Form Schedule E 2017

What is the Form Schedule E

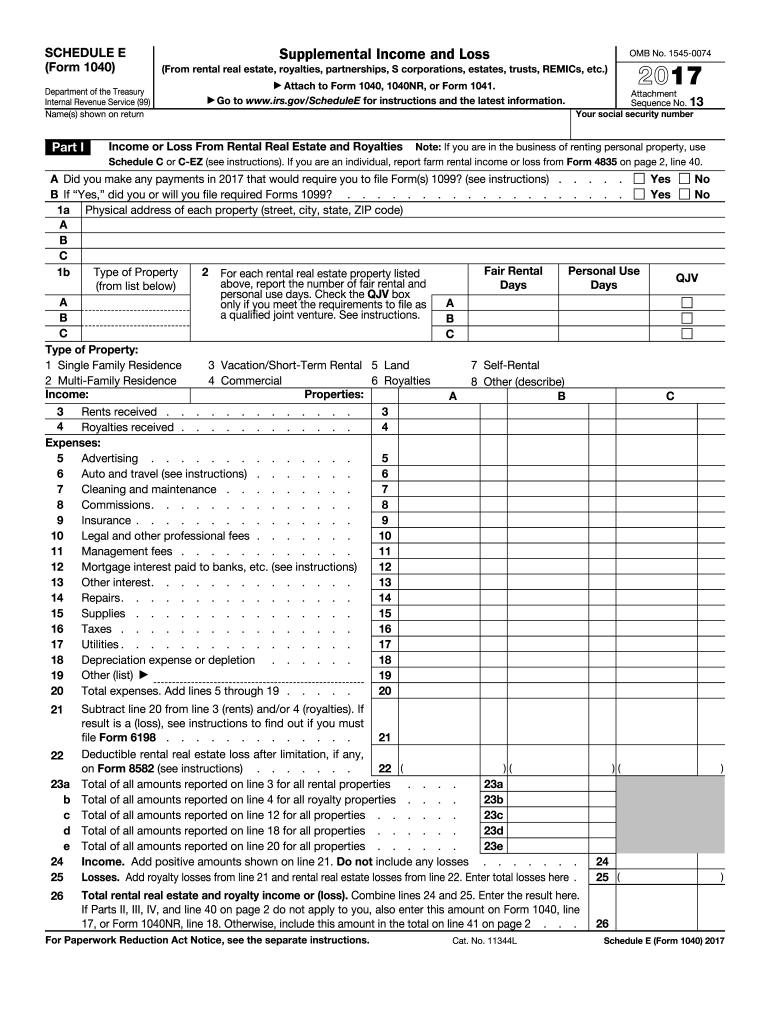

The Form Schedule E is a tax form used by individuals in the United States to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and other sources. It is part of the IRS Form 1040 series and is essential for taxpayers who earn income from these sources. The information provided on Schedule E helps determine the taxpayer's overall income and tax liability.

How to use the Form Schedule E

To use the Form Schedule E effectively, taxpayers must first gather all relevant financial information related to their rental properties or other income sources. This includes records of rental income, expenses, and any applicable deductions. Once this information is collected, it should be entered accurately into the form. Each section of Schedule E corresponds to different types of income or loss, so it is crucial to follow the instructions carefully to ensure correct reporting.

Steps to complete the Form Schedule E

Completing the Form Schedule E involves several key steps:

- Gather all necessary documents, such as rental agreements, expense receipts, and prior tax returns.

- Fill out the identification section, including your name and Social Security number.

- Report income from each rental property or source in the appropriate sections.

- List all deductible expenses related to your properties, such as repairs, maintenance, and property management fees.

- Calculate the total income or loss for each property and enter the amounts on the form.

- Transfer the final figures to your Form 1040 when filing your federal tax return.

Legal use of the Form Schedule E

The legal use of the Form Schedule E requires that taxpayers report their income and expenses accurately and honestly. Failing to do so can lead to penalties or audits by the IRS. It is important to keep thorough records and documentation to support the information reported on the form. Taxpayers should also ensure they are using the most current version of the form and following all IRS guidelines.

Filing Deadlines / Important Dates

The deadlines for filing the Form Schedule E align with the general tax filing deadlines in the United States. Typically, individual taxpayers must file their federal income tax returns, including Schedule E, by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any state-specific deadlines that may apply.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form Schedule E through various methods:

- Online: Many taxpayers choose to e-file their returns, which allows for faster processing and confirmation of receipt.

- Mail: The form can be printed and mailed to the appropriate IRS address. Ensure that the form is signed and dated.

- In-Person: Some taxpayers may opt to file their forms in person at local IRS offices, although this is less common.

Quick guide on how to complete form schedule e 2017

Discover the simplest approach to fill out and endorse your Form Schedule E

Are you still spending time creating your official documents on paper instead of online? airSlate SignNow presents an improved method to finalize and endorse your Form Schedule E and related forms for public services. Our intelligent electronic signature solution equips you with all the tools necessary to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities all readily accessible through a user-friendly interface.

Only a few steps are required to complete your Form Schedule E:

- Upload the editable template to the editor using the Get Form button.

- Check what information you need to enter in your Form Schedule E.

- Move through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to create a legally recognized electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Keep your completed Form Schedule E in the Documents folder within your profile, download it, or send it to your chosen cloud storage. Our solution also offers adaptable file sharing. There’s no requirement to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct form schedule e 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the IGNOU exam form DEC 2017 online?

First u deposit your respective subject assignments at your concerning study center in september and then u can fill up your exam form through official website of IGNOU for Dec17 .IGNOU - The People's University

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

When will we fill out the CAT 2017 exam form?

Hello,Highlights:Registration process for CAT 2017 has commenced from August 9, 2017.MBA aspirants looking forward to appearing for CAT 2017 can now register for the exam.Once the registration is successfully completed, candidates can fill the application form.The registration process for CAT 2017 has commenced from August 9, 2017. MBA aspirants looking forward to appearing for the Common Admission Test (CAT) 2017 will now be able to register for the exam and fill the application form.Registration can be done by filling the information asked in the registration form on the official CAT 2017 website. Once the CAT 2017 registration is successfully completed, candidates will be able to fill the application form for CAT 2017.Steps to Register for CAT 2017:You will be required to register for CAT 2017 online. Since registration is mandatory, you will not be able to proceed to the application form without registration.For registering online, enter your personal details including Name, Date of Birth (DOB), Mobile Number, Email Address and Country.Once you have registered successfully, you will receive a unique username and password on the registered mobile number and email address through SMS and email respectively.The username and password provided in the email/SMS will be your login credentials.Note: Make sure that the email id and mobile number that you have entered are valid as all further information will be communicated to you through the same.Steps to fill the Application Form of CAT 2017:1. Fields and Details: The application form of CAT 2017 will comprise the following five fields:Personal DetailsAcademicsWork ExperienceProgrammesPaymentYou will be required to fill in all the details asked in the fields mentioned above.2. Photograph and Signature: Apart from that, you will have to upload a recent passport size photograph and signature in either .jpg or .jpeg format. The dimensions must be as follows:For Photograph: 35mm x 45mmFor Signature: 80mm x 35mmThe size of the photograph, as well as the signature, must not exceed 80 KB.Also Read: MBA Programme in Insurance Introduced by Jamia Hamdard Launched; Admission through CAT & MAT Scores3. Documents: Candidates applying under reserved categories (NC-OBC/ SC/ ST/ PWD-DA) will also have to upload the attested documents (as mentioned by the organising authority).4. Colleges and Course: Before submitting the application form, candidates will also be required to select the IIMs and corresponding programmes that they wish to apply for. Location preference must also be entered for the personal assessment and interview rounds.5. Exam Centre: For selecting the city where the candidate wants to appear for CAT 2017, four cities must be entered in order of preference. Before submitting the application form, make sure that all the details entered as well as the preferences are in order.Note: Candidates will not have to apply for admission to the flagship programmes offered by the IIMs separately. For all other B-Schools that take admission on the basis of CAT scores, candidates will have to fill in separate application forms.Application/ Registration Fee of CAT 2017:Also Read: IIFT Postpones Exam to December 3; Check Important Dates HereCAT is one of the toughest and most sought after management entrance exams that opens the gates to the premier management institutes of the country including the prestigious IIMs. Securing a good percentile in CAT 2017 can get you several steps closer to securing a seat at the IIMs and other top b-schools for the session 2018-19.All The Best!!

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form schedule e 2017

How to create an electronic signature for the Form Schedule E 2017 online

How to create an eSignature for the Form Schedule E 2017 in Google Chrome

How to create an eSignature for signing the Form Schedule E 2017 in Gmail

How to create an electronic signature for the Form Schedule E 2017 straight from your smartphone

How to generate an eSignature for the Form Schedule E 2017 on iOS devices

How to create an electronic signature for the Form Schedule E 2017 on Android

People also ask

-

What is Form Schedule E and why do I need it?

Form Schedule E is a tax form used to report income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. Using airSlate SignNow, you can easily prepare, sign, and send Form Schedule E electronically, ensuring compliance and accuracy in your tax reporting.

-

How does airSlate SignNow help with completing Form Schedule E?

airSlate SignNow simplifies the process of completing Form Schedule E by providing customizable templates and an intuitive user interface. You can fill out the form, collect electronic signatures, and securely store your documents, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for Form Schedule E?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that allows you to efficiently manage Form Schedule E and other documents while enjoying features like unlimited eSigning and secure cloud storage.

-

Can I integrate airSlate SignNow with my accounting software for Form Schedule E?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to import data directly into Form Schedule E. This integration streamlines your workflow, making it easier to manage your tax documentation.

-

What features does airSlate SignNow offer for managing Form Schedule E?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning to enhance your experience with Form Schedule E. These tools help you reduce errors and save time during the tax preparation process.

-

Is it safe to use airSlate SignNow for sensitive documents like Form Schedule E?

Yes, airSlate SignNow prioritizes security, employing bank-grade encryption to protect your sensitive documents, including Form Schedule E. Your information is safe and secure throughout the eSigning process.

-

Can I access Form Schedule E on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage Form Schedule E from your smartphone or tablet. This flexibility ensures that you can handle your documents on the go without any hassle.

Get more for Form Schedule E

- Ssa 4608 form

- Objections and requisitions on title form

- Download the employment application marcus theatres form

- Ccgatacgcggtatcccagggctaattuaa form

- Tax utah gov forms current tc tc 40rpdf

- Monthly payment agreement template form

- Monthly payment installment payment agreement template form

- Musicians contract template form

Find out other Form Schedule E

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later