Schedule E Form 2016

What is the Schedule E Form

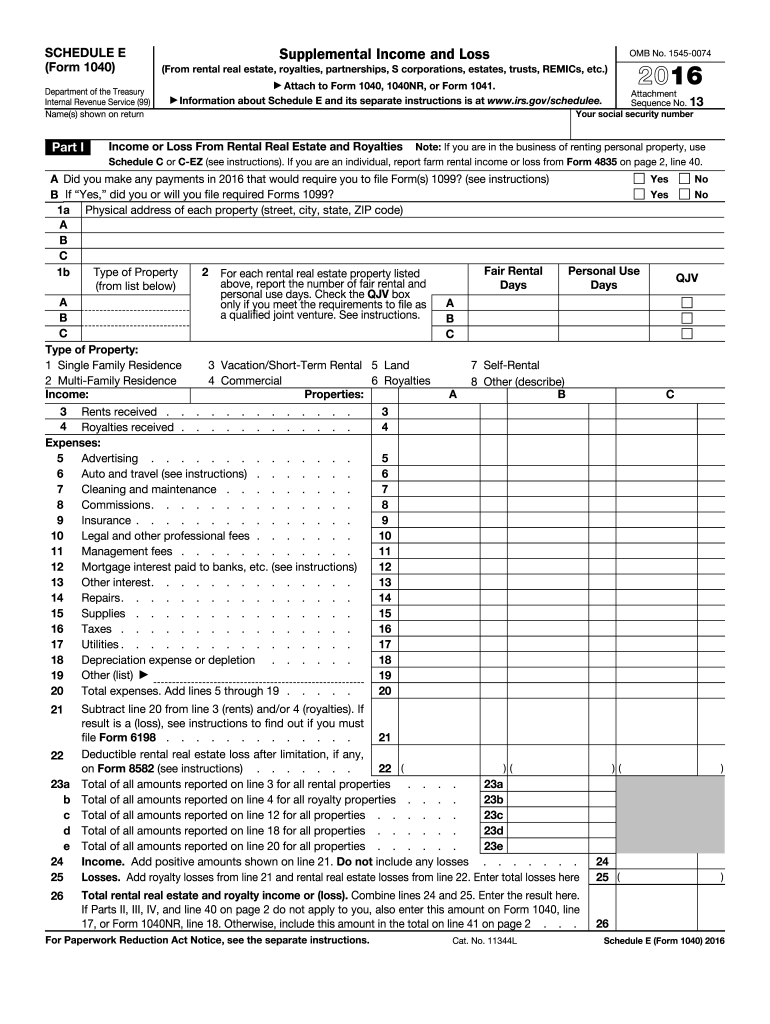

The Schedule E Form is a tax document used in the United States to report income or loss from various sources, including rental real estate, royalties, partnerships, S corporations, estates, and trusts. This form is essential for individuals who earn income from these sources, as it helps them accurately calculate their taxable income. The Schedule E Form is filed with the IRS as part of the individual income tax return, typically using Form 1040.

How to use the Schedule E Form

Using the Schedule E Form involves several steps to ensure that all relevant income and expenses are accurately reported. Taxpayers must first gather all necessary documentation related to their income sources, such as rental agreements, partnership agreements, and any relevant financial statements. Once the information is compiled, taxpayers can fill out the form, detailing income received and expenses incurred. It is important to follow IRS guidelines to ensure compliance and avoid potential penalties.

Steps to complete the Schedule E Form

Completing the Schedule E Form requires careful attention to detail. Here are the key steps involved:

- Gather documentation: Collect all relevant financial records related to rental properties, partnerships, or other income sources.

- Fill out the form: Enter your income and expenses in the appropriate sections of the Schedule E Form.

- Calculate totals: Sum up the income and expenses to determine your net income or loss.

- Review for accuracy: Double-check all entries for accuracy to ensure compliance with IRS regulations.

- File with your tax return: Submit the completed Schedule E Form along with your Form 1040 by the tax deadline.

Legal use of the Schedule E Form

The Schedule E Form is legally recognized by the IRS as a valid method for reporting income from specific sources. It is crucial for taxpayers to use the form correctly to ensure that they comply with tax laws. Accurate reporting helps avoid issues with audits and potential penalties. The form must be completed truthfully and submitted on time to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if that date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time to submit their returns. Staying informed about these dates is essential to avoid late fees or penalties.

Required Documents

To complete the Schedule E Form, taxpayers must have several key documents on hand. These may include:

- Rental agreements for properties

- Financial statements for partnerships or S corporations

- Records of expenses related to rental properties, such as repairs and maintenance

- Any relevant tax documents from previous years that may impact current filings

Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete 2016 schedule e form

Complete Schedule E Form effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers a suitable eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Schedule E Form on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The most efficient method to modify and eSign Schedule E Form with ease

- Obtain Schedule E Form and click Get Form to begin.

- Employ the tools we provide to finish your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools available from airSlate SignNow specifically designed for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Schedule E Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 schedule e form

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule e form

How to make an electronic signature for the 2016 Schedule E Form online

How to generate an eSignature for the 2016 Schedule E Form in Chrome

How to generate an eSignature for signing the 2016 Schedule E Form in Gmail

How to generate an eSignature for the 2016 Schedule E Form right from your mobile device

How to create an electronic signature for the 2016 Schedule E Form on iOS devices

How to make an electronic signature for the 2016 Schedule E Form on Android OS

People also ask

-

What is the Schedule E Form?

The Schedule E Form is used by taxpayers to report supplemental income or loss, including rental real estate and royalties. It allows individuals to detail their income sources and deductions effectively. Accurate completion of the Schedule E Form is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the Schedule E Form?

airSlate SignNow provides a streamlined solution for creating, sending, and electronically signing the Schedule E Form. Its user-friendly interface simplifies the document management process, ensuring that you can complete your tax forms efficiently. By using airSlate SignNow, you can reduce paperwork and enhance collaboration with relevant parties.

-

Is there a cost for using airSlate SignNow to manage my Schedule E Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you're an individual or a larger organization, you can find a suitable plan to access features for managing the Schedule E Form. The cost-effective solutions provided by airSlate SignNow ensure that you can maintain compliance without breaking the bank.

-

What features does airSlate SignNow offer for the Schedule E Form?

AirSlate SignNow includes features such as customizable templates, secure eSignatures, and easy document tracking specifically for the Schedule E Form. These tools enhance the user experience, making it more efficient to complete and submit tax-related documents. You'll also benefit from secure storage and organization of your files.

-

Can I integrate airSlate SignNow with other software to manage my Schedule E Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and various accounting software solutions. This integration makes it easier to upload, share, and manage your Schedule E Form alongside other financial documents. Streamlining your workflow has never been simpler!

-

How does airSlate SignNow ensure the security of my Schedule E Form?

Security is a priority for airSlate SignNow, which implements advanced encryption and secure data handling protocols. Your Schedule E Form and other sensitive documents are protected throughout the signing process. You can trust airSlate SignNow to keep your information safe and confidential.

-

What are the benefits of using airSlate SignNow for the Schedule E Form?

Using airSlate SignNow for the Schedule E Form offers numerous benefits, including time savings, ease of use, and enhanced document security. You can effortlessly prepare, send, and receive your tax forms electronically, eliminating the hassle of physical paperwork. Additionally, collaborative features allow for easier interactions with accountants and tax preparers.

Get more for Schedule E Form

Find out other Schedule E Form

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament