Schedule E Form 2011

What is the Schedule E Form

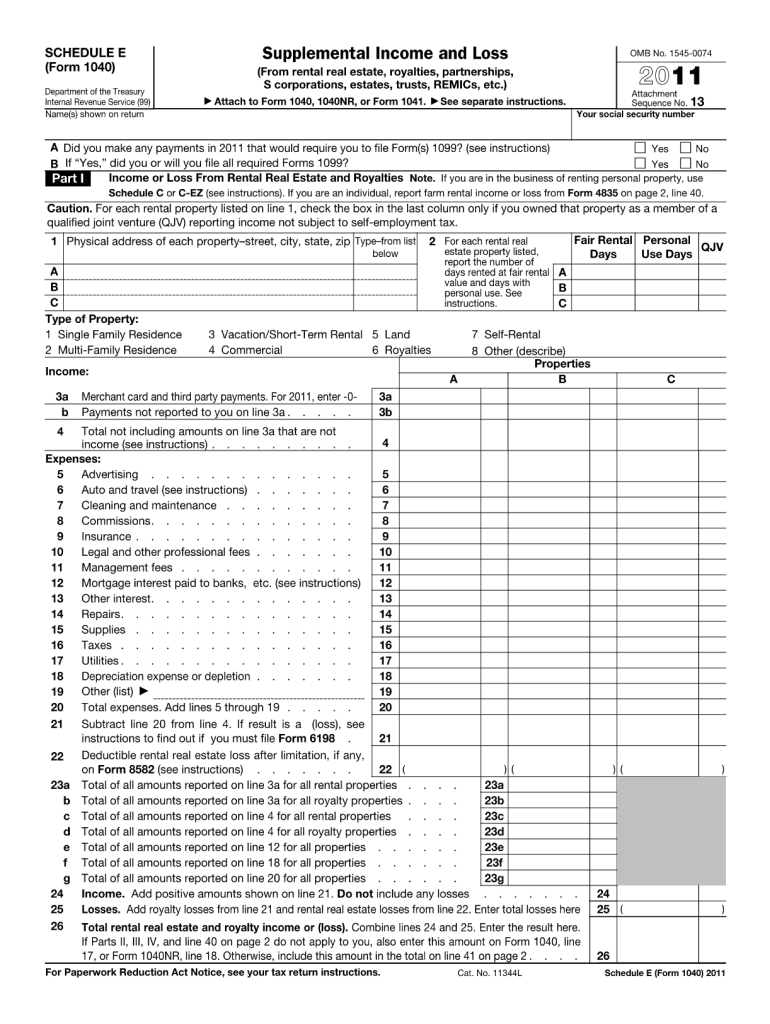

The Schedule E Form is a tax document used by individuals to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and other sources. This form is essential for taxpayers who earn income from these activities, as it helps in calculating the total taxable income. The Schedule E is filed as an attachment to Form 1040, the individual income tax return, and is crucial for ensuring accurate reporting of various income streams.

How to use the Schedule E Form

Using the Schedule E Form involves several steps to ensure accurate reporting of income and expenses. Taxpayers should first gather all necessary information, including income from rental properties or partnerships. Next, the form must be filled out with details such as the type of property, income received, and any associated expenses. It is important to ensure that all figures are accurate and supported by documentation, as this will facilitate the filing process and help avoid potential issues with the IRS.

Steps to complete the Schedule E Form

Completing the Schedule E Form requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, including rental agreements and expense receipts.

- Enter the property address and type of property in the designated sections.

- Report the total income received from each property.

- List all deductible expenses, such as repairs, maintenance, and property management fees.

- Calculate the net income or loss by subtracting total expenses from total income.

- Transfer the net income or loss to your Form 1040.

Legal use of the Schedule E Form

The Schedule E Form is legally recognized for reporting income and expenses associated with rental properties and other income sources. Proper completion of this form ensures compliance with IRS regulations and helps avoid penalties. It is essential for taxpayers to keep accurate records and documentation to support the figures reported on the Schedule E, as this may be required in case of an audit or review by the IRS.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Schedule E Form. The standard deadline for submitting the form is April 15 of each year, coinciding with the due date for Form 1040. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline by six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Who Issues the Form

The Schedule E Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. It is important for taxpayers to ensure they are using the most current version of the form, as updates may occur annually. The IRS provides the Schedule E Form and accompanying instructions on its official website, making it accessible for all taxpayers.

Quick guide on how to complete 2011 schedule e form

Complete Schedule E Form effortlessly on any device

Online document management has become favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Manage Schedule E Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Schedule E Form with ease

- Locate Schedule E Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Schedule E Form while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 schedule e form

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule e form

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Schedule E Form?

The Schedule E Form is a tax form used by individuals and businesses to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It's crucial for taxpayers to accurately complete the Schedule E Form to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the Schedule E Form?

airSlate SignNow streamlines the process of sending and signing the Schedule E Form. With our user-friendly platform, you can easily eSign documents and collect required signatures to ensure that your Schedule E Form is submitted accurately and on time, enhancing your productivity.

-

What features does airSlate SignNow offer for real estate professionals handling Schedule E Forms?

AirSlate SignNow offers features such as customizable templates, secure cloud storage, and mobile access, making it easy for real estate professionals to manage Schedule E Forms efficiently. Our platform allows you to track the status of your documents, ensuring that all necessary signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for filing the Schedule E Form?

Yes, airSlate SignNow provides a cost-effective solution for users needing to sign and manage the Schedule E Form. With flexible pricing plans, customers can choose the best option that aligns with their business needs while benefiting from our powerful features and ease of use.

-

Can airSlate SignNow integrate with other software for managing Schedule E Forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial management software, allowing users to import and export Schedule E Forms effortlessly. Our integrations enhance workflows and ensure that your tax documentation process is as smooth and efficient as possible.

-

What are the benefits of using airSlate SignNow for my Schedule E Form submissions?

Using airSlate SignNow for your Schedule E Form submissions ensures faster processing times and reduced paperwork. Our eSigning feature eliminates delays associated with traditional methods, enabling you to send, sign, and store your tax documents securely from anywhere.

-

Is it secure to sign Schedule E Forms with airSlate SignNow?

Yes, the security of your documents is our top priority. airSlate SignNow employs industry-standard encryption and multiple layers of security to protect your Schedule E Forms and personal data, ensuring that your sensitive information remains safe at all times.

Get more for Schedule E Form

- P f1 tree fund payment application nyc parks form

- Form 112 nyc department of parks amp recreation labor law nycgovparks

- Annual certification report form pdf dec ny

- Health form adult gswnyorg

- Gloversville health history form

- Exhibit a openbook data usage questionnaire form

- Controlled substance count sheet template california form

- Fillable online p f1 tree fund payment application nyc form

Find out other Schedule E Form

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation