Comment Request for U S Employment Tax Returns and 2022

What is the Comment Request for U.S. Employment Tax Returns?

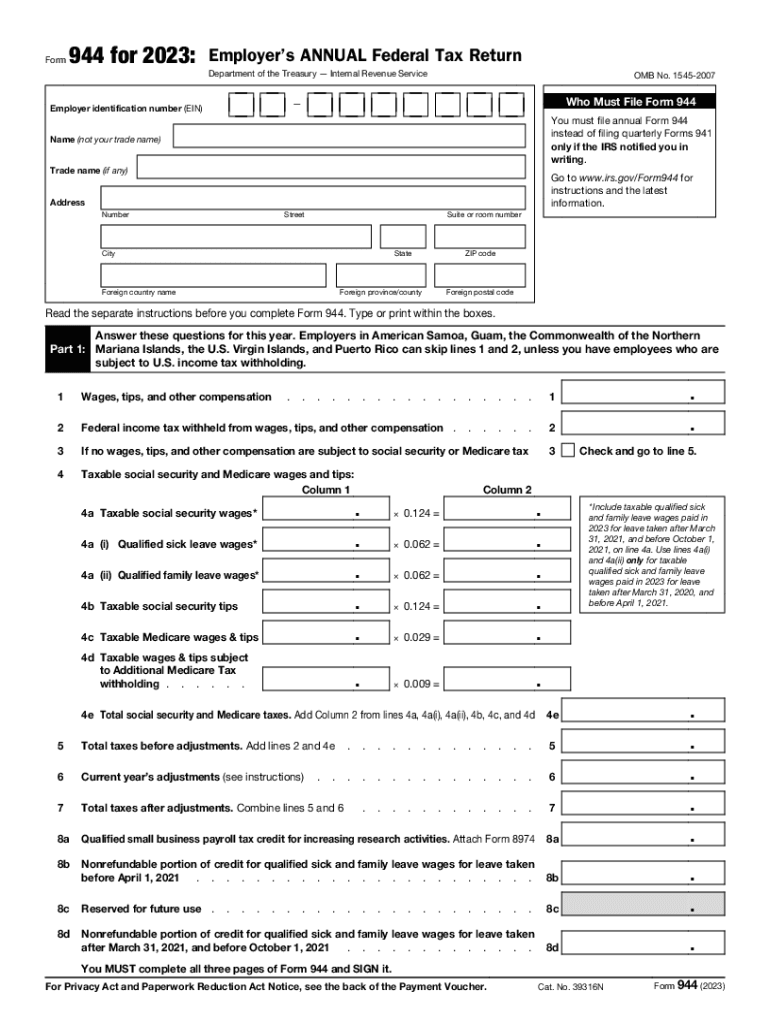

The Comment Request for U.S. Employment Tax Returns is a form used by employers to provide feedback or request clarification regarding employment tax matters. This form is particularly relevant for those who need to address discrepancies or seek guidance related to their tax obligations. It serves as a communication tool between employers and the IRS, ensuring that tax-related issues are resolved efficiently.

Steps to Complete the Comment Request for U.S. Employment Tax Returns

Completing the Comment Request involves several key steps:

- Gather necessary information: Collect relevant details such as your Employer Identification Number (EIN), the specific tax period in question, and any supporting documentation.

- Fill out the form: Clearly articulate your comments or questions in the designated sections of the form. Ensure that your writing is concise and to the point.

- Review your submission: Double-check the form for accuracy, ensuring all required fields are completed and that your comments are clear.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the correct IRS office.

IRS Guidelines for the Comment Request

The IRS provides specific guidelines for completing and submitting the Comment Request for U.S. Employment Tax Returns. These guidelines emphasize the importance of clarity and completeness in your comments. The IRS encourages employers to provide as much detail as possible to facilitate a prompt response. Additionally, adhering to deadlines for submission is crucial to ensure that your comments are considered in a timely manner.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Comment Request is essential for compliance. Generally, employers should submit their comments as soon as an issue arises or when clarification is needed. While there is no specific deadline for the Comment Request itself, timely submission can impact the resolution of tax-related inquiries. Keeping track of important dates related to employment tax filings can help ensure that you remain compliant with IRS regulations.

Required Documents for Submission

When submitting the Comment Request, it is important to include any necessary supporting documents. This may include:

- Copies of previous tax returns or forms relevant to your inquiry

- Correspondence with the IRS regarding the issue

- Any additional documentation that supports your comments or questions

Providing these documents can help the IRS understand your situation better and expedite the review process.

Penalties for Non-Compliance

Failure to address employment tax issues or to submit the Comment Request when necessary can lead to penalties. The IRS may impose fines or interest on unpaid taxes, and unresolved issues can result in further complications. It is crucial for employers to stay proactive in addressing tax matters to avoid these potential penalties.

Quick guide on how to complete comment request for u s employment tax returns and

Complete Comment Request For U S Employment Tax Returns And effortlessly on any device

Digital document management has become trendy among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Comment Request For U S Employment Tax Returns And on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Comment Request For U S Employment Tax Returns And with ease

- Find Comment Request For U S Employment Tax Returns And and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Produce your eSignature using the Sign tool, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Comment Request For U S Employment Tax Returns And and guarantee exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct comment request for u s employment tax returns and

Create this form in 5 minutes!

How to create an eSignature for the comment request for u s employment tax returns and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 944x, and why is it important?

Form 944x is a tax form used by employers to correct errors on previously filed Form 944. It's essential for ensuring accurate tax reporting and compliance with IRS regulations. Understanding how to properly complete and file a Form 944x can save businesses from potential penalties and ensure correct calculations of payroll taxes.

-

How can airSlate SignNow help with Form 944x?

airSlate SignNow provides a seamless platform for electronically signing and sending Form 944x. With features like templates and automated workflows, it streamlines the process of correcting errors and ensures documents are securely signed and easily shared. This solution enhances efficiency and accuracy for tax-related documents.

-

Is there a cost associated with using airSlate SignNow for Form 944x?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to eSigning features, which can facilitate the completion and filing of tax documents like Form 944x. For a detailed overview of pricing, you can visit our pricing page.

-

What features does airSlate SignNow offer for Form 944x processing?

airSlate SignNow offers features including document templates, real-time tracking, and in-app collaborations, all beneficial for processing Form 944x. These tools simplify the editing, signing, and sharing processes, making it easier for businesses to handle tax corrections efficiently. Additionally, the platform is user-friendly, ensuring a smooth experience.

-

Can airSlate SignNow integrate with other software for managing Form 944x?

Yes, airSlate SignNow provides integrations with popular accounting and tax software, enhancing the management of Form 944x. This allows businesses to streamline their tax filing processes and maintain accurate records without manual entry. Integrations with tools like QuickBooks and Xero make collaboration smooth and efficient.

-

What benefits does airSlate SignNow provide for filing Form 944x?

Using airSlate SignNow to file Form 944x offers benefits such as enhanced security, ease of use, and a reduction in paperwork. The electronic signing feature allows for quicker turnaround times, ensuring that corrections are filed timely. Moreover, businesses can maintain compliance with tax regulations, reducing the risk of penalties.

-

Is there a trial period for using airSlate SignNow with Form 944x?

Yes, airSlate SignNow often provides a free trial period, allowing users to explore the features related to handling Form 944x without any upfront cost. This trial gives businesses a chance to assess the platform's capabilities and determine if it meets their needs for document management and eSigning. You can sign up on our website to start your trial.

Get more for Comment Request For U S Employment Tax Returns And

- Proctoring services university of houston form

- Online odu edumediaportable media proctor formmilitary student proctor request form online odu edu

- Applicant format

- University of california san diego mouse histology form

- Transcript requestoffice of the registrargeorgia southern university form

- Proctor acceptance form workforce development

- National letter intent athletic form

- Criminal history disclosure form 407514776

Find out other Comment Request For U S Employment Tax Returns And

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word