Schedule E Form 2009

What is the Schedule E Form

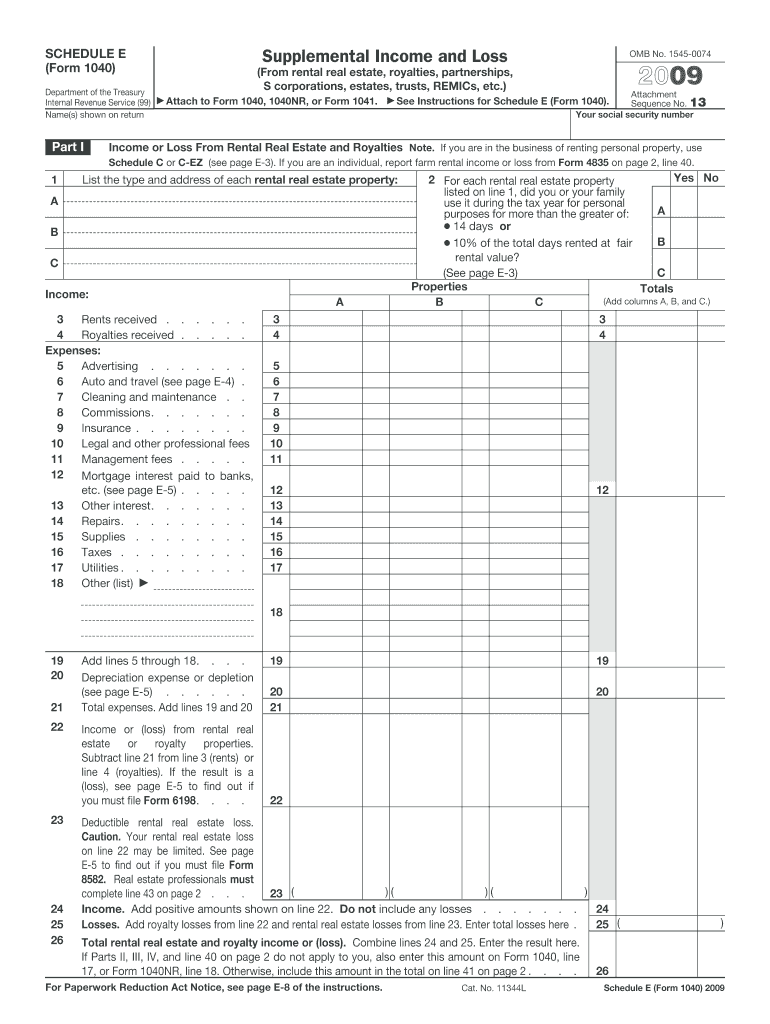

The Schedule E Form is a tax document used in the United States to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and other sources. It is an essential part of the individual income tax return, specifically Form 1040. Taxpayers utilize this form to provide detailed information about their income-generating properties and investments, ensuring compliance with IRS regulations. Accurate completion of the Schedule E Form is crucial for determining the correct taxable income and for claiming deductions related to rental properties and other investments.

How to use the Schedule E Form

Using the Schedule E Form involves several key steps. First, gather all necessary documentation related to your rental properties or investments, including income statements, expense receipts, and any relevant agreements. Next, fill out the form by providing information such as the property address, type of property, and the income received. Additionally, you will need to list any expenses incurred, such as repairs, management fees, and mortgage interest. Once completed, attach the Schedule E Form to your Form 1040 when filing your taxes. Ensure that all figures are accurate to avoid potential issues with the IRS.

Steps to complete the Schedule E Form

Completing the Schedule E Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather all relevant financial documents, including rental income and expense records.

- Begin with Part I of the form, where you will list rental income and expenses for each property.

- In Part II, report income or loss from partnerships and S corporations, if applicable.

- Complete any additional sections that apply to your specific situation, such as estates or trusts.

- Double-check all entries for accuracy and completeness.

- Attach the completed form to your Form 1040 and submit it to the IRS.

Legal use of the Schedule E Form

The Schedule E Form is legally recognized as a valid means of reporting income and expenses related to rental properties and other investments. To ensure its legal standing, taxpayers must adhere to IRS guidelines and accurately report all required information. Proper use of the form not only helps in compliance with tax laws but also protects taxpayers from potential penalties. It is advisable to retain copies of submitted forms and supporting documentation for future reference and in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form align with the standard deadlines for individual income tax returns in the United States. Typically, the due date for filing your Form 1040, including the Schedule E, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, which allows for an additional six months to submit their returns. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule E Form accurately, several documents are required. These include:

- Income statements from rental properties.

- Receipts for deductible expenses, such as repairs and maintenance.

- Mortgage interest statements (Form 1098).

- Records of property management fees, insurance, and utilities.

- Any relevant partnership or S corporation K-1 forms.

Having these documents organized and readily available will streamline the process of completing the Schedule E Form and ensure compliance with IRS requirements.

Quick guide on how to complete schedule e form 2009

Complete Schedule E Form effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Schedule E Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Schedule E Form with ease

- Obtain Schedule E Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Don't worry about lost or mislaid documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule E Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e form 2009

Create this form in 5 minutes!

How to create an eSignature for the schedule e form 2009

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a Schedule E Form and why do I need it?

The Schedule E Form is an IRS tax form used for reporting supplemental income and loss. It includes income from rental properties, partnerships, and S corporations. Understanding and accurately filling out the Schedule E Form is crucial for ensuring compliance with tax regulations and maximizing deductions.

-

How does airSlate SignNow help with filling out the Schedule E Form?

airSlate SignNow simplifies the process of handling the Schedule E Form by allowing users to easily eSign and send the document electronically. With its intuitive interface, you can complete the form quickly and efficiently, ensuring that all necessary information is included and accurate.

-

What features does airSlate SignNow offer for managing the Schedule E Form?

airSlate SignNow offers a range of features for managing the Schedule E Form, including customizable templates, document tracking, and cloud storage. These features streamline the eSigning process, making it easier to manage multiple documents and maintain organization.

-

Is airSlate SignNow cost-effective for individuals needing a Schedule E Form?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses needing to manage their Schedule E Form. With flexible pricing plans, it caters to various budgets while offering essential eSigning features to simplify document handling.

-

Can I integrate airSlate SignNow with other software when using the Schedule E Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to incorporate into your existing workflows. This integration ensures that you can efficiently manage your Schedule E Form alongside other financial tools.

-

What are the benefits of using airSlate SignNow for my Schedule E Form?

Using airSlate SignNow for your Schedule E Form provides benefits such as increased efficiency, enhanced security, and improved document management. The platform allows for quick turnaround times and ensures that your forms are legally binding and securely stored.

-

How secure is my information when using airSlate SignNow for the Schedule E Form?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your data when handling the Schedule E Form. You can confidently manage sensitive information knowing that it is safeguarded against unauthorized access.

Get more for Schedule E Form

Find out other Schedule E Form

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal