires detailed information about each transaction, including the date of acquisition, date of sale, proceeds, cost basis, and any adjustments to gain or loss.

Steps to Complete IRS Form 8949

Completing IRS Form 8949 involves several straightforward steps:

- Gather all relevant documentation for your transactions, including purchase and sale records.

- Determine the correct category for each transaction: short-term or long-term, based on the holding period.

- Fill in the details for each transaction, including dates, proceeds, cost basis, and adjustments.

- Calculate the total gain or loss for each category and transfer the totals to Schedule D of your tax return.

It is important to ensure that all information is accurate to avoid issues with the IRS.

Legal Use of IRS Form 8949

The legal use of IRS Form 8949 is critical for ensuring compliance with federal tax laws. This form must be filed accurately to reflect your capital gains and losses. Failure to report these transactions can lead to penalties, interest, and potential audits by the IRS. It is essential to keep records of all transactions and supporting documents for at least three years, as the IRS may request this information during an audit.

Filing Deadlines for IRS Form 8949

IRS Form 8949 must be filed along with your annual tax return. The deadline for filing your tax return is typically April 15 of each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. If you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods for IRS Form 8949

You can submit IRS Form 8949 through various methods:

- Online: Many tax software programs allow you to complete and file Form 8949 electronically.

- Mail: You can print the completed form and mail it to the appropriate IRS address based on your location.

- In-Person: Some taxpayers may choose to file in person at local IRS offices, although this method is less common.

Penalties for Non-Compliance with IRS Form 8949

Failing to file IRS Form 8949 or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late filing or failure to report income. Additionally, if discrepancies are found during an audit, taxpayers may be subject to further penalties, including interest on unpaid taxes. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete get the free about form 8949internal revenue service irsgov

Prepare Get The About Form 8949Internal Revenue Service IRS gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Get The About Form 8949Internal Revenue Service IRS gov on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Get The About Form 8949Internal Revenue Service IRS gov with ease

- Locate Get The About Form 8949Internal Revenue Service IRS gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Get The About Form 8949Internal Revenue Service IRS gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free about form 8949internal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the get the free about form 8949internal revenue service irsgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8949 and why is it important?

IRS Form 8949 is used to report sales and other dispositions of capital assets. It is important for individuals and businesses to accurately report their capital gains and losses to the IRS. By completing IRS Form 8949 correctly, taxpayers can ensure compliance and potentially reduce their tax liability.

-

How can airSlate SignNow help me with IRS Form 8949?

airSlate SignNow provides a seamless eSigning solution that allows you to prepare, sign, and send IRS Form 8949 electronically. This makes the process of filing your tax return more efficient and helps you avoid delays. Plus, you can easily track the status of your document submissions and ensure everything is in order.

-

What features does airSlate SignNow offer for IRS Form 8949?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and electronic signatures specifically designed for documents like IRS Form 8949. These features streamline the signing process and enhance document management. Our solution also ensures your documents are compliant with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8949?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those focused on eSigning IRS Form 8949. Plans are competitively priced and designed to provide cost-effective solutions for individuals and businesses. Sign up today to find the best plan for your IRS Form 8949 needs.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 8949?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage IRS Form 8949 directly from your preferred platform. This integration helps streamline the process of tracking sales and dispositions, and ensures your tax documents are always up to date.

-

How secure is the submission of IRS Form 8949 using airSlate SignNow?

Security is a top priority for airSlate SignNow. When submitting IRS Form 8949, your documents are encrypted with advanced security protocols. This ensures that sensitive financial information is protected throughout the entire signing and submission process.

-

Can multiple parties eSign IRS Form 8949 using airSlate SignNow?

Yes, multiple parties can eSign IRS Form 8949 using airSlate SignNow. Our platform supports collaborative signing, allowing all necessary stakeholders to sign the document efficiently and securely. This feature ensures that your IRS Form 8949 is completed quickly and with minimal hassle.

Get more for Get The About Form 8949Internal Revenue Service IRS gov

Find out other Get The About Form 8949Internal Revenue Service IRS gov

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document