Form 4562 2011

What is the Form 4562

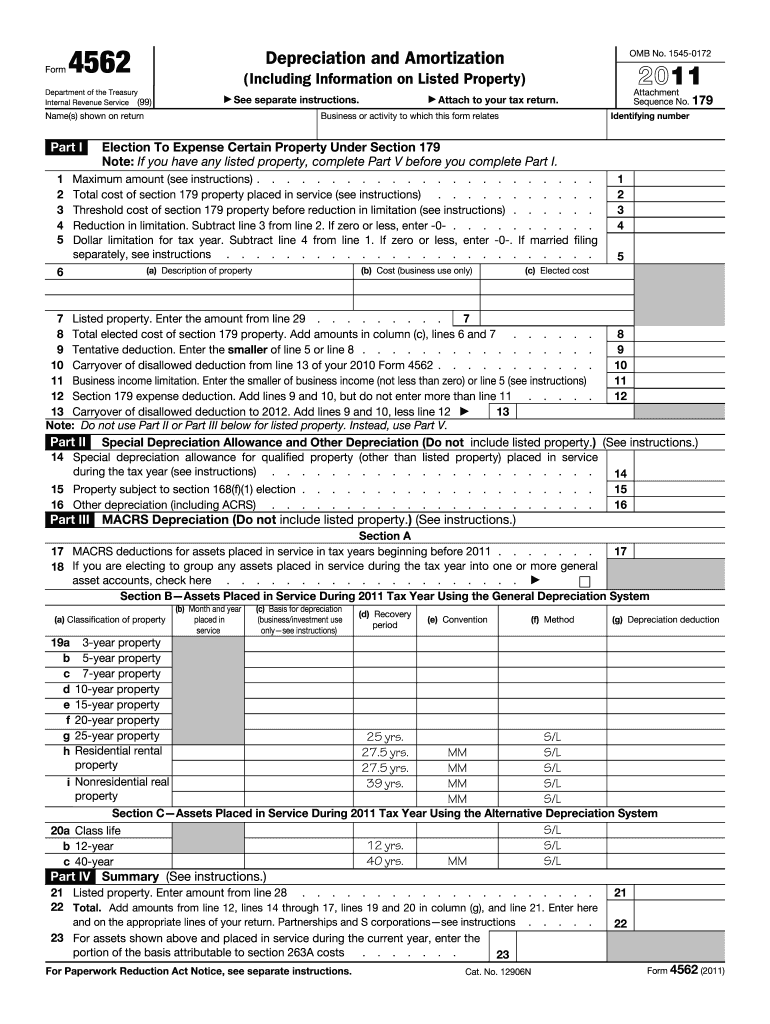

The Form 4562, also known as the Depreciation and Amortization form, is a tax document used by businesses and individuals to report depreciation and amortization of assets. This form is essential for claiming deductions related to the depreciation of property used in a trade or business. It helps taxpayers calculate the allowable depreciation for various types of assets, including vehicles, machinery, and real estate. Properly completing this form can significantly impact tax liabilities, making it a crucial component of tax preparation.

How to use the Form 4562

Using the Form 4562 involves several steps to ensure accurate reporting of depreciation and amortization. Taxpayers must first gather information about the assets they plan to depreciate. This includes the purchase date, cost, and type of property. The form requires taxpayers to categorize assets based on their useful life and select the appropriate depreciation method, such as the Modified Accelerated Cost Recovery System (MACRS). Once completed, the form is submitted along with the annual tax return to the IRS.

Steps to complete the Form 4562

Completing the Form 4562 involves a systematic approach:

- Gather necessary information about the assets, including purchase price and date.

- Determine the asset classification and useful life.

- Select the appropriate depreciation method, such as MACRS or straight-line depreciation.

- Fill out the form, ensuring all sections are accurately completed.

- Review the form for any errors before submission.

Each section of the form corresponds to specific types of assets and depreciation methods, so it is important to follow the instructions carefully.

Legal use of the Form 4562

The legal use of the Form 4562 is governed by IRS regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding asset classification, depreciation methods, and reporting requirements. Proper use of this form not only helps in maximizing tax deductions but also minimizes the risk of audits or penalties. It is advisable to maintain thorough records of all assets and their depreciation calculations in case of IRS inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4562 align with the annual tax return deadlines. Generally, individual taxpayers must file their returns by April 15 of each year. However, if an extension is filed, the deadline may be extended to October 15. Businesses may have different deadlines based on their fiscal year. It is essential to be aware of these dates to avoid late filing penalties and ensure timely processing of tax returns.

Form Submission Methods (Online / Mail / In-Person)

The Form 4562 can be submitted through various methods. Taxpayers can file it electronically using tax software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed to the IRS along with the tax return. In-person submissions are typically not available for this form, as most taxpayers opt for electronic or mail submissions. Choosing the right method depends on personal preference and the complexity of the tax situation.

Quick guide on how to complete 2011 form 4562

Complete Form 4562 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle Form 4562 on any platform using the airSlate SignNow Android or iOS applications and enhance your document-driven processes today.

The easiest way to modify and eSign Form 4562 with ease

- Find Form 4562 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Accentuate relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Form 4562 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 4562

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 4562

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 4562 and how does it relate to airSlate SignNow?

Form 4562 is used to report depreciation for assets, and airSlate SignNow can help you eSign this crucial document electronically. By using our platform, businesses can streamline their filing process with secure and efficient eSigning capabilities.

-

How does airSlate SignNow simplify the process of signing Form 4562?

airSlate SignNow provides an intuitive interface that allows you to easily upload, sign, and send Form 4562. Our electronic signature solution ensures that your documents are signed quickly, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 4562?

Yes, airSlate SignNow offers competitive pricing plans suited for various business needs. Our cost-effective solutions ensure that you can easily manage and eSign documents like Form 4562 without breaking the bank.

-

Can airSlate SignNow integrate with accounting software for handling Form 4562?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing for easy management of Form 4562 and related documents. This synergy helps ensure that your financial data management remains cohesive and efficient.

-

What features does airSlate SignNow offer for signing Form 4562?

airSlate SignNow includes features such as templates, bulk sending, and personalized branding that enhance the eSigning process for Form 4562. These tools facilitate quick and personalized document management for users.

-

How can I ensure the security of my Form 4562 when using airSlate SignNow?

Security is a priority at airSlate SignNow; we employ robust encryption and authentication measures for all documents, including Form 4562. You can rest assured that your sensitive information is protected throughout the eSigning process.

-

Is it easy to collaborate with others on Form 4562 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form 4562 effortlessly. Our platform provides features for sharing documents, tracking changes, and obtaining signatures, ensuring a smooth collaborative experience.

Get more for Form 4562

- Due by the 15th day of the fourth month following the close of the taxable year form

- Statutory required 6 month filing window for cagov form

- Fiduciary declaration of estimated tax form

- It 2663 department of taxation and finance form

- South carolina sc department of revenue form

- New york form it 201 att other tax credits and taxes

- Fillable michigan department of treasury 518 rev 02 18 form

- Form ct 3 m general business corporation mta surcharge return tax year 2020

Find out other Form 4562

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage