Form 8949 2016

What is the Form 8949

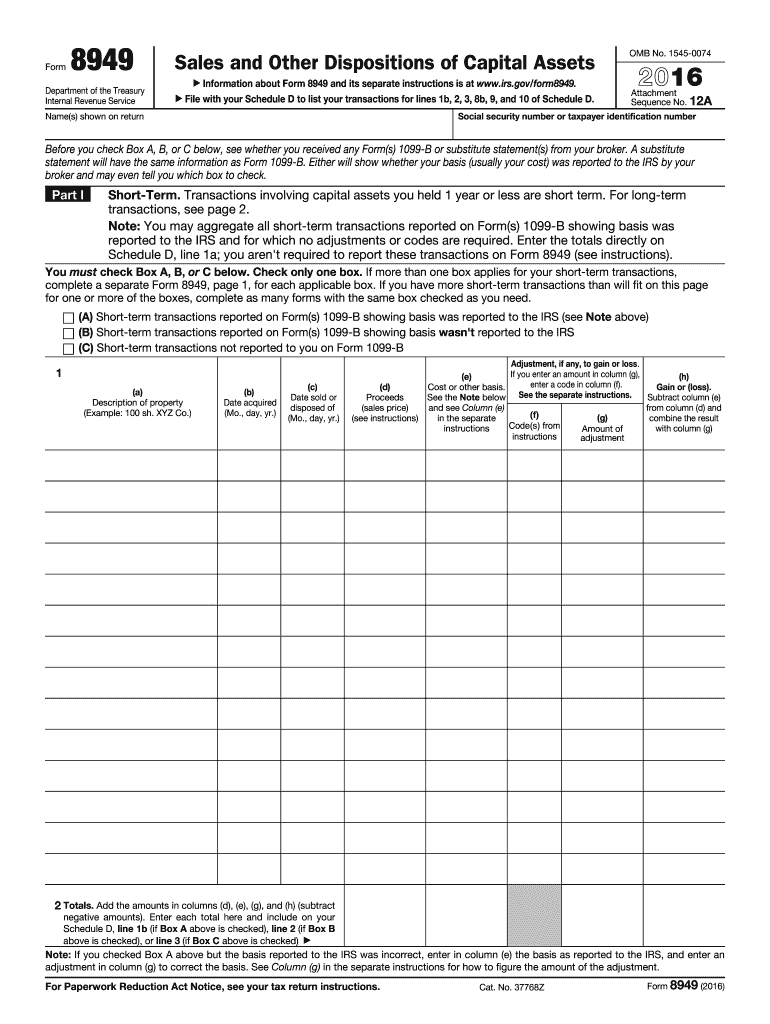

The Form 8949 is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the amount of taxable income derived from these transactions. It is typically used alongside Schedule D of the IRS Form 1040, which summarizes the total capital gains and losses. Understanding the purpose of Form 8949 is crucial for ensuring compliance with IRS regulations and for effective tax reporting.

How to use the Form 8949

Using the Form 8949 involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant information regarding their asset transactions, including purchase and sale dates, amounts, and any adjustments. The form is divided into two parts: Part I for short-term transactions and Part II for long-term transactions. Each transaction must be listed individually, detailing the asset description, date acquired, date sold, proceeds, cost or other basis, and any adjustments. After completing the form, the totals are transferred to Schedule D for final reporting.

Steps to complete the Form 8949

Completing the Form 8949 requires careful attention to detail. Follow these steps for accuracy:

- Gather all necessary documentation related to asset transactions.

- Determine whether each transaction is short-term or long-term.

- Fill out the form by listing each transaction, including the asset description, acquisition date, sale date, proceeds, and cost basis.

- Calculate any adjustments needed for each transaction.

- Sum the totals for both short-term and long-term transactions.

- Transfer the totals to Schedule D and ensure all forms are filed correctly.

Legal use of the Form 8949

The Form 8949 is legally recognized as a valid document for reporting capital gains and losses to the IRS. To ensure its legal standing, it is important to follow IRS guidelines meticulously. This includes providing accurate information and proper signatures where required. The form must be filed by the tax deadline to avoid penalties. Utilizing a reliable eSignature platform can enhance the legal validity of the form when submitting electronically.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8949. These guidelines outline the necessary information to include, the distinction between short-term and long-term transactions, and the importance of accurate reporting. Taxpayers should refer to the IRS instructions for Form 8949 to ensure compliance and to understand any recent changes or updates to the form. Adhering to these guidelines is essential for avoiding errors that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8949 align with the annual tax return deadlines in the United States. Typically, individual taxpayers must submit their forms by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about these dates to ensure timely submission and avoid any late fees or penalties associated with late filing.

Quick guide on how to complete 2016 form 8949

Effortlessly Manage Form 8949 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly option compared to conventional printed and signed papers, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any interruptions. Manage Form 8949 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

Effortlessly Modify and eSign Form 8949

- Find Form 8949 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize key sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to preserve your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Adjust and eSign Form 8949 and guarantee seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8949

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8949

How to make an eSignature for your 2016 Form 8949 online

How to make an eSignature for the 2016 Form 8949 in Chrome

How to make an eSignature for signing the 2016 Form 8949 in Gmail

How to make an eSignature for the 2016 Form 8949 right from your mobile device

How to create an electronic signature for the 2016 Form 8949 on iOS

How to create an eSignature for the 2016 Form 8949 on Android devices

People also ask

-

What is Form 8949 and how can airSlate SignNow help with it?

Form 8949 is a tax form used to report sales and exchanges of capital assets. With airSlate SignNow, you can easily prepare, sign, and send Form 8949 electronically, streamlining your tax filing process. Our platform ensures compliance and accuracy while saving you time.

-

Is airSlate SignNow suitable for filing Form 8949?

Yes, airSlate SignNow is ideal for filing Form 8949. Our user-friendly platform allows you to fill out and eSign the form digitally, making it easy to manage your capital gains and losses. Plus, you can store and share your forms securely.

-

What are the pricing options for using airSlate SignNow with Form 8949?

airSlate SignNow offers flexible pricing plans to suit your needs, whether you are an individual or a business. You can choose a monthly or annual subscription that provides access to all features necessary for managing Form 8949 effectively. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for Form 8949 management?

Absolutely! airSlate SignNow integrates with various software applications to streamline your workflow for Form 8949. Whether you use accounting software or document management systems, our integrations help you manage your tax documents more efficiently.

-

What features does airSlate SignNow offer for completing Form 8949?

airSlate SignNow offers features like customizable templates, real-time collaboration, and mobile access that make completing Form 8949 easier. You can also track document status and receive notifications for signatories, ensuring a smooth process.

-

How secure is my data when using airSlate SignNow for Form 8949?

Security is a top priority at airSlate SignNow. When you complete Form 8949, your data is protected with advanced encryption and compliance with industry standards. We ensure that your information remains confidential and secure throughout the signing process.

-

Can I access Form 8949 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to access and sign Form 8949 on the go. Our mobile app provides all the essential features you need to manage your documents anytime, anywhere.

Get more for Form 8949

Find out other Form 8949

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors