Schedule E Form 2010

What is the Schedule E Form

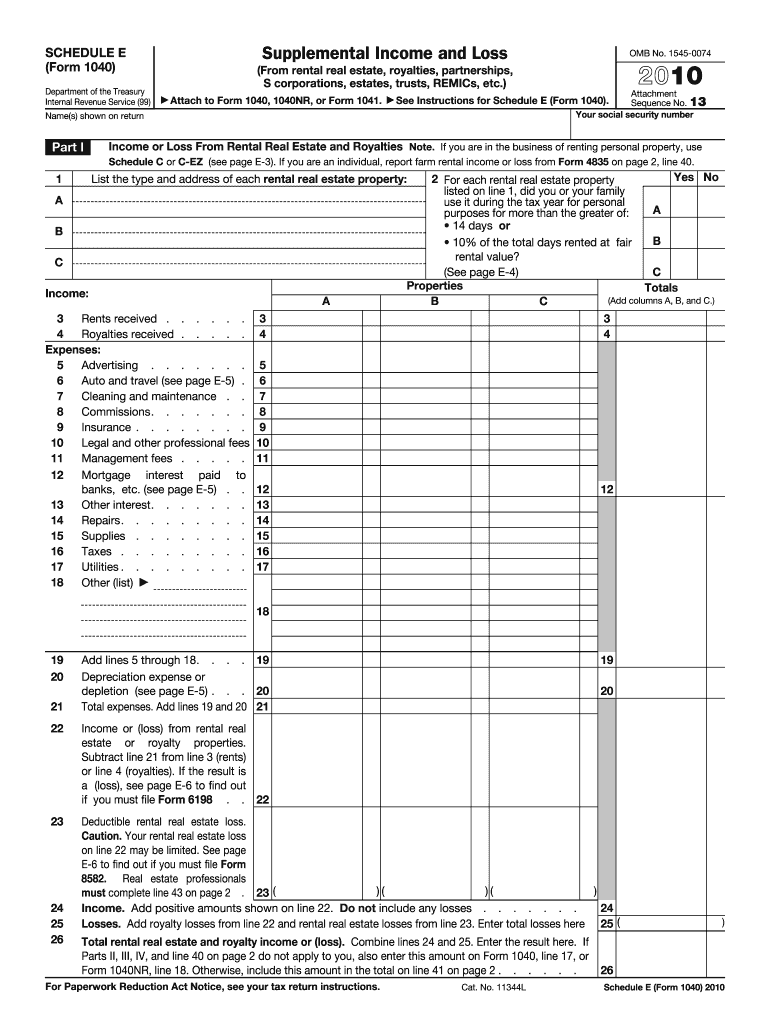

The Schedule E Form is a tax document used in the United States to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs (Real Estate Mortgage Investment Conduits). This form is essential for taxpayers who earn income from these sources, as it helps them accurately calculate their tax obligations. The Schedule E is filed as an attachment to the Form 1040, which is the individual income tax return.

How to use the Schedule E Form

Using the Schedule E Form involves several steps to ensure accurate reporting of income and deductions. Taxpayers should first gather all relevant financial information, including income from rentals or partnerships and any associated expenses. The form is divided into sections where taxpayers must report their income, deductions, and losses. Each property or business should be listed separately, allowing for detailed reporting. Upon completion, the form must be submitted along with the Form 1040 during the tax filing process.

Steps to complete the Schedule E Form

Completing the Schedule E Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including rental agreements, income statements, and expense receipts.

- Fill out Part I for rental income and expenses, detailing each property individually.

- Complete Part II if you are reporting income or loss from partnerships or S corporations.

- Calculate your total income and deductions, ensuring to include any passive activity losses.

- Review the form for accuracy before submitting it with your Form 1040.

Legal use of the Schedule E Form

The Schedule E Form is legally recognized by the Internal Revenue Service (IRS) for reporting specific types of income. To ensure compliance, it is crucial that taxpayers accurately report their income and expenses, as inaccuracies can lead to penalties or audits. The form must be filed by the tax deadline and should reflect all applicable IRS guidelines to maintain its legal validity.

Filing Deadlines / Important Dates

Taxpayers must be aware of the deadlines associated with the Schedule E Form. Typically, the deadline for filing individual tax returns, including the Schedule E, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax laws or filing dates that may occur, as these can impact the timely submission of the form.

Examples of using the Schedule E Form

There are various scenarios in which the Schedule E Form is utilized. For instance, a landlord renting out residential properties would report rental income and associated expenses, such as maintenance costs and property taxes. Similarly, an individual receiving income from a partnership would use the form to report their share of the partnership's income or loss. Each example highlights the form's versatility in capturing different types of income for tax purposes.

Quick guide on how to complete 2010 schedule e form

Effortlessly manage Schedule E Form on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Schedule E Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Schedule E Form with ease

- Find Schedule E Form and select Get Form to begin.

- Utilize the features we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select your preferred method for delivering your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule E Form to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule e form

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule e form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the Schedule E Form?

The Schedule E Form is a tax form used by individuals to report rental income, royalties, and other pass-through income. It's essential for both property owners and investors to accurately complete the Schedule E Form to ensure compliance with IRS regulations. Using airSlate SignNow can help streamline the signing process for your Schedule E Form.

-

How can airSlate SignNow help with the Schedule E Form?

airSlate SignNow simplifies the eSigning and document management process, making it easy to send and receive your Schedule E Form for signatures. With our user-friendly platform, you can ensure that your Schedule E Form is completed quickly and efficiently, without the hassle of paperwork. Save time and increase accuracy with airSlate SignNow.

-

Is airSlate SignNow cost-effective for eSigning the Schedule E Form?

Yes, airSlate SignNow offers affordable pricing plans tailored for businesses of all sizes, making it a cost-effective solution for eSigning documents like the Schedule E Form. Our platform eliminates the need for printing and mailing, thereby reducing overall costs. You can choose the plan that best fits your needs while ensuring efficient management of your Schedule E Form.

-

What features does airSlate SignNow offer for managing the Schedule E Form?

airSlate SignNow provides various features to enhance your experience with the Schedule E Form, including customizable templates, real-time tracking, and secure storage. With these features, you can quickly create and manage your Schedule E Form, ensuring that you never miss an important deadline. Our platform is designed to help you maintain compliance by keeping all your documents organized.

-

Can I integrate airSlate SignNow with other applications for my Schedule E Form?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, allowing you to streamline your workflow when handling the Schedule E Form. Whether you're using accounting software or project management tools, our integration capabilities ensure that your documents are accessible where you need them. Enhance your productivity by utilizing integrated solutions alongside your Schedule E Form.

-

How secure is my Schedule E Form when using airSlate SignNow?

Your security is our top priority at airSlate SignNow. The platform complies with industry standards and employs encryption to keep your Schedule E Form and other documents safe and secure. With our robust security features, you can have peace of mind knowing that your sensitive information remains protected.

-

Is there a mobile option for signing the Schedule E Form?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to sign and manage your Schedule E Form on-the-go. Whether you're using a smartphone or tablet, our mobile application enables you to review, edit, and get signatures for your Schedule E Form anytime, anywhere. Stay productive with mobile accessibility.

Get more for Schedule E Form

- Natwest bank form

- Gmc internship form

- Self employment short 2014 if youre self employed have relatively simple tax affairs and your annual business turnover was form

- Ukself assessment forms and helpsheets

- Laer meisieskool la rochelle girls primary school form

- Eff membership form

- La rochelle primary form

- Form 24 ms medical and dental professions board hpcsa

Find out other Schedule E Form

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney