Schedule E Form and Instructions Form 1040Schedule E for Supplemental Income and Loss Explained2020 Schedule E Form and Instruct 2022-2026

Understanding the Schedule E Tax Form

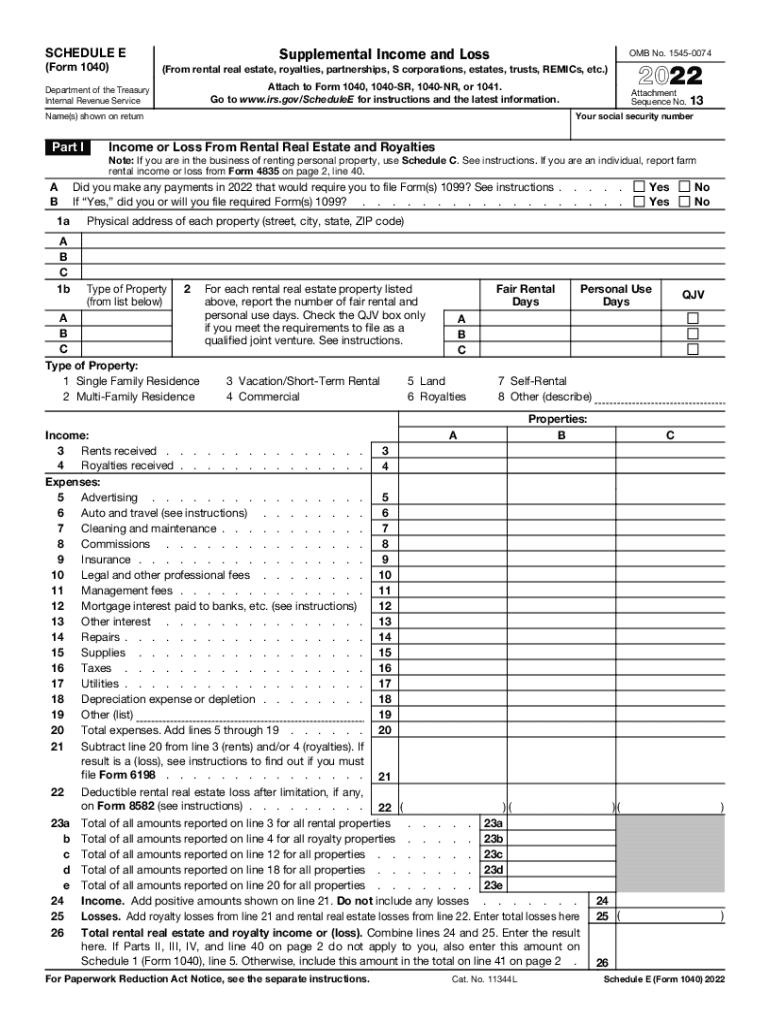

The Schedule E tax form is a crucial document used by U.S. taxpayers to report supplemental income or loss. This form is typically filed alongside Form 1040, the individual income tax return. It encompasses various types of income, including rental income, royalties, partnerships, S corporations, and estates. Understanding how to accurately complete this form is essential for ensuring compliance with IRS regulations and for maximizing potential deductions.

Steps to Complete the Schedule E Tax Form

Completing the Schedule E tax form involves several key steps:

- Gather necessary documents: Collect all relevant financial statements, including income records, expense receipts, and any prior year tax returns.

- Identify income sources: Determine all sources of supplemental income that need to be reported, such as rental properties or partnership earnings.

- Fill out the form: Input your income and expenses in the designated sections of the Schedule E form. Ensure that all figures are accurate and reflect your financial situation.

- Review and verify: Double-check all entries for accuracy. Ensure that you have included all necessary information to avoid potential issues with the IRS.

- File the form: Submit your completed Schedule E form along with your Form 1040 by the tax filing deadline.

Legal Use of the Schedule E Tax Form

The Schedule E tax form is legally recognized by the IRS for reporting supplemental income. It must be filled out accurately to ensure compliance with federal tax laws. Failure to report income or inaccuracies can result in penalties or audits. It is important to maintain thorough records to support the information provided on the form, as this can be crucial in the event of an IRS inquiry.

Filing Deadlines for the Schedule E Tax Form

Taxpayers must adhere to specific deadlines when filing the Schedule E tax form. Generally, the deadline coincides with the due date for Form 1040, which is typically April 15 of each year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid any last-minute complications.

Key Elements of the Schedule E Tax Form

The Schedule E tax form consists of several key elements that taxpayers should be aware of:

- Part I: This section is for reporting income or loss from rental real estate.

- Part II: This part covers income or loss from partnerships and S corporations.

- Part III: This section is for reporting royalties.

- Part IV: This part is for reporting income or loss from estates and trusts.

Examples of Using the Schedule E Tax Form

There are various scenarios in which taxpayers might use the Schedule E tax form:

- A landlord reporting rental income from residential properties.

- A partner in a business reporting their share of partnership income.

- A taxpayer receiving royalties from intellectual property.

- An individual reporting income from an estate or trust.

IRS Guidelines for the Schedule E Tax Form

The IRS provides specific guidelines for completing and filing the Schedule E tax form. Taxpayers should refer to the IRS instructions for detailed information on eligibility, required documentation, and filing procedures. Adhering to these guidelines helps ensure that the form is completed correctly and submitted on time, minimizing the risk of penalties or audits.

Quick guide on how to complete 2020 schedule e form and instructions form 1040schedule e for supplemental income and loss explained2020 schedule e form and

Complete Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct effortlessly

- Locate Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark relevant parts of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule e form and instructions form 1040schedule e for supplemental income and loss explained2020 schedule e form and

Create this form in 5 minutes!

People also ask

-

What is a schedule E tax form and why do I need it?

The schedule E tax form is used to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and more. It's essential for accurately documenting your earnings and ensuring compliance with tax regulations. With airSlate SignNow, you can easily facilitate eSigning of your schedule E tax form, making tax season smoother.

-

How can airSlate SignNow help me prepare my schedule E tax form?

airSlate SignNow provides you with tools to create, edit, and share documents like the schedule E tax form. Our platform allows you to collaborate with tax professionals and clients effortlessly, ensuring that your tax forms are completed on time and correctly. Start using airSlate SignNow to streamline your tax preparation process.

-

Is airSlate SignNow affordable for small businesses needing to file a schedule E tax form?

Yes, airSlate SignNow offers various pricing plans tailored to fit the budget of small businesses. You can choose a cost-effective solution that provides all necessary features to manage your schedule E tax form and other essential documents. Start with our free trial to explore the benefits without any financial commitment.

-

What features does airSlate SignNow offer for managing tax forms like the schedule E?

airSlate SignNow provides features like document editing, eSigning, templates for schedule E tax forms, and automated workflows. These tools help you save time and reduce errors when preparing your tax documents. Enjoy the convenience of managing all your tax forms in one easy-to-use platform.

-

Can I integrate airSlate SignNow with other accounting software for schedule E tax form management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software solutions, making it easier to import and export data related to your schedule E tax form. This integration helps you maintain accurate records and streamline your tax preparation process across platforms.

-

What benefits does electronic signing provide for my schedule E tax form?

Electronic signing with airSlate SignNow ensures that your schedule E tax form is signed quickly and securely, eliminating the need for physical paperwork. This speeds up your tax filing process, allows for greater efficiency, and enhances document security by providing audit trails. Experience the advantages of eSigning today!

-

How does airSlate SignNow ensure the security of my schedule E tax form?

airSlate SignNow implements industry-leading security measures to protect your schedule E tax form and sensitive information. With features such as encryption, secure access controls, and compliance with data protection regulations, you can feel confident that your documents are safe with us.

Get more for Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct

Find out other Schedule E Form And Instructions Form 1040Schedule E For Supplemental Income And Loss Explained2020 Schedule E Form And Instruct

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement