Schedule E Form 2015

What is the Schedule E Form

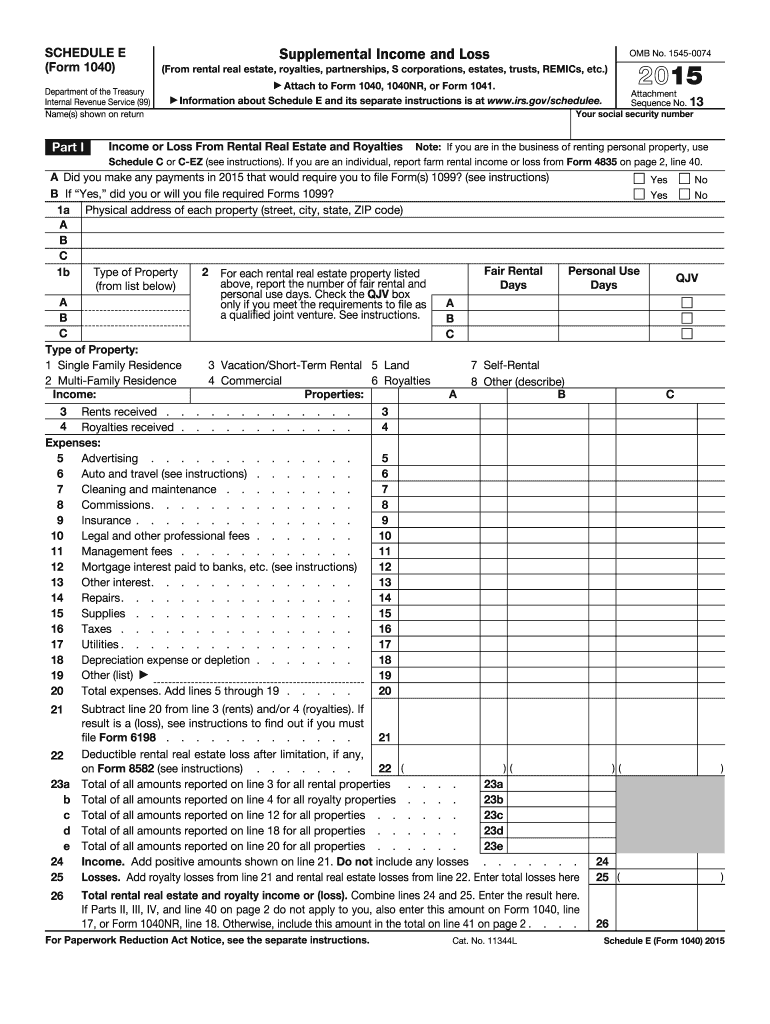

The Schedule E Form is a tax document used by individuals and businesses in the United States to report income or loss from various sources, including rental real estate, royalties, partnerships, S corporations, estates, and trusts. This form is an essential part of the IRS Form 1040, allowing taxpayers to detail their supplemental income. It helps the IRS track income that may not be reported on other tax forms, ensuring compliance with tax obligations.

How to use the Schedule E Form

To effectively use the Schedule E Form, taxpayers must first gather all relevant financial information related to their income sources. This includes details about rental properties, partnership agreements, and any royalties received. Once the necessary data is collected, the form can be filled out by entering income amounts, expenses, and deductions associated with each income source. After completing the form, it should be attached to the taxpayer's Form 1040 when filing their annual tax return.

Steps to complete the Schedule E Form

Completing the Schedule E Form involves several key steps:

- Gather all relevant financial documents, including rental agreements and partnership statements.

- Enter personal information, such as name and Social Security number, at the top of the form.

- List each property or income source in the appropriate sections, detailing income received and expenses incurred.

- Calculate the total income or loss for each source and ensure all calculations are accurate.

- Review the completed form for any errors before attaching it to Form 1040 for submission.

Key elements of the Schedule E Form

The Schedule E Form contains several important sections that taxpayers must complete:

- Part I: Income or loss from rental real estate and royalties.

- Part II: Income or loss from partnerships and S corporations.

- Part III: Income or loss from estates and trusts.

- Part IV: Summary of income or loss and any applicable deductions.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E Form. Taxpayers should refer to IRS Publication 527 for detailed instructions on reporting rental income and expenses. It is essential to follow these guidelines closely to ensure compliance and avoid potential issues during tax audits. The IRS also updates its guidelines periodically, so staying informed about any changes is crucial for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form align with the general tax return deadlines. Typically, individual taxpayers must file their tax returns by April 15 of each year. If additional time is needed, taxpayers can file for an extension, which generally allows for an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete schedule e 2015 form

Effortlessly Prepare Schedule E Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a remarkable eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Schedule E Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Schedule E Form with Ease

- Obtain Schedule E Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and select the Done button to save your modifications.

- Decide on how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Schedule E Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e 2015 form

Create this form in 5 minutes!

How to create an eSignature for the schedule e 2015 form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule E Form and why is it important?

The Schedule E Form is a crucial tax document used by individuals to report income or loss from rental properties, partnerships, S corporations, estates, trusts, and more. Understanding its significance helps ensure accurate tax filings and compliance with IRS regulations. At airSlate SignNow, we simplify the signing process, allowing you to handle your Schedule E Form with ease.

-

How can airSlate SignNow help with the eSigning of a Schedule E Form?

airSlate SignNow provides an easy-to-use platform to electronically sign and send your Schedule E Form, enhancing convenience and efficiency. With robust security features and a user-friendly interface, you can complete your tax documents hassle-free. This service helps streamline the submission process, reducing potential errors and saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for the Schedule E Form?

Yes, airSlate SignNow offers flexible subscription plans that cater to different needs and budgets. Users can choose from various pricing tiers, depending on their frequency of use and features required. Investing in our solution for your Schedule E Form ensures secure, efficient, and reliable document handling.

-

What features make airSlate SignNow suitable for handling the Schedule E Form?

airSlate SignNow comes with numerous features that enhance your experience with the Schedule E Form. Key features include its eSignature capability, document templates, automated workflows, and secure cloud storage. These tools allow users to manage their tax paperwork seamlessly, ensuring efficient access and completion.

-

Can I integrate airSlate SignNow with my accounting software for the Schedule E Form?

Absolutely! airSlate SignNow supports integrations with popular accounting software, making it easy to manage your Schedule E Form alongside your financial documents. This integration streamlines the process and reduces the risk of errors by allowing seamless data transfer between platforms.

-

What are the benefits of using airSlate SignNow for the Schedule E Form compared to traditional methods?

Using airSlate SignNow for the Schedule E Form offers numerous advantages over traditional paper methods. It enhances efficiency through electronic workflows, reduces the risk of losing important documents, and ensures compliance with eSignature laws. Additionally, our platform is secure and convenient, allowing you to manage your tax documents from anywhere.

-

Is airSlate SignNow secure for handling sensitive documents like the Schedule E Form?

Yes, airSlate SignNow prioritizes security for all sensitive documents, including the Schedule E Form. Our platform utilizes advanced encryption methods, secure cloud storage, and stringent privacy protections to safeguard your information. You can trust that your tax documents are well-protected when using our services.

Get more for Schedule E Form

- Health net outpatient oregon healthnet medicare authorization form oregon outpatient oregon healthnet medicare authorization

- Wrli com form

- Organizational membership application citygate network form

- Butler area school district notice regarding blood form

- Full text of ampquoteric ed117739 back to the basics in english form

- Generic medical release formdocx

- Participant release formdocx

- Girl health history form girl scouts western pa

Find out other Schedule E Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF