Schedule E Form 1040 Internal Revenue Service 2020

What is the Schedule E Form 1040?

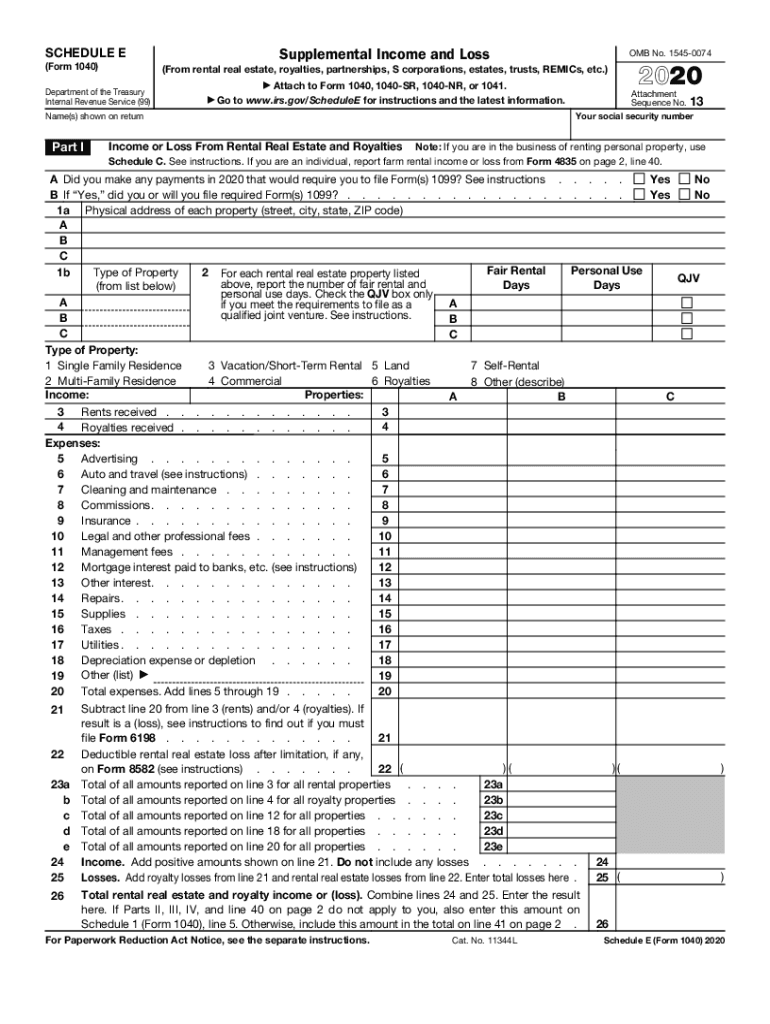

The Schedule E Form 1040 is a tax form used by individuals in the United States to report income or loss from various sources, including rental real estate, partnerships, S corporations, estates, trusts, and more. This form is part of the federal income tax return process and is submitted alongside the standard Form 1040. It allows taxpayers to detail their income from these sources and claim any related deductions, ensuring accurate reporting of their overall tax liability. Understanding the Schedule E is essential for anyone who earns income from passive activities or has investments in partnerships or real estate.

How to Use the Schedule E Form 1040

Using the Schedule E Form 1040 involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary documentation related to your rental properties or partnerships, such as income statements, expense receipts, and prior year tax returns. Next, fill out the form by entering your income and expenses in the appropriate sections. It is important to accurately report all income received and to itemize any deductible expenses, such as property management fees, repairs, and depreciation. After completing the form, review it for accuracy and ensure that it is submitted along with your Form 1040 by the tax deadline.

Steps to Complete the Schedule E Form 1040

Completing the Schedule E Form 1040 involves a systematic approach:

- Gather documents: Collect all relevant financial documents, including rental agreements and expense records.

- Fill out Part I: Report income from rental properties by entering the total rent received.

- Complete Part II: If applicable, list income and expenses from partnerships and S corporations.

- Deduct expenses: Itemize any allowable deductions, such as repairs, maintenance, and depreciation.

- Review and verify: Double-check all entries for accuracy before submission.

- Submit with Form 1040: Ensure that Schedule E is included with your main tax return.

Key Elements of the Schedule E Form 1040

The Schedule E Form 1040 consists of several key elements that taxpayers must understand:

- Part I: Focuses on income and expenses from rental real estate.

- Part II: Covers income or loss from partnerships and S corporations.

- Part III: Details income or loss from estates and trusts.

- Part IV: Addresses income from real estate mortgage investment conduits (REMICs).

Each part requires specific information, and understanding these elements is crucial for accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form 1040 align with the general tax return deadlines. Typically, individual taxpayers must file their federal income tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which allows for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failing to accurately report income or submit the Schedule E Form 1040 can result in significant penalties. The IRS may impose fines for underreporting income, late filing, or failure to file altogether. Additionally, taxpayers may face interest charges on any unpaid taxes. It is essential to ensure compliance with IRS regulations to avoid these potential penalties and to maintain a good standing with tax authorities.

Quick guide on how to complete 2020 schedule e form 1040 internal revenue service

Complete Schedule E Form 1040 Internal Revenue Service effortlessly on any device

Online document administration has become popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Schedule E Form 1040 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Schedule E Form 1040 Internal Revenue Service with minimal effort

- Find Schedule E Form 1040 Internal Revenue Service and click on Get Form to commence.

- Use the tools we offer to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Stop worrying about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Schedule E Form 1040 Internal Revenue Service and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule e form 1040 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule e form 1040 internal revenue service

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a schedule E 1040?

A schedule E 1040 is a tax form used by individuals to report income or loss from rental real estate, royalties, and other sources. Understanding how to accurately complete a schedule E 1040 is essential for anyone involved in real estate investing or property management.

-

How can airSlate SignNow help me with my schedule E 1040?

airSlate SignNow provides an efficient way to streamline the process of signing and managing documents related to your schedule E 1040. With its easy-to-use platform, you can quickly eSign all necessary forms and ensure compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit varying business needs, including options that cater specifically to freelancers and small businesses. Each plan includes features that can facilitate the handling of documents, such as those related to your schedule E 1040.

-

Can I integrate airSlate SignNow with other applications for tax purposes?

Yes, airSlate SignNow seamlessly integrates with popular applications like QuickBooks and Zapier, which can help automate various aspects of your documents and streamline your workflow when dealing with your schedule E 1040.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect your sensitive documents like the schedule E 1040. This ensures that your personal information remains confidential and secure.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various document management features, such as customizable templates, real-time collaboration, and mobile access, which can be particularly beneficial when preparing documents for your schedule E 1040. These features enhance efficiency and accuracy in your tax filings.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow has a mobile-friendly application that allows you to manage and eSign documents from anywhere. This flexibility is especially helpful when dealing with critical documents related to your schedule E 1040 while on the go.

Get more for Schedule E Form 1040 Internal Revenue Service

- 60 days form application

- Response petition form

- Law 60 days form

- Order 60 days form

- Wpf ps 120100 petition for rescission of denial of paternity within 60 days washington form

- Wpf ps 120200 summons rescission of denial of paternity within 60 days washington form

- Wpf ps 120300 response to petition for rescission of denial of paternity within 60 days washington form

- Findings fact conclusions form

Find out other Schedule E Form 1040 Internal Revenue Service

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word