Annual Income Tax Returns Form 1120 POL 2022

What is the Annual Income Tax Returns Form 1120 POL

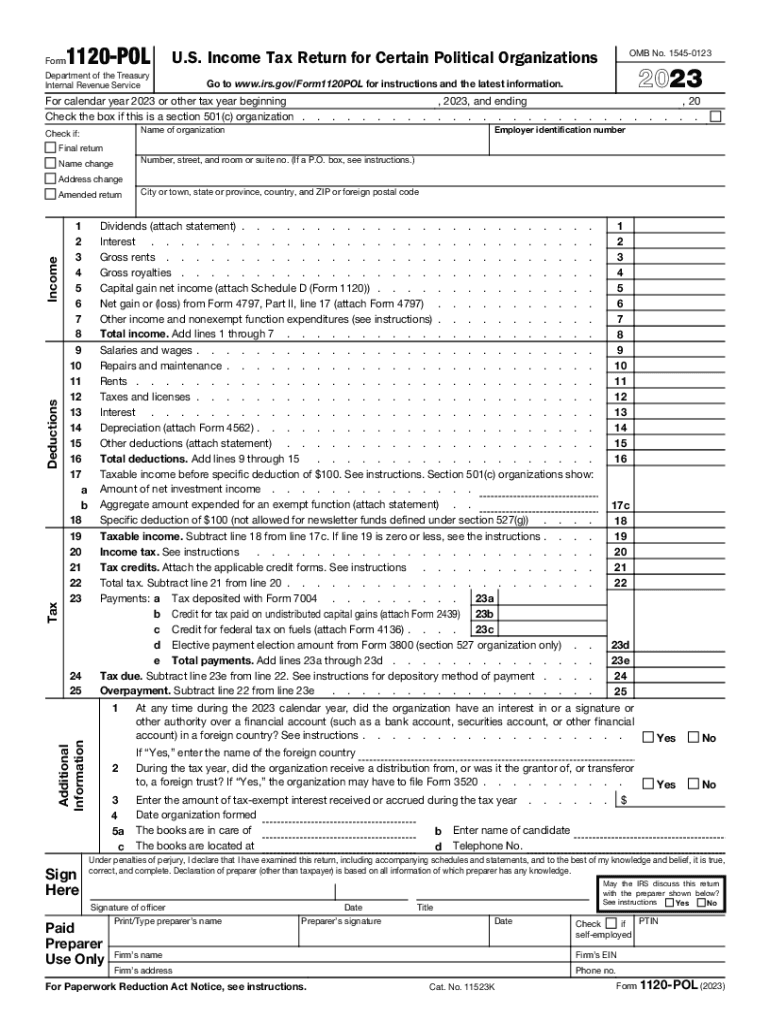

The Annual Income Tax Returns Form 1120 POL is a specific tax form used by certain organizations in the United States, particularly those classified as political organizations under the Internal Revenue Code. This form is designed for reporting income, deductions, and credits, enabling these organizations to fulfill their tax obligations. It is essential for maintaining compliance with IRS regulations and ensuring transparency in financial reporting.

How to use the Annual Income Tax Returns Form 1120 POL

Using the 1120 POL form involves several key steps. First, organizations must gather all necessary financial documents, including income statements and expense reports. Next, they should carefully complete each section of the form, ensuring accurate reporting of all relevant financial data. After filling out the form, organizations can review it for accuracy and completeness before submitting it to the IRS. Proper use of this form helps political organizations avoid penalties and maintain their tax-exempt status.

Steps to complete the Annual Income Tax Returns Form 1120 POL

Completing the 1120 POL form requires a systematic approach. Follow these steps:

- Gather all financial records, including income and expenses.

- Fill out the identifying information at the top of the form, including the organization’s name and address.

- Report total income in the appropriate section, detailing various sources of revenue.

- List all allowable deductions, ensuring compliance with IRS guidelines.

- Calculate the net income or loss and complete the tax computation section.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Annual Income Tax Returns Form 1120 POL

The legal use of the 1120 POL form is crucial for organizations seeking to maintain their tax-exempt status. This form must be filed annually to report income and expenses accurately. Failure to file or inaccuracies in reporting can lead to penalties or loss of tax-exempt status. Political organizations must adhere to IRS regulations regarding the types of income that must be reported and the deductions that can be claimed, ensuring compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 POL form are critical for compliance. Generally, the form must be filed by the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means a deadline of May 15. It is important to stay informed about any changes to these deadlines, as late filings can result in penalties and interest on unpaid taxes.

Required Documents

To successfully complete the 1120 POL form, organizations need to prepare several key documents:

- Financial statements, including income and expense reports.

- Records of contributions and donations received.

- Documentation of any expenses claimed as deductions.

- Prior year tax returns, if applicable, for reference.

Quick guide on how to complete annual income tax returns form 1120 pol

Effortlessly Prepare Annual Income Tax Returns Form 1120 POL on Any Device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to design, edit, and eSign your documents swiftly and without delays. Manage Annual Income Tax Returns Form 1120 POL on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Annual Income Tax Returns Form 1120 POL effortlessly

- Locate Annual Income Tax Returns Form 1120 POL and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for these tasks.

- Create your eSignature using the Sign function, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from the device of your choice. Edit and eSign Annual Income Tax Returns Form 1120 POL to guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual income tax returns form 1120 pol

Create this form in 5 minutes!

How to create an eSignature for the annual income tax returns form 1120 pol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120 pol form and why is it important?

The 1120 pol form is a crucial tax document used by corporations to report their income, deductions, and credits. It’s essential for compliance with IRS regulations and helps businesses accurately calculate their tax obligations. Using tools like airSlate SignNow can streamline the process of filling out and submitting the 1120 pol form.

-

How can airSlate SignNow help with the 1120 pol form?

With airSlate SignNow, you can easily prepare, send, and eSign the 1120 pol form electronically. Our platform simplifies document management, allowing you to focus on your business rather than paperwork. Using our solutions can enhance accuracy and reduce the time spent on tax filing.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to businesses of all sizes. You can choose a plan that best suits your needs, whether you are a small business tackling the 1120 pol form or a larger corporation needing advanced features. All plans come with a free trial to help you assess our services.

-

Are there any integrations available for the 1120 pol form?

Yes, airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage your 1120 pol form alongside your other financial documents. This integration can help streamline your workflow, reducing errors and saving you time during tax season.

-

What features does airSlate SignNow offer for document security?

Document security is a top priority at airSlate SignNow. Our platform includes features like encryption, two-factor authentication, and a full audit trail to ensure your 1120 pol form is protected. You can handle sensitive information with confidence knowing that your documents are secure.

-

Can I customize the 1120 pol form within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the 1120 pol form to fit your business's specific needs. You can add fields, adjust formatting, and incorporate your branding, ensuring that the form meets all regulatory requirements while maintaining your company’s identity.

-

Is it easy to get started with the 1120 pol form on airSlate SignNow?

Getting started with the 1120 pol form on airSlate SignNow is very user-friendly. Our intuitive interface guides you through the process of creating and sending your form quickly. Additionally, we provide support and resources to help you become proficient in no time.

Get more for Annual Income Tax Returns Form 1120 POL

Find out other Annual Income Tax Returns Form 1120 POL

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement