What to Know About Form 4562 Depreciation and 2022

Understanding Form 4562 for Depreciation

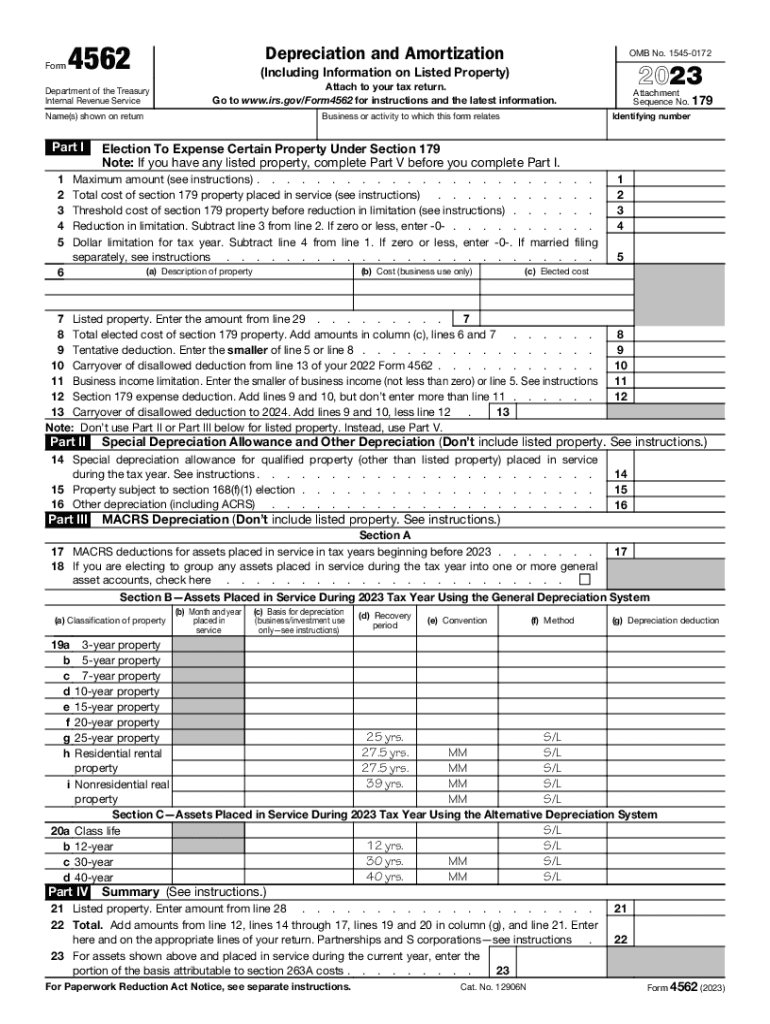

Form 4562 is used by businesses to claim deductions for depreciation and amortization. This form is essential for reporting the depreciation of property, including tangible assets like machinery and equipment, as well as intangible assets. Understanding how to fill out this form correctly can lead to significant tax savings for businesses. The IRS allows businesses to take advantage of various depreciation methods, including the Modified Accelerated Cost Recovery System (MACRS) and Section 179 expensing.

Steps to Complete Form 4562

Completing Form 4562 involves several key steps:

- Gather necessary information about the property you are depreciating, including purchase date, cost, and type of property.

- Determine the appropriate depreciation method, such as MACRS or Section 179, based on your business needs and the type of asset.

- Fill out the relevant sections of Form 4562, ensuring you accurately report the depreciation and amortization amounts.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 4562

The IRS provides specific guidelines for the completion and submission of Form 4562. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The form must be filed with your income tax return for the year in which the property was placed in service. Additionally, the IRS has detailed instructions available for each section of the form, which can help clarify any uncertainties during the filing process.

Filing Deadlines for Form 4562

Filing deadlines for Form 4562 align with your business tax return due dates. Generally, if you are a sole proprietor, your return is due on April 15. For partnerships and corporations, the deadlines can vary. It is important to file Form 4562 timely to avoid any potential late fees or penalties. If you need additional time, consider filing for an extension, which can provide extra months for submission.

Eligibility Criteria for Using Form 4562

Not all businesses are required to use Form 4562. To be eligible, your business must have depreciable assets or intangible assets that are subject to amortization. Additionally, businesses that wish to take advantage of Section 179 deductions must also complete this form. Understanding the eligibility criteria can help determine if Form 4562 is necessary for your tax filings.

Examples of Using Form 4562

Form 4562 can be applied in various scenarios. For instance, a small business that purchases new equipment for operations may use this form to deduct the depreciation over the asset's useful life. Similarly, a business that invests in software can utilize Form 4562 to amortize the cost of the software over a specified period. These examples illustrate how Form 4562 can provide significant tax benefits for different types of assets.

Quick guide on how to complete what to know about form 4562 depreciation and

Complete What To Know About Form 4562 Depreciation And effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and store it securely online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Manage What To Know About Form 4562 Depreciation And on any device with airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

How to modify and eSign What To Know About Form 4562 Depreciation And without breaking a sweat

- Obtain What To Know About Form 4562 Depreciation And and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign What To Know About Form 4562 Depreciation And and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what to know about form 4562 depreciation and

Create this form in 5 minutes!

How to create an eSignature for the what to know about form 4562 depreciation and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to get 4562 with airSlate SignNow?

To get 4562 with airSlate SignNow, simply visit our website, sign up for an account, and choose the appropriate plan. The onboarding process is straightforward, allowing you to start sending and eSigning documents within minutes. Enjoy hassle-free access to all features, ensuring you can get 4562 efficiently.

-

What features does airSlate SignNow offer to help me get 4562?

airSlate SignNow provides a variety of features aimed at helping you get 4562. These include customizable templates, bulk sending options, and advanced security measures. The user-friendly interface makes it easy to manage your documents, enabling you to focus on your business while we help you get 4562.

-

How much does it cost to get 4562 with airSlate SignNow?

The cost to get 4562 with airSlate SignNow depends on the plan you choose. We offer flexible pricing options to suit different business needs, ranging from individual subscriptions to enterprise solutions. By choosing airSlate SignNow, you can save money while accessing top-notch eSigning capabilities.

-

What are the benefits of using airSlate SignNow to get 4562?

Using airSlate SignNow to get 4562 provides numerous benefits, including time savings, improved workflow efficiency, and enhanced document security. Businesses can streamline their operations, reduce paperwork, and ensure that documents are signed promptly. Get 4562 with airSlate SignNow and transform the way you manage your documents.

-

Can I integrate airSlate SignNow with other applications to get 4562?

Yes, you can seamlessly integrate airSlate SignNow with various applications to get 4562. Our platform supports numerous integrations with popular tools like Salesforce, Google Drive, and Dropbox. This allows you to enhance your productivity by connecting your existing workflows while utilizing airSlate SignNow's features.

-

Is there customer support available to assist me in getting 4562?

Absolutely! airSlate SignNow offers dedicated customer support to assist you in getting 4562. Our support team is available through various channels, including live chat, email, and phone, ensuring you have access to help whenever you need it. We are committed to providing a smooth experience as you navigate our platform.

-

What types of documents can I send and eSign to get 4562?

You can send and eSign a wide variety of documents with airSlate SignNow to get 4562. This includes contracts, agreements, forms, and invoices, among others. Our platform is designed to handle everyday business paperwork, ensuring you can manage all your signing needs in one place.

Get more for What To Know About Form 4562 Depreciation And

- Basketball scouting report form

- Klb physics book 4 pdf download form

- 7 eleven employee website form

- Refund application form

- Ann latsky nursing college online application for 2021 form

- Rite aid screening questionnaire and consent form

- Application for cash aid food stamps andor california cdph ca form

- Richmond city office of building inspection form

Find out other What To Know About Form 4562 Depreciation And

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure