Form 1040 Schedule E 2021

What is the Form 1040 Schedule E

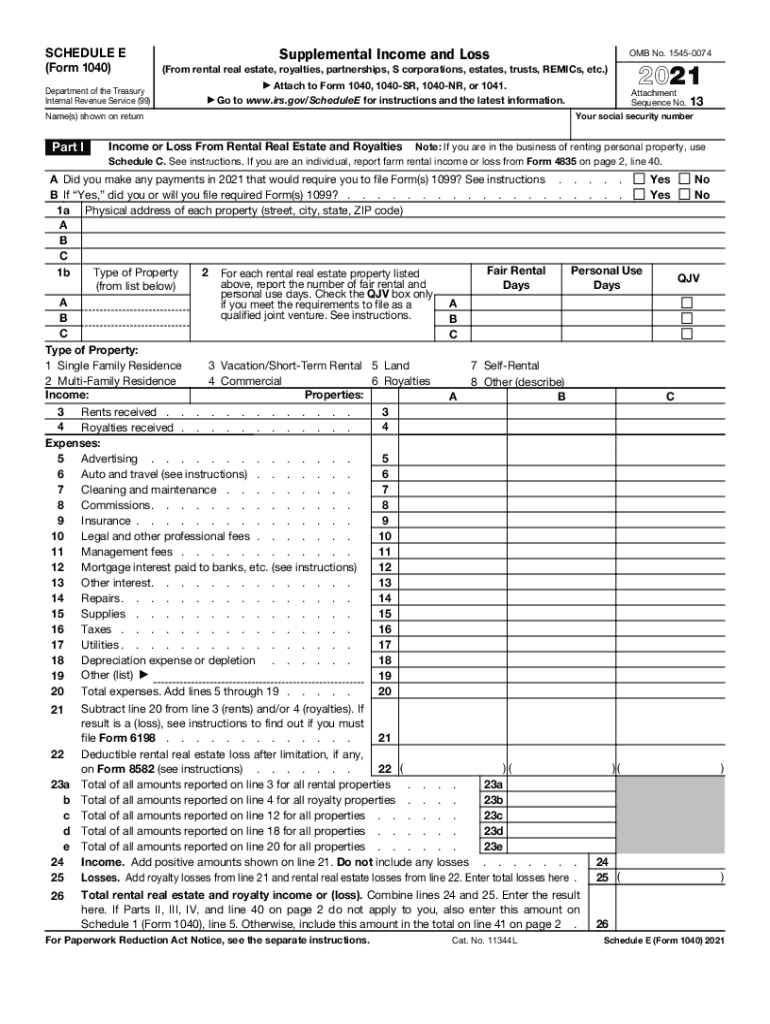

The Form 1040 Schedule E is a tax form used by individuals to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and residual interests in REMICs. This form is an integral part of the federal income tax return, specifically the IRS Form 1040. It allows taxpayers to detail their income sources and expenses related to these activities, which can significantly impact their overall tax liability.

How to use the Form 1040 Schedule E

Using the Form 1040 Schedule E involves several steps. Taxpayers must first gather all necessary documentation related to their income and expenses from rental properties or other sources. This includes records of rental income, operating expenses, and depreciation. Once you have all the information, you can fill out the form by entering the income and expenses in the appropriate sections. It is crucial to ensure accuracy to avoid issues with the IRS.

Steps to complete the Form 1040 Schedule E

Completing the Form 1040 Schedule E requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including rental agreements and expense receipts.

- Begin by entering your name and Social Security number at the top of the form.

- Report your rental income in Part I of the form, listing each property separately.

- Deduct allowable expenses in Part I, such as repairs, maintenance, and property management fees.

- If applicable, complete Part II for income or loss from partnerships and S corporations.

- Review the completed form for accuracy before submitting it with your Form 1040.

Legal use of the Form 1040 Schedule E

The legal use of the Form 1040 Schedule E is governed by IRS regulations. To ensure compliance, taxpayers must accurately report all income and expenses associated with their rental properties or other sources. Failure to report income can lead to penalties, audits, and additional taxes owed. It is essential to keep thorough records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule E align with the general tax return deadlines. Typically, the deadline for filing the federal income tax return, including Schedule E, is April 15. If you need additional time, you can file for an extension, which typically gives you until October 15 to submit your return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Examples of using the Form 1040 Schedule E

Examples of using the Form 1040 Schedule E include reporting income from rental properties, partnerships, and trusts. For instance, if you own a rental property that generates monthly income, you would report the total rental income received and deduct any related expenses, such as repairs or property management fees. Additionally, if you are a partner in a business, you would report your share of the partnership's income or loss on this form.

Quick guide on how to complete form 1040 schedule e

Complete Form 1040 Schedule E effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without interruptions. Manage Form 1040 Schedule E across any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 1040 Schedule E without stress

- Obtain Form 1040 Schedule E and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Form 1040 Schedule E and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule e

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule e

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the best way to schedule e meetings using airSlate SignNow?

To schedule e meetings using airSlate SignNow, simply create a new document, add the necessary signatures, and choose a date to send it. This ensures all participants are aligned on the schedule e time, making document signing seamless and efficient. With reminders set up, everyone stays informed about the upcoming signing process.

-

How does airSlate SignNow streamline the process to schedule e signatures?

airSlate SignNow simplifies the scheduling of e signatures by allowing users to customize workflows and set deadlines for document signing. By automating reminders and notifications, you can ensure that all parties are prompted to complete their actions on time, enhancing productivity and reducing delays.

-

What pricing plans does airSlate SignNow offer for scheduling e services?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options for individual users and teams. Each plan includes features to help you easily schedule e signatures, with volume pricing available for larger organizations. You can choose a plan that best fits your budget while maximizing the benefits of electronic signature capabilities.

-

Can I integrate airSlate SignNow with other tools to help schedule e tasks?

Yes, airSlate SignNow integrates with numerous tools like Google Workspace, Microsoft Office, and Salesforce, which can help you efficiently schedule e tasks. These integrations allow for smoother workflows, enabling team members to collaborate and manage documents without switching between multiple applications. Streamlining your processes enhances your overall efficiency.

-

What are the key features of airSlate SignNow that help in scheduling e documents?

Key features of airSlate SignNow that assist in scheduling e documents include customizable templates, document tagging, and automated notifications. These tools help ensure that all necessary information is captured prior to signing and that reminders are sent to participants. This ultimately boosts the completion rate and speeds up the signing process.

-

How secure is the process of scheduling e signatures with airSlate SignNow?

Security is a top priority for airSlate SignNow when scheduling e signatures. The platform utilizes advanced encryption methods and complies with industry regulations to protect sensitive information. You can trust that all transactions and documents are safeguarded throughout the scheduling and signing process.

-

What advantages does airSlate SignNow provide when I schedule e agreements?

Using airSlate SignNow to schedule e agreements provides signNow advantages such as increased efficiency, reduced turnaround times, and cost savings. The platform automates the signing process, making it simpler for all parties to complete agreements promptly. This can enhance business relationships and improve operational workflows.

Get more for Form 1040 Schedule E

- Warranty deed from limited partnership or llc is the grantor or grantee georgia form

- Georgia warranty deed form

- Warranty deed form 497304177

- Ga warranty deed 497304178 form

- Ga defendant form

- Georgia plaintiff form

- Legal last will and testament form for single person with no children georgia

- Legal last will and testament form for a single person with minor children georgia

Find out other Form 1040 Schedule E

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History