Schedule E Form 1997

What is the Schedule E Form

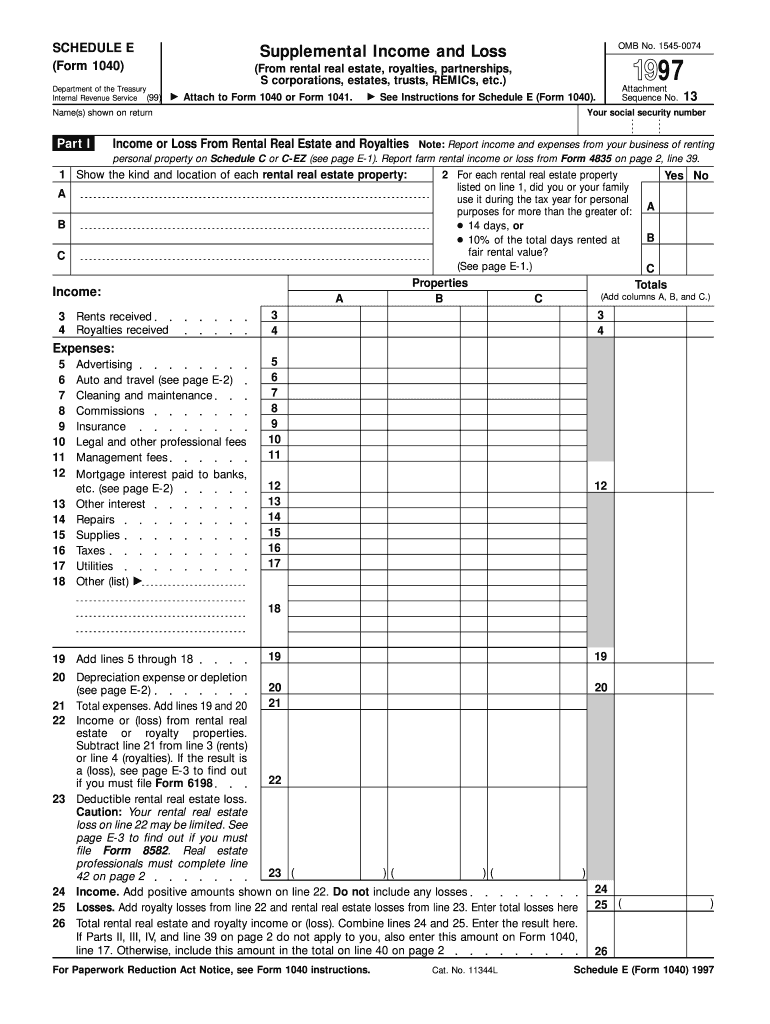

The Schedule E Form is a tax document used by individuals in the United States to report income or loss from various sources, including rental real estate, royalties, partnerships, S corporations, estates, and trusts. This form is essential for taxpayers who need to detail their supplemental income, ensuring accurate reporting to the Internal Revenue Service (IRS). By completing the Schedule E Form, taxpayers can claim deductions related to expenses incurred in generating this income, such as mortgage interest, property taxes, and repairs.

How to use the Schedule E Form

To use the Schedule E Form effectively, taxpayers should first gather all relevant financial records associated with their rental properties or other income sources. This includes documentation of income received, expenses incurred, and any applicable depreciation. Once the necessary information is compiled, the taxpayer can fill out the form by entering the income and expenses in the appropriate sections. It is crucial to ensure that all entries are accurate and supported by documentation to avoid issues during tax filing.

Steps to complete the Schedule E Form

Completing the Schedule E Form involves several key steps:

- Gather all necessary documentation, including income statements and expense receipts.

- Fill out the top section of the form with your personal information, including your name and Social Security number.

- Report income from each rental property or other income sources in the designated sections.

- Detail all relevant expenses, such as repairs, maintenance, and property management fees.

- Calculate the total income or loss for each property and transfer the totals to the appropriate lines.

- Review the completed form for accuracy and ensure all calculations are correct.

Legal use of the Schedule E Form

The legal use of the Schedule E Form is governed by IRS regulations, which require taxpayers to report all income accurately. Failure to comply with these regulations can lead to penalties, including fines and interest on unpaid taxes. It is essential for taxpayers to understand the legal implications of the information reported on the form and to maintain accurate records to support their claims. Using a reliable digital solution for eSigning and submitting the form can also enhance compliance with legal requirements.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines when submitting the Schedule E Form. Generally, the deadline for filing individual income tax returns, including the Schedule E, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available for filing, which can provide additional time to complete their tax returns without incurring penalties.

Examples of using the Schedule E Form

Examples of using the Schedule E Form include reporting income from rental properties, such as single-family homes, multi-family units, or vacation rentals. Taxpayers who own shares in partnerships or S corporations may also use this form to report their share of income or loss from these entities. Additionally, individuals receiving royalties from intellectual property or other sources can utilize the Schedule E to report this income accurately.

Quick guide on how to complete schedule e 2013 form 1997

Accomplish Schedule E Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Schedule E Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Schedule E Form with ease

- Obtain Schedule E Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you prefer to send your form, either by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Schedule E Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e 2013 form 1997

Create this form in 5 minutes!

How to create an eSignature for the schedule e 2013 form 1997

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Schedule E Form?

The Schedule E Form is a tax form used by individuals to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. Understanding how to use the Schedule E Form can help you accurately report your earnings and minimize your tax liability.

-

How can airSlate SignNow assist me with the Schedule E Form?

airSlate SignNow provides an intuitive platform that enables you to easily fill out and eSign the Schedule E Form. With our user-friendly interface, you can streamline the signing process and ensure that your documents are legally binding in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the Schedule E Form?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective and transparent. Pricing may vary based on the features you need, but investing in our services will ultimately save you time and hassle while managing your Schedule E Form.

-

What features does airSlate SignNow offer for managing the Schedule E Form?

airSlate SignNow includes features such as secure eSigning, customizable templates, and workflow automation specifically tailored for the Schedule E Form. With these features, you can ensure that your documents are completed efficiently and that they meet all necessary requirements.

-

Can I integrate airSlate SignNow with other tools for the Schedule E Form?

Absolutely! airSlate SignNow allows for seamless integrations with various applications and services, enabling you to manage your Schedule E Form alongside other business tools. This helps you maintain a streamlined workflow and enhances overall productivity.

-

How does airSlate SignNow ensure the security of my Schedule E Form?

We prioritize the security of your Schedule E Form by employing advanced encryption protocols and secure storage solutions. Your sensitive data is protected at every step of the process, so you can eSign and manage your documents with confidence.

-

Can multiple parties eSign the Schedule E Form using airSlate SignNow?

Yes, airSlate SignNow supports multi-party eSigning, allowing multiple stakeholders to review and sign the Schedule E Form easily. This ensures that all relevant parties can participate in the signing process without delays.

Get more for Schedule E Form

- Illinois realtors real property disclosure form

- Notice of dishonored check civil keywords bad check bounced check illinois form

- Mutual wills containing last will and testaments for unmarried persons living together with no children illinois form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children illinois form

- Mutual wills or last will and testaments for unmarried persons living together with minor children illinois form

- Illinois non marital 497306259 form

- Il procedure form

- Illinois paternity form

Find out other Schedule E Form

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure